And although today it has more psychological meaning and we have to wait a long time for real economic benefits, as the market will be as limited as possible by 2024, the main thing is that the Verkhovna Rada will be able to adopt other equally important bills on land reform over the next two weeks.

In particular, the decentralization of land relations (transfer of state-owned agricultural land to communal ownership and transfer of land management powers to the local level) will improve the quality of land management. This will be a significant force of increasing tax revenues of local budgets, which is necessary for the development of rural communities in the context of increasing the level of their independence in the framework of decentralization reform.

Rural communities, land and agricultural sector

Land is one of the main resources for rural development. The budgets of rural communities receive revenues from various taxes, which generated in different ways by agricultural land, and from the lease of state / communal agricultural land. Owners of land plots receive income from the lease of their shares to farmers. Rural residents also receive a significant share of income from self-employment on land (sale of agricultural products), employment in agricultural enterprises and non-monetary income in the form of the value of consumed products from their own gardens. Opportunities for non-agricultural employment and income in rural areas are currently very limited.

Currently, the following interesting observations from the available statistics are quite clear:

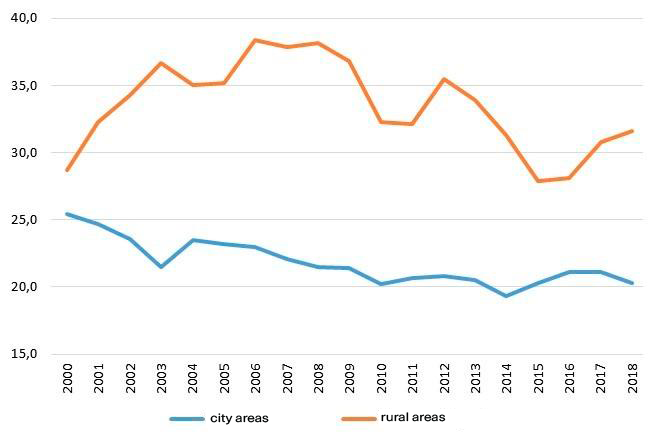

- Villages are much poorer than cities. Rural residents lag far behind the urban population in terms of income. Figure 1 shows that rural poverty is much higher than urban poverty, and this gap is widening: in 2018, it was 11 p.p (fourfold increase over the past 20 years).

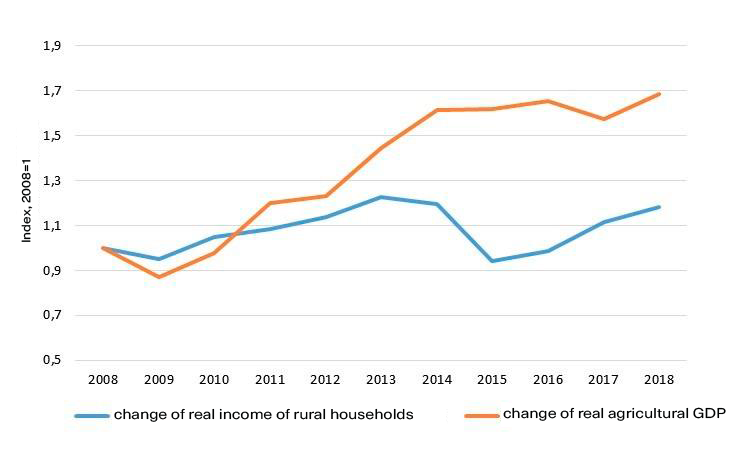

- Agriculture, although a kind of backbone of the rural economy, still does not contribute enough to increase the welfare of rural residents. Figure 2 shows that agriculture is growing much faster than the real income of rural residents.

- Rural development has suffered significantly in the last two decades from underfunding of rural community budgets. There are many reasons for this, but inefficient land management, lack of land market and underestimation of land are among the main ones. More about it in details – below.

Figure 1. Poverty threshold l by relative criterion,% *

Source: Own presentation based on data from the Institute of Demography and Social Research of the National Academy of Sciences of Ukraine

Figure 2. Dynamics of real incomes of the rural population and value added of agriculture

Source: Own presentation based on SSSU data

Budgets of rural communities and land

The moratorium on the circulation of agricultural land and the regulatory and monetary valuation of land reduce the “land” income of communities.

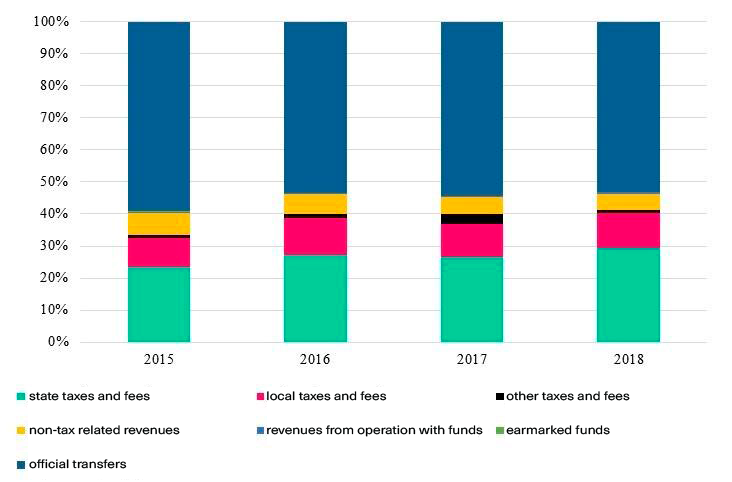

The budgets of rural communities are currently very dependent on transfers from the State budget — on average by 60-80% (the rest – own tax and non-tax revenues). The land generates the following revenues to local budgets:

- land tax,

- rent for state and communal lands,

- single tax of the fourth group for agricultural producers,

- personal income tax received from the lease of land.

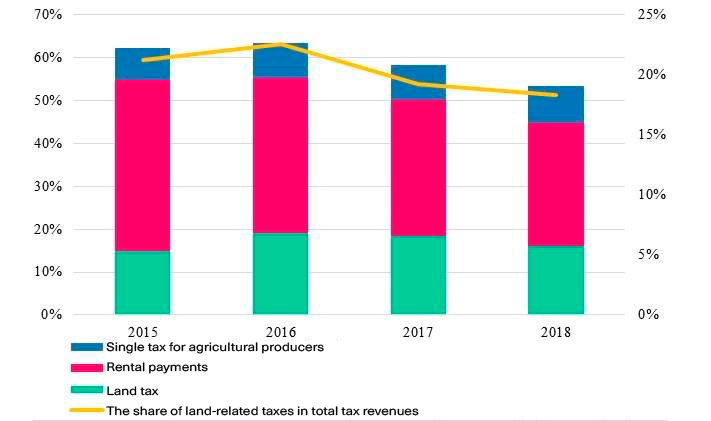

About 11% of total local budget revenues are own revenues from local taxes and fees (Figure 4). More than 50% of them are generated by land-related sources. Of these sources, the most important is the rent money for state and communal lands (Figure 5).

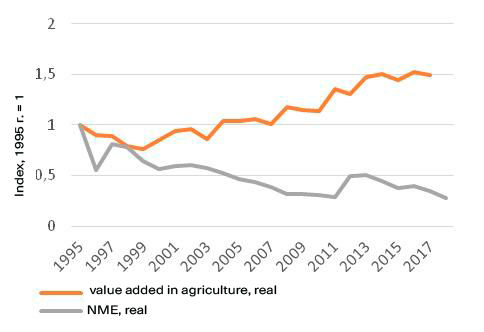

One of the significant problems of “land” taxation is its base, namely the normative monetary evaluation (NME) of land (for all the above-mentioned items of income, except for personal income tax on income received from the lease of land **). It is the level of NMEs that is one of the reasons for the significant underreception of land revenues by rural communities due to the diversification of the dynamics of real normative monetary evaluation ( NME) and real value added in agriculture.

In Ukraine (Figure 3) the growth rate of NME (which is determined administratively) lags significantly behind the growth rate of profitability of the agricultural sector. Due to the fact that NME “do not keep up” with the growth of profitability, farmers are devoting less and less of their income to rural development in the form of taxes and payments. Moreover, in 2018, NME decreased on average (according to the new Methodology), which reduced the tax burden on farmers in nominal terms ( here is more detailed analysis of the situation ).

Figure 3. Dynamics of real value added in agriculture and NME (normative monetary evaluation)

Source: World Bank WDI (2018), Stategeocadastre and SSSU

Paradoxically, the moratorium on the purchase and sale of agricultural land is a fundamental reason for the situation with NME, as the lack of a market implies the absence of a market price, and hence the need for such an artificial structure as an NME for tax purposes. The opening of the land market should help solve the problem of low tax base, as it will allow to rely on the market value of land in the calculation of tax liabilities and bring them closer to a fair (higher) level. Of course, given the extremely limited land market till 2024, it is difficult to hope for a fair price due to very limited demand, but from 2024 we can expect significantly higher demand and, consequently, approaching the fair value of land. Model calculations indicate that if a liberal land market had been introduced from the outset with minimal restrictions and support from farmers, the value of land could have doubled.

Figure 4. Structure of local budget revenues

Source: Own presentation based on annual reports of the State Treasury Service of Ukraine

Figure 5. The share of revenues from land-related taxes in local budgets’ own and total tax revenues

Source: Own presentation based on annual reports of the State Treasury Service of Ukraine

The low level of land management in Ukraine is the reason for low budget revenues

Another important reason why local budgets do not receive land generated revenues is the inefficient management of land resources, as evidenced by the significant share of unregistered land. In general, in Ukraine, according to the Stategeocadastre, the average share of unregistered lands is about 28% of the territory (Figure 6).

Figure 6. Share of unregistered lands,%

Source: Own presentation based on data from the Stategeocadastre. Pieces are village and settlement councils in accordance with the administrative structure of the country. Figures in square brackets — the percentage of unregistered land. Figures in parentheses – the number of village and town councils.

To empirically verify the relationship between the share of unregistered land and tax revenues from the above four items, we built a nonparametric model and graphically represented the relationship between the percentage of unregistered land and tax revenues per hectare and the level of budget execution under these articles (Figure 7). As we can see, there is a rather strong negative correlation between the amount of land generated tax revenues and the share of unregistered land.

Figure 7. The ratio of budget land generated revenues (per hectare — vertical axis) and the share of unregistered land (horizontal axis)

How land reform increases communities’ capacity for development

As has been said many times, land reform is not limited to Bill 2178-10 on the circulation of agricultural land, but contains a package of at least 8 bills considered by Зarliament and a set of measures to increase the transparency of land management. For example, mandatory registration of land transaction prices, development of the Land Relations Monitoring System and the Agrarian Register, creation of the Credit Guarantee Fund, etc. The proposed package of bills solves the above problems in this way.

1) Moratorium and NME

Bill 2178-10 abolishes the moratorium and together with other laws introduces a civilized circulation of agricultural land. One of the main expected consequences is an increase in rental prices and the value of agricultural land and the emergence of a “normal” market price. Having a market price, it will be possible to move to it as a tax base and thus generate fair tax revenues from each hectare of agricultural land. Of course, the bill passed on March 30 postpones this at least until 2024, but such a development is inevitable.

2) Improvement of the quality of land management

- In this direction, the “scope of work ” of the land package is quite broad and is primarily aimed at improving the efficiency of state and communal land use, which are currently a source of mass corruption and significant budget losses (see here and here). The design of the solution to this issue is as follows:

- Transfer of approximately 5.5 million hectares of state-owned agricultural land (out of the available 7.2 million hectares) located outside settlements to communal hromada ownership as part of the decentralization reform. As well as the transfer of land management functions from the Stategeocadastre to the local level (bill №2194). This will give rural communities additional development resources and the opportunity to better manage land resources on the ground.

- Determining the rules of land distribution during the privatization of agricultural lands of state and communal enterprises (draft law №3012-1, up to 3 million hectares). At privatization of these agricultural lands the following is offered:

1.up to 40% of the total area of agricultural land will be transferred free of charge to private ownership to employees of enterprises;

2.up to 20% of the total area of agricultural land is transferred free of charge to the ATO and JFO fighters;

- at least 40% of the total area of agricultural land will be sold or leased at transparent land auctions.

- State and communal lands will be sold or leased exclusively at transparent electronic land auctions (Bill 2195).

Taking into account the adopted bill №2178-10, it is probably possible to talk about the transfer of state and communal agricultural lands only for rent, as the sale of state and communal agricultural lands is indefinitely prohibited. However, the effectiveness of land auctions is quite significant. Since 2016, the sale of lease rights to state-owned agricultural land takes place exclusively through land auctions. This has led to a significant increase in the cost of renting public land. In 2016, the lease price through land auctions was UAH 2,249.8 / ha, while the lease price for state-owned land on a non-competitive basis under previous agreements was only UAH 940 / ha. For comparison, the average cost of renting private agricultural land (so-called shares) in 2016 was 1093.4 UAH / ha against 862 UAH / ha in 2015. Moreover, this gap between the cost of renting private and state land increased in 2018 (UAH 3,431.5 / ha — the average cost of renting state-owned agricultural land at auctions).

Thus, the launch of a full-fledged land market in the form of the proposed package of land laws and other accompanying measures should be a significant impetus to the development of rural communities. Decentralization of land relations (transfer of state agricultural land to communal ownership and transfer of land management powers to the local level) will improve the quality of land management. This will be a significant factor of increasing tax revenues of local budgets. This is especially necessary for the development of rural communities in the context of increasing the level of their independence in the framework of decentralization reform.

The launch of the test Agrarian Register is an important step towards overcoming the problem of unregistered land, which is one of the factors in the gap between the actual and economically possible level of budget revenues. The lifting of the moratorium and the opening of free market circulation of agricultural land will create conditions for the calculation of tax liabilities based on their real (market) value. This is an important factor for the growth of local budget revenues.

* Poverty threshold by relative criterion – the share of persons whose income level is below 75% of the median level of average per capita equivalent expenditures for the population of Ukraine as a whole (ie lower than 75% of the expenditure level, which is in the middle of the average per capita expenditure)

** Tax rates are as follows: 1% — the maximum rate of land tax for agricultural land, but the real rate is much less than 1%, 0.95% — the maximum rate of the single tax of the 4th group, and single tax payers are exempt from paying land tax on leased or own land, as well as income tax. Not less than 3%, but not more than 12% — the rental rate for state and communal lands. In most communities, the rates of local taxes and fees are not set at the maximum level. In any case, tax rates remain relatively stable, and the dynamics of revenues to local budgets depends entirely on the dynamics of changes in NME.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations