After Ukrainian ports were blocked by Russia in February 2022, both exports of Ukrainian agricultural commodities and domestic price of these commodities plummeted. Introduction of the Black Sea Grain Initiative (Grain Deal) significantly increased the volume of exports of agriculture commodities from Ukraine. However, the impact on domestic prices of these commodities was only marginal, and a significant gap between domestic and world market prices remains.

War and agriculture

Ukraine has grown into an agricultural powerhouse on international agricultural markets, with arable land comprising over half of its territory. In 2021, Ukraine ranked as the seventh-largest wheat producer and the sixth-largest corn producer globally. The Black Sea ports served as the primary channels for export.

The onset of the full-scale invasion by Russia on February 24, 2022 resulted in the occupation or blockade of Ukrainian ports along the Black Sea and Sea of Azov thus disrupting Ukraine’s agricultural exports, nearly 90% of which flew via ports. This resulted in a steep rise in global prices for agricultural products, while prices within Ukraine plummeted, primarily due to the soaring logistics costs as domestic sellers were forced to turn to alternative, much more expensive, means of transportation such as trucks and railways.

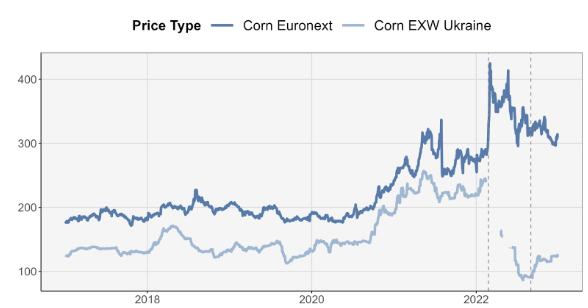

Figure 1. Corn Prices in Ukraine and the world (USD/metric ton)

Source: Martyshev et al (2023).Dotted lines represent the beginning of Russian full-scale invasion and the start of the Grain Deal, from left to right in that order.

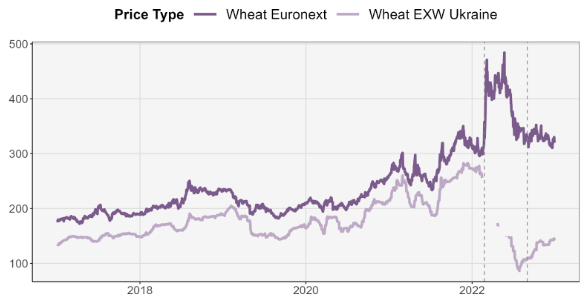

Figure 2. Wheat Prices in Ukraine and the world (USD/metric ton)

Source: Martyshev et al (2023). Dotted lines represent the beginning of Russian full-scale invasion and the start of the Grain Deal, from left to right in that order.

In an effort to alleviate this situation, the Black Sea Grain Initiative agreement was brokered by Turkey and the United Nations in July 2022 with the objective of creating a “grain corridor” to safely export grains through three Black Sea ports – Odesa, Chornomorsk, and Pivdennyi.

This agreement resulted in a significant increase in exports, but the domestic prices in Ukraine remained low (figures 1, 2), thus hampering Ukrainian farmers from fully benefiting from the Grain Deal.

Grain Deal impact on agricultural commodity prices

We investigated the impact of the Grain Deal on wheat and corn prices in Ukraine, which are the country’s primary agricultural exports. We used a linear regression model, with the difference between international (Euronext) and Ukrainian (EXW) grain prices as the dependent variable. This difference represents the portion of the domestic price in Ukraine that is not determined by world prices, but rather encompasses various transfer costs associated with transportation, storage, port terminal services, other related expenses, as well as political and market specifics of the internal market.

To capture the effect of the Deal and account for potential structural changes resulting from the full-scale invasion, we introduce specific explanatory variables for both events. Another variable is included to control for market panic that may have occurred during Russia’s suspension of participation in the Grain Deal between October 29 and November 1, 2022. All three variables, along with seasonal control variables, are binary, taking a value of 1 during the corresponding events and 0 otherwise.

The appendix includes tables presenting the estimation results of the employed models for both crops. As anticipated, the coefficient for the war variable demonstrates significant effect, indicating that the full-scale invasion alone widened the price gap between domestic and world prices by a factor 2.5-3 for wheat and corn, while the rest of the increase was caused by other factors.

Regarding our key variable of interest, which assesses the effect of the Grain Deal Initiative, the results reveal that the implementation of the Grain Initiative had indeed narrowed the gap between world and domestic wheat prices by up to 25%, though impact is rather weak from a statistical point of view, so it needs to be taken with a grain of salt. The effect on corn price gap turned out to be insignificant. This major outcome of the analysis remains consistent across various models that were estimated in the study (Table A and Table B).

Why an increase in exports didn’t increase domestic prices?

The results of the study confirm that the effect of Grain Deal on domestic prices of grains was only marginal if noticeable at all, despite an increase in exports. One of the main reasons for this outcome is that by the time the Grain Deal was launched, the new harvest had already started, and the exports were unable to fully compensate for the crops that needed to be transported (Martyshev, Nivievskyi and Bogonos, 2023). As a result, supply pressure on Ukrainian grain market wasn’t lifted off and logistics costs remained high.

Moreover, uncertainties and delays in negotiations and trade arrangements with Russia further hinder the achievement of price convergence. The suspension of the agreement by Russia in October, driven by baseless accusations, introduced additional obstacles and uncertainties into the market. The delays in ship inspections imposed by Russian representatives further compounded the existing uncertainties. As a result, domestic producers face challenges in efficiently planning and executing their trade activities, leading to increased costs.

Unfortunately, we don’t anticipate any near-term improvements. Russia’s recent deliberate destruction of the Kakhovka dam is expected to have far-reaching and devastating consequences. Apart from the evident humanitarian and ecological catastrophe, it will add additional strain to the agricultural sector and likely exacerbate the existing difficulties in achieving price convergence.

References

Martyshev, Pavlo, Nivievskyi, Oleg and Bogonos, Maria. 2023. “Regional war, global consequences: Mounting damages to Ukraine’s agriculture and growing challenges for global food security.” IFPRI (blog), March 27, 2023

Appendix

Table A. OLS estimation results with interpolated values – the effect of Grain Deal on the gap between world and domestic prices

|

|

Wheat |

Corn |

|

Intercept |

3.69 *** (0.02) |

3.95 *** (0.07) |

|

Invasion |

1.82 *** (0.08) |

1.46 *** (0.06) |

|

Grain Deal |

-0.25 * (0.10) |

-0.09 (0.11) |

|

Suspension |

0.02 (0.05) |

0.06 (0.06) |

|

R2 |

0.89 |

0.86 |

Notes: Significance codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘.’ 1. Missing values are interpolated. Standard errors in parenthesis. Estimated by OLS with HAC corrected standard errors. The models control for seasonality with monthly dummies. Number of observations is 1565.

Table B. OLS estimation results with dropped values – the effect of Grain deal on the gap between world and domestic prices

|

|

Wheat |

Corn |

|

Intercept |

3.69 *** (0.02) |

3.95 *** (0.07) |

|

Invasion |

1.73 *** (0.03) |

1.44 *** (0.03) |

|

Grain Deal |

-0.16 *** (0.04) |

-0.08 . (0.04) |

|

Suspension |

0.02 (0.15) |

0.06 (0.16) |

|

R2 |

0.89 |

0.86 |

Notes: Significance codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘.’ 1. Missing values are dropped. Standard errors in parenthesis. Estimated by OLS without correction for possible autocorrelation. The models control for seasonality with monthly dummies. Number of observations is 1496.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations