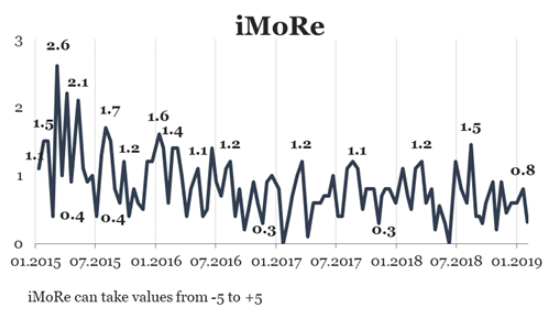

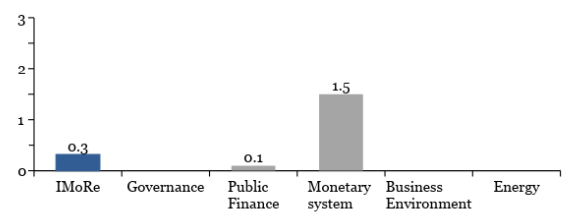

Reform Index is +0,3 points for the period from January 14 – 27, 2019 on a scale of -5,0 to +5,0. In the previous round the index was +0,8 points.

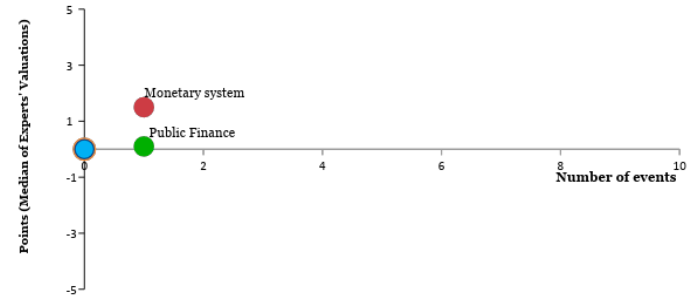

The major events of this round – new approaches for the assessment of the banks stability and an improved procedure of state social inspectors’ work.

Chart 1. Reform Index dynamics

Chart 2. Reform Index and its components in the current round

Major event of the round

New approaches for the assessment of the banks stability, +1,5 points

Every year, the National Bank of Ukraine conducts stress testing of banks. He checks what losses the bank may receive in the event of a crisis. According to the results of stress testing, it is possible to assess whether the bank has enough capital to cover its losses during the crisis period. If the capital was not enough, the NBU required the bank to increase the bank’s capital by a certain amount in hryvnias.

This approach was not flexible enough. NBU determines the amount of additional capitalization at the beginning of the year. However, during the year, the situation in the economy and in the bank could change, so a particular amount could lose its relevance.

The NBU resolution of January 17, 2019 No. 21 somewhat changes this approach. Now, requirements for additional capitalization will be set as a percentage of risk-weighted bank assets. These requirements will be determined, as before, based on the results of the stress tests. This approach is more stringent, since now the amount of additional capitalization will increase if the volume of bank assets increases during the year.

Chart 3. Value of Reform Index components and number of events

(Please see other charts on the website)

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations