Russia has long been blackmailing the EU with its energy supplies. However, we show that refusing to buy Russian energy and finance Putin’s war will be less costly for the EU than we used to think. On this issue the EU bargaining position is stronger than that of Russia. The EU only needs to use it to achieve peace.

Before Putin started to threaten the world with nuclear weapons, he used gas and oil as a geopolitical weapon. Indeed, Russia cut off (or threatened to cut off) whole countries from its energy supplies unless these countries obey orders from Moscow. In recent history Ukraine was cut off in 2006 and 2009. In retrospect, it is shocking that Germany and other EU countries were oblivious to this brazen blackmail and now are on the hook at a pivotal point in history. Russia can bomb cities in Europe and face little reaction from the EU because the EU is so dependent on Russian energy. One Russian economist observed that even if Russia occupies Finland, Europe will still buy Russian gas.

Buying energy from Russia or other regimes that kill innocent people is immoral. To add insult to injury, the scale of oil and gas flows from Russia to the EU is absurd. Andrius Kubilius, an EU member of parliament, writes that a daily EU purchase of oil and gas from Russia is equivalent to giving Putin 100 new tanks – twice the number of tanks that the Ukrainian army can destroy in a day.

The US government imposed sanctions on imports of Russian energy and called on other countries to follow. If the EU and China join this effort, the demise of the Russian economy will be very fast, thus forcing Putin to stop the aggressive war against Ukraine and negotiate peace. In this case there will be a temporary spike in energy prices which can be softened by the use of oil that is currently floating in tankers and if the Gulf countries increase supply (they can do this rather fast). Another short-run opportunity is introduction of ‘oil/gas for food’ program – so that energy revenues could be used only to buy goods of a humanitarian nature.

However, this is an unlikely scenario. The images of ever greater destruction in Ukraine–Russia bombed a maternal hospital in Mariupol and killed scores of babies and (expecting) mothers–will likely spur a public outcry in European democracies which will force governments to abandon Russian energy. Other countries may be less concerned about moral aspects and thus continue purchases of Russian oil and gas. However, even in this very sad, but more realistic scenario, Russia will pay a heavy price.

First, many people think that oil is a homogenous good but this is not entirely true. Oil can be heavy and light, sweet and sour. Switching from one type to another requires some investment and adjustment in oil refineries.

Second, oil has to be transported from wells to customers. Oil pipelines from Russia to Europe (these carry modest amounts of Russian oil exports) can’t be redirected. Tankers shuttling between Russian ports and EU ports can be used to export oil to non-EU countries but shipping oil from Russia to China or India will take much longer (especially if the Suez canal is not available) thus limiting the ability of the tanker fleet to transport oil. Using rail is more expensive and adjusting the capacity is hard in the short run too.

Third, Russia is used to being a monopolist dealing with small buyers. In this scenario, it will have to face a monopsonist, i.e., a buyer who has market power. This means Russia will get a less favorable deal. For example, relative to the EU, China buys gas from Russia at lower prices.

Fourth, the contracts between Russia and potential buyers will likely be settled in a major currency (US dollar, euro, etc.) which makes these trades vulnerable to financial sanctions. Even the recent 30-year gas contract between Russia and China stipulates that the euro will be used to clear trades.

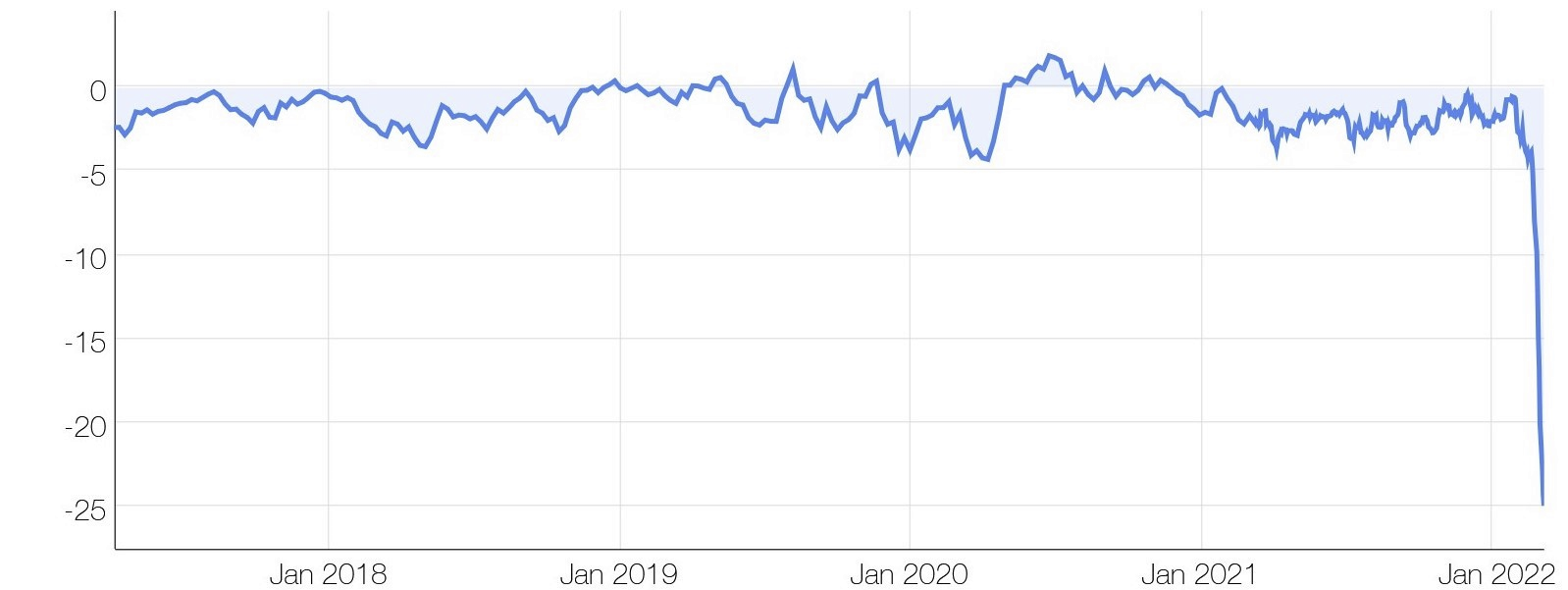

What will happen with oil prices in this scenario? If oil is as fungible as many people believe, the world prices will not be affected too much and Russia may continue to profit from oil exports. If oil is not that fungible, there should be a wide spread between Urals (the Russian blend of oil) and other major oil types such as Brent or West-Texas. The markets suggest that the latter is the case. The infamous purchase of Russian oil by Shell had a $30/barrel discount. The chart below shows that this price differential is highly unusual. The incidence of this discount (i.e., who is paying for it) remains to be seen in the longer run but for now it is the Russian producers who absorb it. This means that the Russian war machine will have less money.

The Urals-Brent price differential, USD/barrel

In conclusion, the West has significant leverage with Russia even with modest sanctions. On the other hand, the EU countries have the ability to carry on without Russian energy with modest costs. This is not the time to appease Putin again. This is the time to stand up to Putin and use a strong bargaining position to bring peace to Europe and protect global security.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations