On September 14, the government submitted the next wartime budget to the Verkhovna Rada in a timely manner despite the extremely high uncertainty for the upcoming year. Meanwhile, negotiations with international partners—on whom the country’s macro-financial stability largely depends—are ongoing. The main questions are whether there will be enough funds to cover the significant budget deficit and whether the planned expenditures will be sufficient if the war continues throughout the next year.

Key findings:

- The draft budget for 2025 is based on principles similar to those of the 2024 budget, prioritizing defense, security, and social protection of the population. Financial support from international partners remains critically important for budget stability. The 2025 budget draft takes into account the principles of the Budget Declaration for 2025-2027, which was adopted for the first time since the beginning of the full-scale invasion, demonstrating consistency in budget policy.

- The revenue figures in the 2025 budget draft take into account the “resource” draft law No. 11416-d dated August 30, 2024, which has already been approved by Parliament in its first reading. It provides for significant changes in tax collection, including an increase in the military levy rate from 1.5% to 5%, its extension to individual entrepreneurs under the simplified tax system, an increase in the corporate tax rate for financial institutions to 25%, and an increase in the corporate tax rate for banks for 2024 to 50%, the introduction of advance payments for businesses engaged in the retail sale of petroleum products, among others. The government expects to raise an additional UAH 126.7 billion in tax revenues in 2025.

- Expenditures on the defense and security sector remain a priority throughout 2025. The planned spending under the Ministry of Defense programs amounts to UAH 1,568 billion, which, although significantly higher than the initial plan for 2024 (UAH 1,164 billion), is still insufficient if the intensity of hostilities continues throughout 2025. Therefore, if the trends of 2024 persist and no additional funding is provided, the Ministry of Defense budget will need to be revised in the second half of 2025, similar to the 2024 budget, which had amendments proposed in August this year.

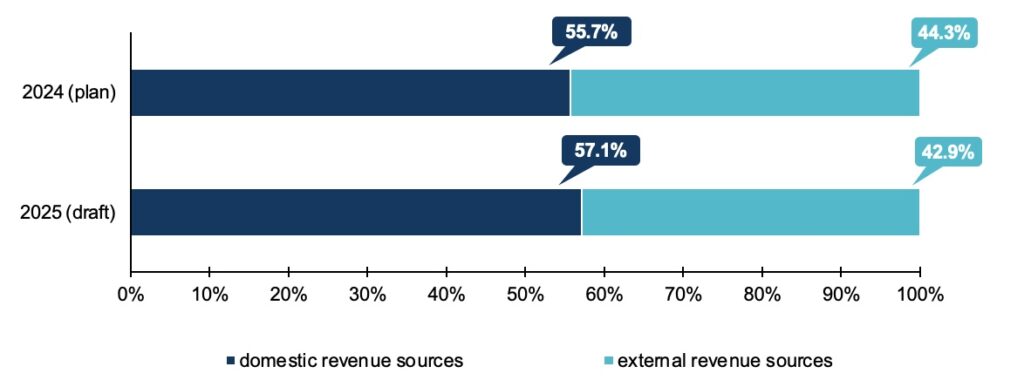

- The main sources of revenue for the 2025 state budget are expected to be tax revenues, estimated at almost UAH 2 trillion (26% more than planned for 2024), and external borrowings of over UAH 1.7 trillion (4.7% more than the 2024 plan). After accounting for the costs of servicing external public debt, external borrowings are projected to finance 42.9% of total 2025 state budget expenditures, while domestic sources will cover the remaining 57.1%, a higher share than planned for 2024. Alongside tax revenues, external assistance remains a crucial resource for maintaining Ukraine’s financial stability in 2025.

- An increase in tax revenues in 2025 is expected across all major taxes, including PIT, corporate income tax, VAT, and excise tax. The main drivers of potential revenue growth will be changes in tax legislation, such as raising rates for certain taxes and broadening their scope. Additionally, part of the expected growth in tax revenues is linked to the macroeconomic situation in the country, including projected inflation of 109.7% and the devaluation of the national currency in 2025, with an average annual exchange rate anticipated at 45 UAH/USD.

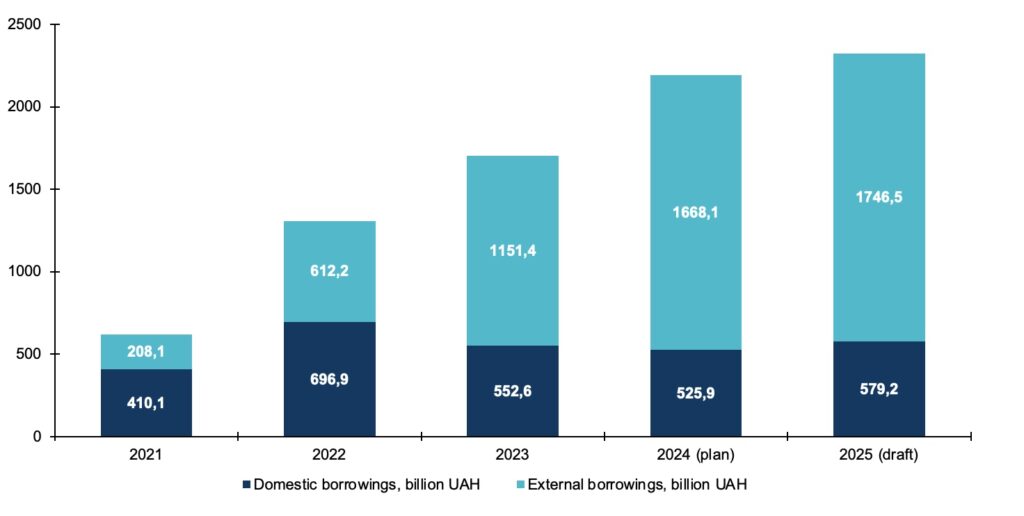

- The government expects to continue receiving significant regular financial support from international partners next year. In 2025, UAH 1.7 trillion (USD 36.9 billion) in loans from foreign partners is anticipated to flow into the general fund of the state budget, including UAH 537.2 billion from the European Union under the Ukraine Facility program, UAH 123.6 billion from the IMF, UAH 140.2 billion from the World Bank, and UAH 857.3 billion from other creditors. An additional UAH 88 billion (about USD 2.0 billion) in external loans will be directed to the special fund of Ukraine’s state budget. Besides external loans, which will play a key role in financing the budget deficit in 2025, the government also plans to attract UAH 87.6 billion in grant funds, UAH 72.9 billion from the EU under the Ukraine Facility, and UAH 14.7 billion from other foreign partners. At the same time, it is planned to allocate almost the entire amount of domestic government borrowings in 2025 to repay domestic government debt (borrowings of UAH 579.2 billion, repayments of UAH 562.0 billion).

- The planned state budget deficit for 2025 is expected to be UAH 1.6 trillion, or 19.4% of GDP. This deficit will be financed through UAH 1.7 trillion in external borrowings and UAH 579.2 billion from the issuance of domestic government bonds. As a result, the combined total of state and state-guaranteed debt will rise, reaching 101.8% of GDP by the end of 2025. Even after partial restructuring and partial debt forgiveness in 2024, this debt level is significantly higher than the Maastricht criterion of 60% of GDP and the “safe” level of 64% for developing countries, which is considered non-detrimental to economic growth.

- The government expects the implementation of the Extraordinary Revenue Acceleration Loans for Ukraine (ERA) mechanism, which could provide an additional USD 50 billion in grants or loans, with servicing and repayment funded by the income from frozen Russian sovereign assets located in G7 jurisdictions. It is anticipated that part of these funds will be used for direct budget support as early as 2025; however, the timing and the exact amount of these funds remain uncertain..

Details

General Provisions

- In developing the 2025 budget, the government relied on the baseline scenario of the macroeconomic forecast, considering cautious estimates of the 2024 results and high uncertainty in national and regional security. This uncertainty is driven by possible changes on the frontlines, the intensity of hostilities, and their economic consequences. Under such conditions, there is a significant risk that some actual indicators will deviate substantially from the planned ones. It is already clear that certain budget parameters, as in this year, do not fully align with the conditions of a prolonged war throughout 2025 (e.g., defense spending may be insufficient, and the expected growth in business activity may be slower). There is a high likelihood that some budget items, both expenditures and revenues, will require adjustments during the next year.

- The main forecasted macroeconomic indicators of Ukraine’s economic and social development for 2023–2025 are set at the levels used in preparing the Budget Declaration, indicating a consistent approach to document development. In 2025, nominal GDP is expected to grow to UAH 8,466.3 billion despite significant changes in the economic structure (Table 1). Real GDP growth in 2025 will be only 2.7% (in the first half of 2024, growth slowed to 4% [±1%], according to the Ministry of Economy). Inflation next year is expected to accelerate, averaging 9.7%, nearly double the 2024 figure (5.4%). Inflationary pressure is driven by additional business costs for adapting to limited energy supplies and rising prices for both raw materials and labor resources (the average salary in 2025 is expected to increase to UAH 24,400 per month, and the unemployment rate will decrease slightly to 17.7%), as well as devaluation (the exchange rate of the hryvnia against the US dollar has depreciated by 8.3% since early 2024).

Table 1. Key Macroeconomic Indicators*Estimate of the Ministry of Economy of Ukraine

| Indicator | 2023 | 2024 | 2025 | |

| Report | Resolution of the Cabinet of Ministers of Ukraine dated December 15, 2023, No. 1315 | Expectations of the Ministry of Economy (as of June 28, 2024) | Resolution of the Cabinet of Ministers of Ukraine dated June 28, 2024, No. 780 | |

| Nominal, billion UAH | 6 537.8 | 7 643.0 | 7 484.7 | 8 466.3 |

| %, year-on-year | 5.3 | 4.6 | 3.5 | 2.7 |

| Consumer Price Index: | ||||

| Average compared to the previous year, %, year-on-year | 12.9 | 8.5 | 5.4 | 9.7 |

| December compared to December of the previous year, %, year-on-year | 5.1 | 9.7 | 7.9 | 9.5 |

| Average monthly wage of employees, gross, nominal, UAH | 17 442 | 21 809 | 20 581 | 24 389 |

| Unemployment rate of the population | 18.9* | 18.7 | 18.2 | 17.7 |

| Among those aged 15-70, according to ILO methodology, % of the corresponding age labor force | ||||

*Estimate of the Ministry of Economy of Ukraine

Source: State Statistics Service of Ukraine, National Bank of Ukraine, Government forecast

3. The 2025 budget draft takes into account potential amendments to the Tax Code, as proposed in Draft Laws No. 11090, dated March 18, 2024, and No. 11416-d, dated August 30, 2024. These proposed changes include, among others:

- Increasing excise tax rates on tobacco products to align with those in the European Union;

- Raising the military levy rate from 1.5% to 5% and extending this levy to individual entrepreneurs under the simplified tax system (STS): 1st, 2nd, and 4th STS groups will pay 10% of the minimum wage set at the beginning of the year, on a monthly basis; 3rd STS group will pay 1% of income;

- Increasing the corporate income tax rate for banks for 2024 from 25% to 50% (with the rate for banks in 2025 set at 25%) and raising the rate for non-bank financial institutions from 18% to 25%.

4. The 2025 State Budget draft continues the suspension of certain provisions of the Budget Code to account for the significant budget deficit and the need for swift decision-making in wartime conditions. The following rules remain suspended:

- The deficit cannot exceed 3% of nominal GDP;

- The maximum state budget deficit cannot exceed the figure set by the Budget Declaration;

- The total state and state-guaranteed debt at the end of the budget period cannot exceed 60% of annual nominal GDP;

- The maximum amount of state guarantees provided cannot exceed 3% of the planned revenues of the general fund of the state budget;

- Key terms of transactions involving state debt that exceed 5% of the total state debt are determined by the Cabinet of Ministers in agreement with the Budget Committee of the Verkhovna Rada ( the government will not seek approval from the Committee for these terms);

- At least 1.5% of the state budget’s general fund revenues should be allocated to the State Fund for Regional Development (this would mean that the SFRD will once again not be funded next year).

5. In the materials submitted with the 2025 budget draft, the government identifies significant fiscal risks and factors that may reduce budget revenues and/or require additional expenditures, which could, in turn, increase the budget deficit and state debt. The main risks include:

- According to the World Bank (RDNA3), since the start of the full-scale invasion, economic losses have reached USD 0.5 trillion and continue to grow daily.

- Destruction of production complexes and infrastructure: This leads to a systemic reduction in fixed capital. The destruction of the energy system negatively affects the entire economy by limiting its potential and necessitating additional imports of energy-saving equipment, which also impacts the pace of economic recovery.

- Blocking of Ukrainian seaports: The established “maritime corridor” helped boost agricultural exports to pre-war levels. A reduction in sea exports due to damaged port infrastructure or restricted maritime routes may not only lower foreign currency earnings but also increase pressure on alternative export routes.

- Unfolding demographic crisis (population decline and workforce reduction): According to the Ministry of Social Policy, average life expectancy in 2023 compared to 2020 has significantly decreased—by 9.1 years for men (from 66.4 to 57.3 years) and by 5.3 years for women (from 76.2 to 70.9 years). This decline further exacerbates imbalances in the distribution of the productive workforce.

- Decline in grain harvest: Loss of arable land and difficulties in finding workers pose significant medium-term risks of lower yields, which could reduce foreign currency revenue and negatively impact the processing industry.

- Weakening of international support: Limited access to macro-financial assistance (loans and grants) will necessitate finding additional domestic resources, which is challenging given the difficult economic conditions and internal constraints due to the ongoing war.

- Rising prices in global energy markets: This could increase production costs and reduce the competitiveness of several manufacturers.

- Securing state debt financing at a cost higher than the lowest possible rate, as well as failure to meet obligations by small and medium-sized businesses and municipal enterprises under joint projects with international financial organizations (IFOs). If these enterprises are unable to service loans issued under state guarantees, the state will have to fulfill these obligations.

6. The key sources of revenue and funding for the state budget in 2025 are expected to be tax revenues (almost UAH 2 trillion, 26% more than planned for 2024) and external borrowings (nearly UAH 1.7 trillion, 4.7% more). Tax revenues and net external borrowings will cover 91.4% of the 2025 budget expenditures. Specifically, tax revenues will cover 50.4% and external loans 41.1% (compared to the current 2024 plan of 47.6% and 44.9%, respectively)—see Figure 1. The remaining expenditures will be financed through domestic borrowings and non-tax revenues.

7. Next year, tax revenues will cover just over 50% of all state budget expenditures. This is slightly higher than the planned level for 2024 and significantly more than in 2022 and 2023, which were 35.1% and 30%, respectively. This indicates the growing role of domestic revenue sources amid declining expected volumes of external financial assistance. Overall, the state budget’s own resources (tax and non-tax revenues, capital operations, transfers, and net domestic borrowings) should be sufficient to finance 57.5% of expenditures in 2025 (compared to 55.7% in the 2024 plan). A significant portion of the budget financing will come from domestic borrowings, which are planned to reach UAH 579.2 billion, 10.1% more than in 2024. Additionally, grant revenues of UAH 87.6 billion are expected in 2025, including UAH 72.9 billion under the Ukraine Facility program and UAH 14.7 billion from other foreign partners of Ukraine.

Figure 1. Structure of revenues to the state budget in 2024-2025

Source: State Budget for 2024, Draft State Budget for 2025

Budget revenues

1. The 2025 budget draft includes revenues of UAH 2.3 trillion, which is 32.1% more than the 2024 plan. The growth in 2025 compared to the current 2024 plan is mainly explained by two factors. First, in 2025, due to the expected adoption of tax changes, which are estimated to bring in UAH 126.7 billion, nearly UAH 2 trillion in tax payments are expected to flow into the state budget, 26% more than planned for 2024. Second, changes in the macroeconomic environment, such as the rate of inflation and the devaluation of the hryvnia, will also have some impact on the increase in state budget revenues.

2. The Tax Service is expected to collect UAH 1,182.5 billion, or 50.6% of all 2025 budget revenues (127% of the current 2024 budget plan). Customs is projected to accumulate UAH 801.1 billion, or 34.3% of all 2025 budget revenues (124.5% of the 2024 budget plan). The remainder will come from other non-tax revenues, including grants, administrative fees and charges, capital operations income, etc.

3. The structure of tax revenues will not undergo significant changes compared to the 2024 plan. As is tradition, indirect taxes will be key in the 2025 budget, accounting for over 51.3% of revenues. VAT (both import and domestic) is expected to contribute 39% of the budget revenues, while excise taxes (both import and domestic) will account for 12.3%. Among direct taxes, the largest contribution is expected from PIT and the military levy, which together are projected to provide 19.6% of total revenues.

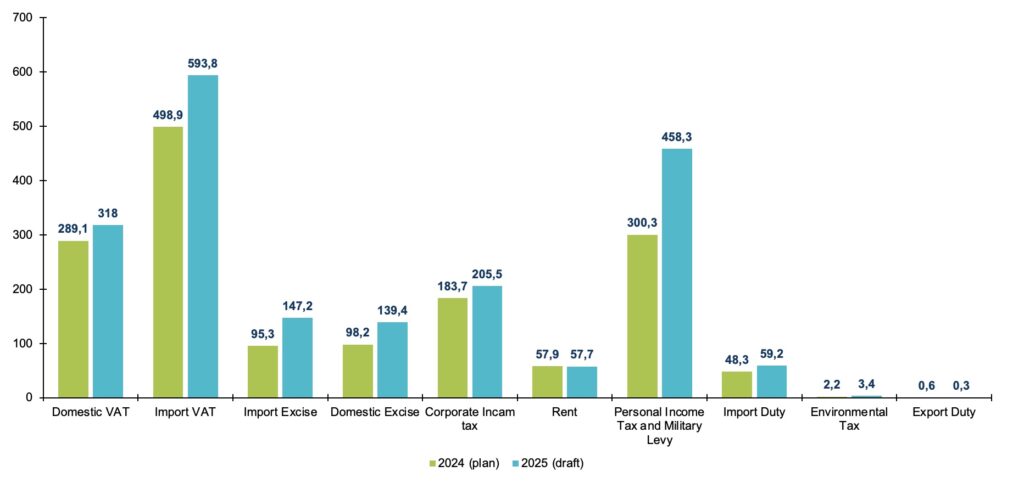

4. The plan for the primary tax revenues to the state budget (see Figure 2):

- PIT and the military levy are expected to bring in UAH 458.3 billion (+152.6% compared to the 2024 plan). This increase in revenue from these payments in 2025 is due to potential changes in the military levy collection mechanism, which may be adopted as early as September 2024. Specifically, these changes include raising the levy rate from 1.5% to 5% and introducing mandatory levy payments for individual entrepreneurs under the simplified tax system.

- VAT (domestic and import) is projected to generate UAH 911.8 billion (+15.7% compared to the 2024 plan). The main reasons for this growth include inflation in 2025 (forecasted at 9.7% year-on-year), an expected 3.7% increase in import volumes, rising consumer spending, and the devaluation of the national currency.

- Excise tax (domestic and import) is expected to bring in UAH 286.6 billion (+48.1% compared to the 2024 plan). The anticipated growth in excise revenues compared to the 2024 plan is primarily due to the increase in excise tax rates on fuel from September 1, 2024, and the potential increase in rates on tobacco products from October 1, 2024. In 2025, 25% of the excise tax on fuel and vehicles (UAH 39.3 billion) will be allocated to the State Road Fund within the special fund of the state budget (in 2024, the entire excise tax amount is directed to the general fund of the state budget).

- Corporate income tax is projected to generate UAH 205.5 billion (+11.9% compared to the 2024 plan). It is expected that in 2025, increased revenue will be accumulated as a result of raising the tax rate to 25% for financial institutions and applying an increased profit tax rate of 50% on banks’ profits for the year 2024.

Figure 2. Planned tax revenues to the budget in 2024-2025, billion UAH

Source: State Budget for 2024, Draft State Budget for 2025

5. The lowest revenue compared to the 2024 plan is expected from:

- Export duties: Only UAH 0.3 billion, or 52.1% of the 2024 plan. In Ukraine, export duties apply only to a few groups of goods (live cattle and hides, oilseed crops, metal semi-finished products, scrap metal, and natural gas). The likely decline in expected revenue from this tax is linked to reduced exports across all these categories due to the security situation in Ukraine.

- Rent payments: UAH 57.7 billion (-0.3% compared to the 2024 plan). The reduction in projected rent revenues to the state budget in 2025 is minimal, suggesting that the government anticipates the continuation of current economic trends in the sectors where this payment is applied. However, rent revenues from the transportation of petroleum products are expected to increase to UAH 578 million, which is 51.1% more than the 2024 plan. This forecast is based on the projected average exchange rate of the hryvnia against the US dollar and the expected volumes of oil transportation by JSC Ukrtransnafta.

6. The National Bank of Ukraine is expected to transfer UAH 63.9 billion to the state budget’s general fund as part of its profit. This amount is UAH 46.2 billion, or 261%, higher than the 2024 plan (UAH 17.7 billion) and UAH 25.3 billion, or 65.5%, more than the actual amount transferred by the NBU this year (UAH 38.6 billion).

7. Grant revenues are planned at UAH 87.6 billion, or 3.7% of total revenues: UAH 72.9 billion in grants under the Ukraine Facility and UAH 14.7 billion in grants from other foreign partners. This is significantly more than the UAH 2.4 billion planned for 2024 but less than the UAH 267.5 billion received in the first eight months of the current year. Therefore, there is moderate optimism that actual grant assistance in 2025 will exceed the planned amount.

8. In 2025, the “missing” budget revenues will once again be at a record level due to tax exemptions. Funds that could have been received by the state and local budgets but will not due to tax benefits amount to UAH 154.7 billion (+33.1% compared to actual losses in 2023, +6.6% compared to expected losses in 2024, and +38.9% compared to projected losses planned in the 2024 draft of UAH 94.5 billion). More than half of these benefits are defense-related (55.7%). Since the end of July, VAT exemptions on the import of energy-saving equipment into Ukraine have come into effect, but the amount of losses from these exemptions has not yet been reflected in the list of benefits and losses.

Traditionally, the largest losses from VAT exemptions are expected to be UAH 131.7 billion (+49.4% compared to actual losses in 2023 and +9.3% compared to expected losses in 2024), including:

- Supply of defense-related products: UAH 86.1 billion

- Healthcare: UAH 28.7 billion

- Education and culture: UAH 8.5 billion

- Residential construction: UAH 2.4 billion

- Public transportation passenger services: UAH 1.1 billion

- Supply of investment gold: UAH 0.9 billion

Also significant are the exemptions from:

- Property tax: UAH 20.6 billion (the same as in 2024, and UAH 2 billion or 9% less than actual losses in 2023), representing losses for local budgets.

- Corporate income tax: UAH 1.4 billion (-72.7% compared to actual losses in 2023 and -55.1% compared to expected losses in 2024).

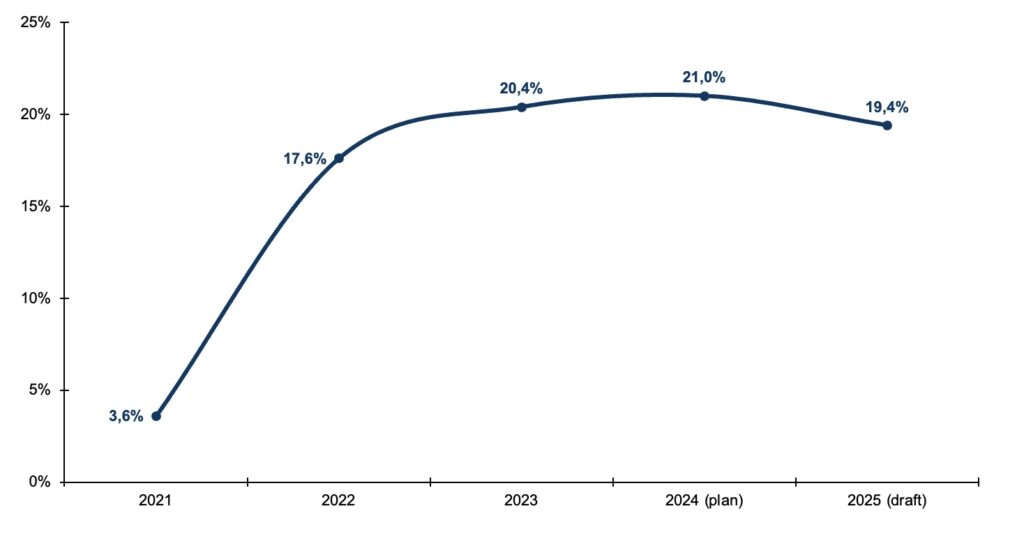

Budget deficit

1. The budget deficit has exceeded single-digit figures for the fourth consecutive year, planned at 19.4% of GDP for 2025, due to the need to finance significant defense expenditures, slow economic recovery, and limited opportunities for tax increases (Figure 3). To finance the deficit, UAH 1.7 trillion in external loans and UAH 579.2 billion from the domestic debt market through government bonds are planned. This indicates an accumulation of state and state-guaranteed debt, which is expected to reach 101.8% of GDP by the end of 2025. This level of debt, even after partial restructuring and debt forgiveness in 2024, is significantly higher than the Maastricht criterion (60% of GDP) and the “safe” level of 64% for developing countries, which does not hinder economic growth. However, these are criteria for peacetime, and public debt increases in all countries during wartime.

Figure 3. State budget deficit, % of GDP

Source: State Budget for 2024, Draft State Budget for 2025

2. Just as in the previous year, a large portion of the debt (75.1% or UAH 1,746.5 billion, equivalent to USD 38.8 billion) is planned to be raised from abroad through IFOs or foreign governments (Figure 4). It is expected that UAH 1.7 trillion (USD 36.9 billion) in loans from foreign partners will flow in to finance the general fund budget deficit, including UAH 537.2 billion from the European Union under the Ukraine Facility program, UAH 123.6 billion from the IMF, UAH 140.2 billion from the World Bank, and UAH 857.3 billion from other creditors.

3. In 2025, debt accumulation is planned exclusively through external borrowings. Domestic state borrowings, totaling UAH 579.2 billion, will primarily be allocated to repaying government bonds, with the government planning to use 97% of the funds raised from the sale of these bonds for this purpose.

Figure 4. Volume of domestic and external borrowings, billion UAH

Source: State Budget for 2024, Draft State Budget for 2025

4. As a result of the sharp increase in debt in 2024-2025, expenditures on public debt repayment are set to rise by UAH 64.6 billion or 10.3% in 2025 compared to the 2024 plan. All of this increase will come from domestic debt, while payments on external debt in 2025 are expected to be 29% lower than in 2024, made possible by restructuring part of the external public debt. Debt servicing costs in 2025 will grow to UAH 480.8 billion from UAH 419.9 billion in 2024, but their share in total expenditures will slightly decrease from 12.7% in 2024 to 12.2% in 2025. The share of external debt in the total public debt (including both direct and guaranteed debt) at the end of 2025 will be 74.7%, with internal debt accounting for 25.3% of GDP, compared to 58% and 42%, respectively, in 2021. A significant portion of foreign currency debt makes public debt more sensitive to the devaluation of the national currency. The cost of new borrowings (excluding existing loans) in 2025 is expected to be relatively low, with the average cost of external debt anticipated to be around 5% per annum.

5. For 2025, the maximum amount of state guarantees provided based on decisions by the Cabinet of Ministers of Ukraine is set at 3% of planned revenues of the state budget’s general fund, amounting to UAH 62.9 billion. Additionally, up to UAH 115 billion in state guarantees can be issued based on Ukraine’s international agreements.

Budget spending

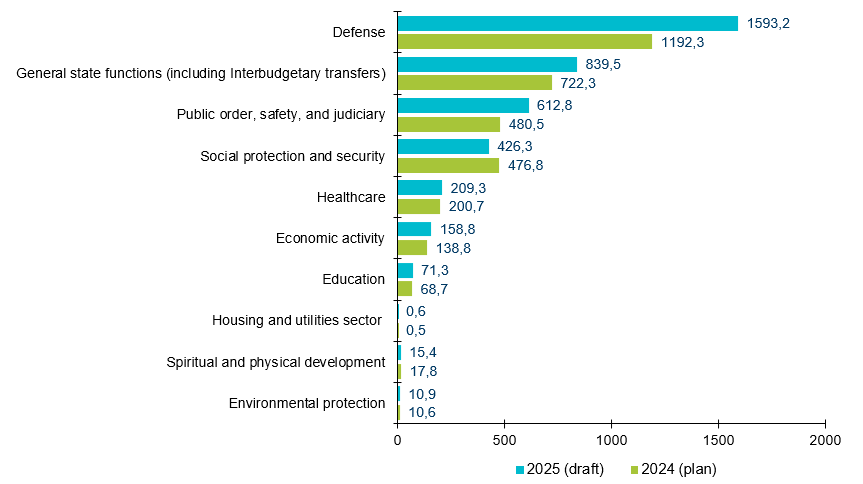

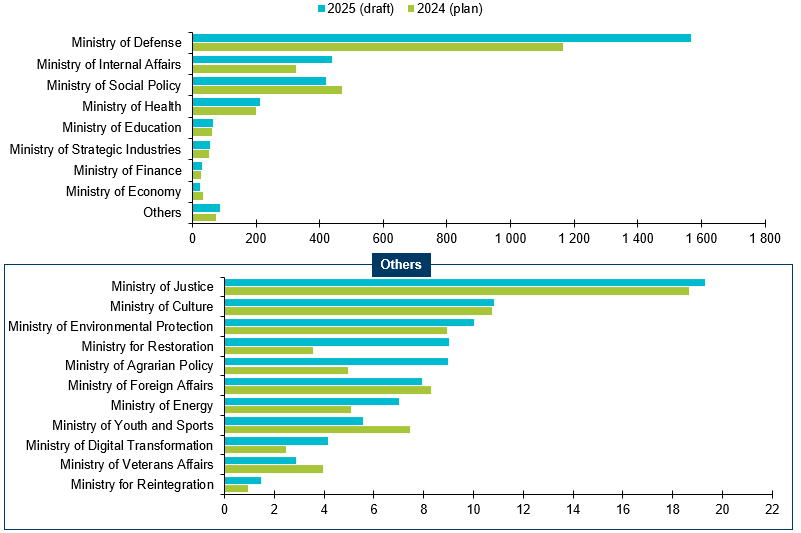

1. The 2025 budget draft plans expenditures at UAH 3.9 trillion, which is UAH 629.1 billion (+19%) more than the 2024 plan. The primary priorities remain defense, security, and the social sphere (Figure 5). Accordingly, over 60% of expenditures are concentrated in three Ministries:

- Ministry of Defense: UAH 1,568.1 billion (+34.7% or +UAH 404.1 billion compared to the 2024 plan)

- Ministry of Internal Affairs: UAH 438.3 billion (+35.2% or +UAH 114.1 billion compared to the 2024 plan, including an increase of UAH 57.8 billion for the National Guard, UAH 14.9 billion for the National Police, and UAH 36.2 billion for the Border Guard Service)

- Ministry of Social Policy: UAH 420.7 billion (-10.6% or -UAH 49.6 billion compared to the 2024 plan)

Figure 5. Expenditures by functional classification* (general and special fund), billion UAH

*along with state expenditures and lending

Source: State Budget for 2024, Draft State Budget for 2025

2. A key priority for 2025 remains the funding of expenditures for defense and security. The 2025 budget draft allocates a total of UAH 2,223 billion for security and defense (26.3% of GDP and 56.4% of total expenditures). Of this amount, UAH 30 billion is designated for state guarantees, while the remainder is allocated to budget programs of defense agencies.

3. Of the total funding for budget programs of the Ministry of Defense, 99% of all funds are traditionally allocated to two budget programs:

- UAH 1,012.3 billion (UAH 129.5 billion more than the 2024 plan) for salaries, medical care, and assistance to the families of Armed Forces personnel;

- UAH 487.7 billion (UAH 222.3 billion more than the 2024 plan) for the procurement and repair of weapons and military equipment.

UAH 1,152.7 billion from the general fund is expected to be allocated for the monetary support and salaries (including allowances) of Armed Forces members.

4. In the 2025 budget draft, funding has been increased for 14 out of 19 existing Ministries. Among the non-defense and security entities, the largest funding increases are planned for:

- Ministry of Health: Up by UAH 13.8 billion (+6.9%), primarily due to a UAH 16.2 billion increase in funding for the medical guarantees program. However, funding for certain MoH programs has been reduced, including “Public Health and Epidemic Control Measures,” “Staff Training and Qualification Improvement in Healthcare,” and “Provision of Medical Measures for Specific State Programs and Comprehensive Programmatic Measures,” among others.

- Ministry for Restoration: Up by UAH 5.5 billion (+154.1%) due to a UAH 3.4 billion increase for the critical logistics infrastructure and network connectivity restoration program, along with several other infrastructure projects.

- Ministry of Agrarian Policy: Up by UAH 4 billion (+81.5%) due to increased funding for programs supporting farmers and other agricultural producers.

- Ministry of Strategic Industries: Up by UAH 3.5 billion (+6.9%) due to increased funding for state-targeted programs for the reform and development of the defense industry.

- Ministry of Finance : Up by UAH 3.5 billion (+12.7%), primarily due to increased funding for the State Tax Service.

- Ministry of Education: Up by UAH 3.2 billion (+5.3%) due to increased funding for higher education training programs (+UAH 1.1 billion) and for the creation of Centers of Professional Excellence (+UAH 0.7 billion).

- Ministry of Energy: Up by UAH 1.9 billion (+37.8%) due to funding for energy infrastructure restoration and development programs, as well as for restructuring in the coal industry.

- Ministry of Digital Transformation: Funding will increase by UAH 1.7 billion (+68.3%) due to corresponding increases for the Innovations Development Fund.

- Ministry of Environmental Protection and Ministry for Reintegration of the Temporarily Occupied Territories: up by UAH 1.1 billion (+12.2%) and UAH 0.5 billion (+56%), respectively. The Ministry of Justice receives UAH 0.6 billion (+3.3%), while the Ministry of Culture receives UAH 0.1 billion (+0.8%) in additional funding.

At the same time, funding for the remaining Ministries is expected to be reduced. The planned expenditure has decreased (compared to the amended 2024 plan) for:

- Ministry of Social Policy: Down by UAH 49.6 billion or -10.6%, due to reduced funding for the social protection program for citizens in difficult life circumstances (down by UAH 7.9 billion) and transfers to the Pension Fund for pension financing (including covering deficits) and benefits and subsidies for utility services totaling UAH 41.5 billion.

- Ministry of Economy: Down by UAH 10.5 billion or -30.7% due to the cancellation of several programs, including state support for the implementation of investment projects with significant investments (so-called investment nannies) by UAH 3 billion and support for domestic demand for domestic goods and services (cashback) by UAH 3 billion.

- Ministry of Youth and Sports: Down by UAH 1.9 billion or -25.4% due to reduced funding for the development of physical culture, high-performance sports, and reserve sports (a reduction of UAH 1.1 billion) and others.

- Ministry of Veterans Affairs: Down by UAH 1.1 billion or -27.9% due to cuts in the program for mental, sports, physical, psychological rehabilitation, and professional adaptation of veterans by nearly UAH 1 billion.

- Ministry of Foreign Affairs: Down by UAH 0.4 billion or -4.5%, due to reduced funding for Ukraine’s foreign diplomatic missions.

Figure 6. Expenditures of Ministries (general and special fund), billion UAH

Source: State Budget for 2024, Draft State Budget for 2025

5. Overall state expenditures and financing for Ministries will see a significant increase in the Ministry of Finance (+UAH 109.8 billion), primarily due to increased spending on debt servicing (+UAH 60.9 billion), additional subsidies for local authority functions (+UAH 17.8 billion), and the introduction of a new program for financial support of public investment projects (UAH 25 billion). Conversely, expenditures in the Ministry of Education and Science will decrease by UAH 6.8 billion, mainly due to the reduction and elimination of several subventions, including those for creating safe conditions in schools (UAH 2.5 billion), purchasing school buses (UAH 1 billion), creating and modernizing school cafeterias (UAH 1.5 billion), and the “New Ukrainian School,” which will see funding cut from UAH 1.5 billion to UAH 150 million.

6. In the 2025 budget draft, 42 budget programs from the 2024 budget have been canceled (or restructured into new ones), totaling UAH 42.0 billion. The largest programs that will not be continued in 2025 include:

- Specialized medical assistance provided by healthcare institutions of research establishments and higher education institutions (UAH 3.5 billion), which was 51.2% funded as of July and is likely to be successfully completed by the end of the year. In 2025, a consolidated program titled “Specialized Medical Assistance” is planned for UAH 5.8 billion, which will include this program along with two others: specialized medical assistance provided by state healthcare institutions (UAH 2.1 billion) and specialized medical assistance provided in outpatient settings by healthcare institutions of research establishments and higher education institutions (UAH 0.4 billion).

- State support for implementing investment projects with significant investments (UAH 3 billion), the funding for which has been absent throughout the year, likely due to a lack of investment projects.

- Support for domestic demand for domestic goods and services (cashback) at UAH 3 billion. This program is unlikely to have any significant impact on the economy, so it should not be continued.

At the same time, the 2025 budget draft includes eight capital expenditure programs totaling UAH 22.8 billion, among which are:

- UAH 11.3 billion for the development and maintenance of public roads of national significance;

- UAH 6.6 billion for the construction, reconstruction, repair, and maintenance of local public roads;

- UAH 409 million for the functioning and development of internal waterways and inland water transport infrastructure;

- UAH 2.1 billion for the construction of the third metro line in Kharkiv (UAH 0.7 billion was allocated for this program in 2024, but as of July, it had not been used);

- UAH 702 million for the construction of the metro in Dnipro (the increase in funding is UAH 43 million compared to 2024, with a completion rate of 17.8% as of July 2024).

7. Additionally, the 2025 budget draft allocates UAH 14.3 billion for recovery in the regions, including:

-

- A subsidy from the state budget to local budgets for implementing projects under the Ukraine Recovery Program: UAH 5 billion (loan funds from the EIB project);

- Recovery of critical logistics infrastructure and network connectivity (RELINC): UAH 3.4 billion (grant funds from the World Bank project);

- Recovery and development of energy infrastructure: UAH 2.5 billion;

- A subsidy from the state budget to local budgets for implementing projects under the Ukraine Recovery Emergency Loan Program: UAH 1.6 billion (loan funds from the EIB project);

- A subsidy from the state budget to local budgets for the project “Housing Repair for People’s Empowerment (HOPE)”: UAH 0.5 billion (grant funds from the World Bank).

8. The government plans to continue supporting businesses during the state of war. In the 2025 budget draft, UAH 1.4 billion is allocated for a grant support program for business creation and development. Funding for the Entrepreneurship Development Fund program (“5-7-9 Program”) will remain at the 2024 level of UAH 18 billion. Additionally, UAH 1 billion is planned to compensate costs in the agricultural sector for humanitarian land demining of farming lands, and UAH 200 million is allocated to support agricultural producers using irrigated lands.

9. Public investment projects (PIM) will operate under a new framework. According to the new model for managing public investments outlined in the Budget Declaration for 2025-2027, access to budget funding or state support will only be granted to those public investment projects that have undergone preliminary assessment and prioritization and are included in a unified project portfolio. The new PIM model aims to establish a system for managing public investments that ensures the planning of public investment projects based on strategic priorities and a medium-term budget framework. In 2025, funding for public investments is planned as follows:

-

- State budget funds (Program for Preparation and Implementation of Public Investments): UAH 25 billion;

- Loans from foreign governments and IFOs within the framework of existing projects: UAH 59.2 billion;

- Proceeds under Component II of the Ukraine Facility. This instrument provides for investments in specified sectors amounting to EUR 6.97 billion by 2027.

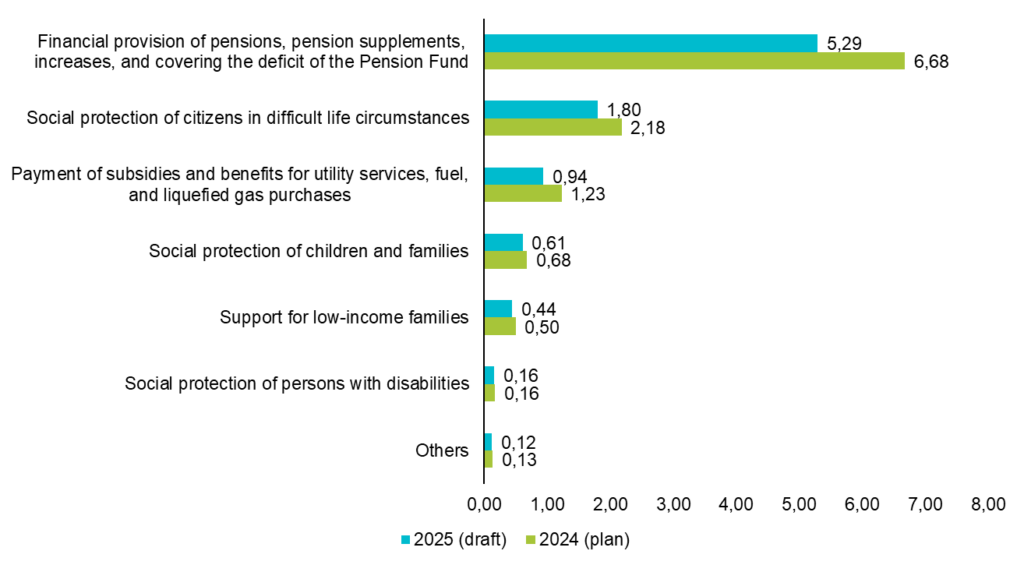

Social and veteran policy, gender equality

1. Expenditures of the Ministry of Social Policy of Ukraine have been reduced by 10.6% or UAH 49.6 billion compared to 2024, totaling UAH 420.7 billion. This decrease is due to a reduction in funding for the Pension Fund by UAH 41.5 billion and cuts to the Ministry’s program budgets by UAH 8 billion. The largest budget program, “Social Protection of Citizens in Difficult Life Circumstances,” aimed at supporting IDPs, those affected by the Chornobyl disaster, providing assistance to individuals with disabilities from childhood and disabled children, and paying social scholarships, has been cut by 9%, from UAH 89 billion to UAH 81 billion. In percentage terms, the most significant reduction (from UAH 67.3 million to UAH 7.3 million, or 89%) occurred in the budget program for “Payment of Financial Assistance to Service Members Released from Military Service.” The program for insuring healthcare workers who contracted COVID-19 has been reduced by 51% (from UAH 39 million to UAH 19 million). Funding for the budget program “Enhancing the Qualifications of Social Work Specialists and Other Social Protection Workers” is not planned at all for 2025. This may slow down the implementation of the social assistance reform (transitioning to personalized assistance for households).

Figure 7. Expenditures on budget programs of the Ministry of Social Policy of Ukraine for 2024-2025, UAH billion

Source: State Budget for 2024, Draft State Budget for 2025

2. The status of implementing basic social assistance and the pension system reform in 2025 remains uncertain. The Ministry of Social Policy has presented a draft law for the introduction of basic social assistance, which combines support for low-income families, assistance for children of single mothers, support for children raised in large families whose parents evade alimony payments, cannot provide for their child, or whose residence is unknown, as well as assistance for individuals without pension rights and persons with disabilities. According to the draft law, basic social assistance is to be implemented starting January 1, 2025. It will not require additional expenditures from the state budget and will be funded within the framework of existing budget programs of the Ministry of Social Policy. However, since the volume of expenditures for the Ministry’s budget programs has been reduced, it is unclear whether there will be sufficient funds to finance basic social assistance if implemented.

3. Next year, the Pension Fund of Ukraine (PFU) will receive a lower transfer from the state budget. The revenues and expenditures of the Pension Fund will amount to UAH 861 billion, with 67% of revenues (UAH 573.2 billion) expected to come from the Social Security Contribution (SSC). Total revenues from the SSC are projected to grow by 7.6%, from UAH 548.2 billion in 2024 to UAH 589.9 billion in 2025. This increase in SSC revenues is planned to be achieved, in part, by raising the maximum base for the social contribution from 15 to 20 minimum wage amounts. Transfers from the state budget to the PFU will be significantly lower: pension funding will decrease by 12% (UAH 34 billion), and funding for housing subsidies and benefits will decrease by 15% (UAH 8 billion). However, the realism of these plans is questionable, as the population in 2024 has decreased to 32.2 million compared to 41.1 million at the beginning of 2022, while the number of pension recipients has decreased much less, from 10.9 million to 10.2 million. Therefore, the pension indexation promised by the government may turn out to be insignificant.

4. The Compulsory State Social Insurance Fund in Case of Unemployment (Unemployment Fund) will transfer UAH 5 billion to the PFU. The budget of the Unemployment Fund is surplus: planned revenues for 2025 are UAH 22 billion, while expenditures are UAH 17 billion. The “excess” will be directed to the PFU. Overall expenditures of the Fund will be reduced by 9% compared to 2024. Accordingly, funding for unemployment benefits will decrease by 29%, from UAH 10.7 billion to UAH 7.6 billion, as the number of registered unemployed has recently been declining. The micro-grant program for starting or developing a business will be cut by 20%, from UAH 5.5 billion to UAH 4.5 billion.

5. The minimum subsistence and minimum wage are “frozen” at the 2024 level. Consequently, social benefits tied to the minimum subsistence level will also remain unchanged. However, in 2025, the minimum subsistence level for supporting low-income individuals will increase by 5%. Accordingly, funding for the “Support for Low-Income Families” program will rise by UAH 1.6 billion. Following a two-stage increase in 2024 (from January 1, 2024, by UAH 400 to UAH 7,100, and from April 1, 2024, by UAH 900 to UAH 8,000), the minimum wage will remain at UAH 8,000 in 2025. This will negatively affect workers whose salaries are tied to the minimum wage, but it will have a positive impact on businesses employing such workers.

6. The primary goal of the new veteran policy implemented by the Ukrainian Veteran Fund is to transition from benefit-based assistance to creating conditions for veterans’ self-realization in civilian life. Accordingly, expenditures for the Ukrainian Veteran Fund (support for veterans and their families) will increase by UAH 100.7 million (+40.7%) to UAH 348.4 million. At the same time, funding for the Ministry of Veterans Affairs of Ukraine will decrease by 27.9%, from UAH 4 billion to UAH 2.9 billion. The largest cuts will be in expenditures for rehabilitation and adaptation programs for veterans: down by UAH 897.5 million (34.7%). Funding for the establishment and operation of the National Military Memorial Cemetery will also be reduced by 85.2% to UAH 76.2 million. However, expenditures for payments in the event of veterans’ deaths or disabilities will increase by 26.4% or UAH 108.3 million to UAH 518.1 million.

7. Thirty-two percent of budget programs in the state budget contain gender indicators that reflect the relationship between public expenditures and the needs of different groups of women and men. The Ministry of Finance continues to implement measures for incorporating gender budgeting as part of the program-targeted approach in the budget process. Compared to last year, the number of principal administrators who have included gender indicators in their budget programs has increased from 45 to 65. In the vast majority of cases, these indicators represent a breakdown of public servants implementing the budget program by gender and job category. A minority of budget programs include a distribution of public service recipients by gender. Only the State Border Guard Service demonstrates a difference in expenditures for male and female employees. However, no budget program currently reflects planned changes in spending that would address the specific needs and interests of different groups of women and men.

The best examples of gender-sensitive performance indicators in budget programs include:

- Current satisfaction levels with the conditions of civil service in the Ministry of Internal Affairs among women (94%) and men (93%) (Budget Program “Leadership and Management of the Activities of the Ministry of Internal Affairs of Ukraine”).

- Average expenditures for providing material support per male service member (UAH 11,900) and female service member (UAH 12,300) (Budget Program “Ensuring the Performance of Tasks, Functions, and Training of Personnel by the State Border Guard Service of Ukraine”).

- Average cost of medical services for the collection, cryopreservation, and storage of reproductive cells for male service members (UAH 9,000) and female service members (UAH 150,000) (Budget Program “Ensuring the Performance of Tasks, Functions, and Training of Personnel by the State Border Guard Service of Ukraine”).

- Gender composition of grant recipients: women (57%), men (43%) (Budget Program “Ensuring the Functioning of the Ukrainian Cultural Fund, Including the Fund’s Support for Project Activities”).

Number of visitors to events held at the Mystetskyi Arsenal National Art and Culture Museum Complex, including online visitors: women (152,500), men (97,500) (Budget Program: “Financial Support for Cultural Institutions and Art”).

Interbudgetary relations

1. The 2025 budget draft includes an increase in financial resources for local budgets. However, all innovations reflect a desire to balance the relationship between central government and local self-government, prioritizing the preservation of financial stability in the state budget amid military challenges. The projected volume of resources for local budgets will amount to UAH 716.7 billion, which is 14% more compared to the 2024 plan. Of this amount, own revenues are UAH 500 billion (+16.5%), and transfers from the state budget are UAH 217 billion (+10.2%), including five grants totaling UAH 78.8 billion and 19 subventions amounting to UAH 138.2 billion (Table 1).

Table 2. Top 10 transfers from the state budget to local budgets in 2025

| Subvention | Billion UAH | Compared to the 2024 plan |

| Educational subvention | 103.2 | = |

| Additional subsidy for the exercise of local self-government powers | 51.2 | +53% |

| Basic subsidy | 24.2 | +15% |

| Subvention for compensation of the difference in utility tariffs | 12.2 | new |

| Subvention for roads | 6.6 | Unavailable in 2024 |

| Subvention for the implementation of projects under the Ukraine Recovery Program | 5.0 | +11% |

| Additional subsidy for the execution of transferred expenditures from the state budget for the maintenance of educational and healthcare institutions | 2.9 | = |

| Subvention for the support of veteran assistance activities | 2.9 | -24% |

| Subvention for the extension of the third subway line in the city of Kharkiv | 2 | +189% |

| Subvention for the implementation of projects under the Emergency Credit Program for the Recovery of Ukraine | 1.5 | -34% |

Source: Draft State Budget for 2025

2. The state taxes allocated to the general fund of local budgets are projected to reach UAH 346.5 billion. The primary source of revenue will be the personal income tax (PIT), amounting to UAH 268.7 billion (+15%). Local taxes and fees are projected at UAH 126.7 million (+19.8%).

3. The share of PIT allocated to local budgets will decrease from 64% to 60%. This decision was a compromise reached after prolonged discussions with local self-government bodies, which had requested to maintain the 64% share (in effect during 2022, 2023, and 2024) due to rising expenditures on utility services. To compensate for the losses from the decrease in the PIT share, a subsidy for supporting enterprises that provide heating, water supply, and wastewater services is being introduced for the first time. The subsidy amounts to UAH 12.2 billion, which is equivalent to 4% of the PIT that could have been received by community budgets. The difference is that local authorities can use PIT revenues at their discretion, while the subsidy has a specific purpose.

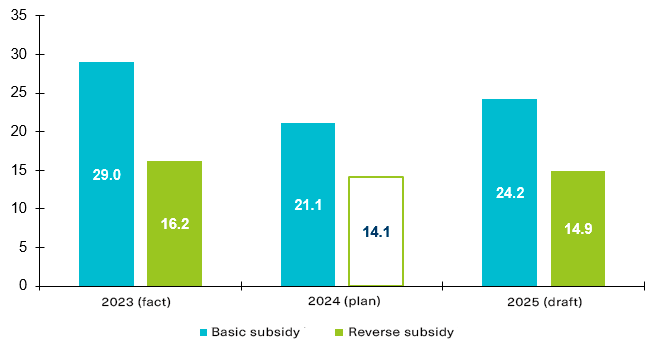

4. An important innovation in the 2025 budget is the changes in the mechanism for horizontal equalization of the tax capacity of communities. One hundred seven temporarily occupied communities will not receive the basic subsidy; instead, they will receive transfers calculated based on the performance of local budgets in 2023. For 1,331 communities in government-controlled territories, the basic and reverse subsidies will be calculated as they have been in recent years, based on projected PIT revenues in 2024. The basic subsidy will amount to UAH 24.2 billion, and the reverse subsidy will be UAH 14.9 billion (in 2024, the reverse subsidy remained in local budgets – see Figure 10).

A separate article in the draft law on the state budget stipulates that the Cabinet of Ministers, regional military (state) administrations, and the Kyiv City State Administration must update the population data in the State Migration Service’s information system by April 1, 2025. This will enable a more even distribution of funds among local budgets starting from 2026.

5. The average level of PIT revenue per resident used for calculating subsidies is UAH 4,052.82. Accordingly, 1,027 budgets will receive the basic subsidy (including 18 regional ones, while the rest are community budgets), where the tax capacity index is lower than 0.9, meaning PIT revenues per resident are less than UAH 3,647.54. The reverse subsidy will be transferred to the state budget from 194 local budgets (including five regional ones: the Dnipropetrovsk, Kyiv, Lviv, Odesa, and Poltava regions) where the tax capacity index exceeds 1.1, meaning PIT revenues per resident are higher than UAH 4,458.10.

Figure 8. Horizontal equalization of tax capacity of territories, billion UAH

* In 2024, the reverse subsidy is not transferred to the state budget.

Source: Openbudget, Draft State Budget for 2025

The budget draft does not include 11 subsidies planned for 2024, totaling UAH 12.5 billion, specifically:

- Compensation for housing for ATO/JFO veterans (Groups I-II of disability): UAH 3 billion

- Compensation for housing for IDP veterans of ATO/JFO (Group III of disability and combat participants): UAH 2.4 billion

- Compensation for housing for veterans of combat operations abroad (Groups I-II of disability): UAH 400 million

- For vocational and technical education centers: UAH 500 million

- For shelters in schools: UAH 2.5 billion

- For the purchase of school buses: UAH 1 billion

- For school cafeterias: UAH 1.5 billion

- For shelters in medical facilities: UAH 1 billion

- For services to support victims of domestic violence: UAH 200 million

- For local elections: UAH 7.6 million

- For reforming healthcare systems: UAH 37.2 million

For the first time, subventions are planned for:

- The implementation of projects under the Ukraine Recovery Program III: UAH 1 billion from grants;

- Providing meals for primary school students in the amount of UAH 100 million (according to the explanatory note, it is expected that after making the necessary adjustments to the provisions of the Agreement between Ukraine and the European Commission “Support for the Rapid Recovery of Ukraine,” the subvention will amount to UAH 2.9 billion. The form in which Ukraine will receive these funds (grant or loan) is currently unknown).

- The education subvention remains the largest among interbudgetary transfers, amounting to UAH 103.2 billion (at the 2024 level). There is currently no information on the distribution of this subsidy among communities.

- The additional subsidy for communities affected by the war will significantly increase in 2025 to UAH 51.2 billion (+UAH 18.8 billion compared to 2024). With these funds, the government will be able to assist communities facing significant budgetary issues due to full-scale aggression. The funds will cover urgent local budget expenditures, including the salaries of public sector employees, taking into account additional pay for challenging working conditions. According to the current regulations, this subsidy is provided to communities located in areas where hostilities are taking place or that were temporarily occupied. Additionally, the subsidy is granted to communities where tax revenues (from land tax, property tax, etc.) are insufficient or where they do not receive taxes from the incomes of service members and law enforcement officers.

- The subvention for roads is being reinstated, which was absent in 2024. It will be UAH 6.6 billion, or 41% of similar expenditures in 2023. Only critically important local road works will be funded.

In summary

The draft 2025 budget largely follows similar approaches to the 2024 budget, with a strong emphasis on defense, security, and social protection for the population. The resemblance to the previous budget is evident in both the revenue and expenditure structures. The main sources of funding remain tax revenues, which are expected to increase through changes in tax legislation and external borrowings. International financial support, including grants and loans from international organizations and partners, continues to be crucial for maintaining budget stability.

A significant increase in defense and security expenditures is planned; however, these allocations may need further adjustments if the intensity of hostilities persists. Despite the increased tax rates and the tax base expansion, the budget deficit remains high, and public debt is projected to continue growing, exceeding 100% of GDP.

Authors: Yuliya Markuts, Dmytro Andriyenko, Inna Studennikova, Taras Marshalok, Lina Zadorozhnia, Vladyslav Iyerusalymov, and Tetiana Lutai, The Center for Public Finance and Governance at Kyiv School of Economics

Фото: depositphotos.com/ua

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations