Valeria Hontareva – the head of the National Bank of Ukraine who managed it during the historic times in the Ukrainian economy – is leaving her post. She took office after the presidential election in June 2014, during the period of tough calls for the National Bank. This article is an attempt to track how the central bank responded to these challenges and to briefly outline the history of monetary and exchange rate policy in the period crucial for Ukraine. We deliberately do not focus on the issue of liquidation of banks and changes in the system of prudential supervision, because this is a related, yet separate sphere of activity of the central bank.

To have an external reference point (albeit imperfect [1] ) and the corresponding background to describe the monetary and the exchange rate policy of Valeria Hontareva, we will compare the actions of the NBU with the actions of the Central Bank of Russia. Russia has been chosen for comparison, because the central banks of both countries have faced similar challenges: drop in the level of exports due to the downturn in the most important commodity markets (iron ore and steel for Ukraine and oil for Russia) and the outflow of foreign capital (in Ukraine – because of the war in the East, the annexation of the Crimea, and the internal political crisis; in Russia – due to international sanctions). Although Russia had a greater ability than Ukraine to respond to the critical factors, and the Ukrainian economy sustained much bigger losses from the war and the annexation than Russia from the sanctions, both the Ukrainian hryvnia, and the Russian ruble have lost more than half of their worth against the US dollar within a very limited period of time.

Can it be concluded that the policy of the Ukrainian central bank was quite successful, inasmuch as it was possible in those conditions?

Critical factors and capacities of central banks

After a deep political crisis in early 2014, Ukraine became an object of external aggression. It faced not only the war in its territory, the annexation of the Crimea, the closure of the Russian market, and a large-scale uncontrolled outflow of capital, but also a collapse in commodity markets. These factors have led to a drop in GDP and export earnings and a deep currency crisis. A new central bank management team, staffed mostly from the market experts, had to react to this situation with lightning speed, taking into account not only economic factors, but also military aggression and serious political risks after the revolutionary change of the ruling elites.

“Rich” legacy

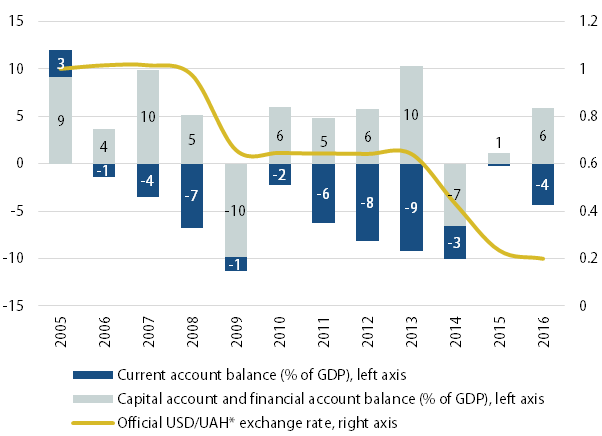

The problems in Ukraine did not appear out of the blue – most of the critical factors and the leverages accessible to the government and the central bank were the consequences of the economic history and the policies of the Ukrainian leaders. The current account deficit has been accumulating in Ukraine since the crisis of 2008-2009 (to a catastrophic level of 9% of GDP or 16.5 billion USD in 2013). It was not sufficiently compensated by the inflow of investments or new foreign borrowings, which created a devaluation pressure on the Ukrainian hryvnia. At the same time, the NBU and the Ministry of Finance – being managed, in fact, from one office – kept the hryvnia exchange rate tied to the US dollar, “burning” external reserves and attracting billions of dollars in foreign debts.

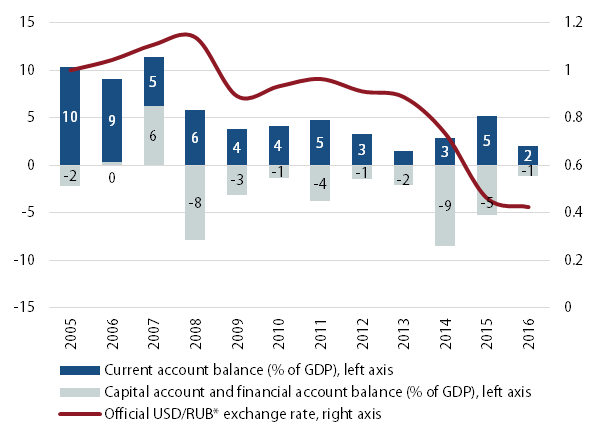

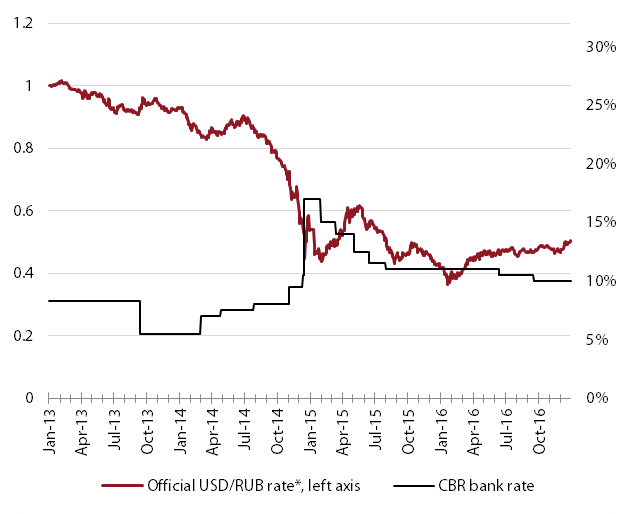

In the meantime, while Ukraine kept the hryvnia exchange rate tied to the US dollar under the conditions of open economy, causing huge imbalances in foreign trade, financial sector, and economic motivation of citizens and companies, Russia has followed a more flexible exchange-rate regime [2], long before 2014, allowing the ruble to revaluate and devaluate (Fig. 1 and 2).

Figure 1. Balance of payments of Ukraine and the official hryvnia exchange rate in 2005-2016

* For convenience of comparison, normalized average annual data of the exchange rate is shown: the ratio to the 2005 rate.

Source: NBU

Figure 2. Balance of payments of Russia and the official ruble exchange rate in 2005-2016

* For convenience of comparison, normalized average annual data of the exchange rate is shown: the ratio to the 2005 rate.

Source: CBR

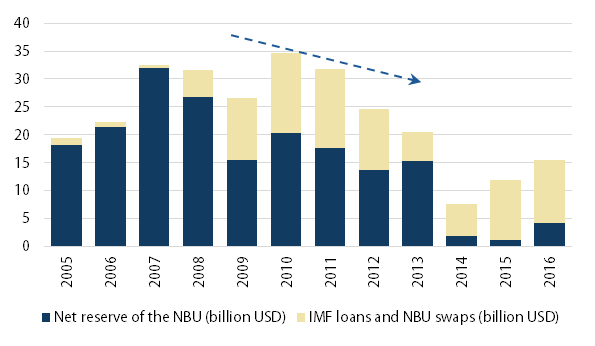

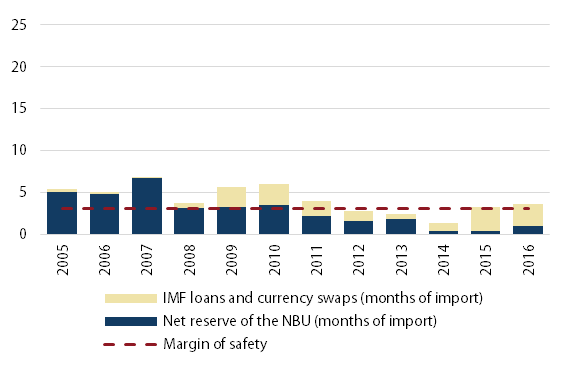

As a result, in 2010-2013, Ukraine “burned” almost half of its currency reserves to maintain the exchange rate, so that in late 2013 they amounted to 20 billion USD – only 35% of short-term debt and 2.5 months of imports (Fig. 3 and 4). [3] Additional external borrowings were needed, but since there were no opportunities for further borrowings on the foreign market, a 3-billion-USD loan (“Eurobonds”) from Russia emerged, which, though, has not remedied the situation [4].

Before the crisis in February 2014 (when Stepan Kubiv took up the post of head of the NBU), Ukraine had already 15.5 billion USD in foreign exchange reserves. When Valeria Hontareva headed the National Bank in June 2014, reserves totaled 17 billion USD, after the IMF transferred the first tranche of its loan in the amount of 3.2 billion USD to Ukraine in May (Fig. 3). At the same time, in 2014, Naftogaz needed 2.8 billion USD to pay for the gas imported from Russia in 2013 [5] and another 1.7 billion USD to repay Eurobonds issued in 2009. In addition, the company had to buy foreign currency to pay for the gas imported for current demand. It is clear that the possibilities of the central bank to maintain the hryvnia exchange rate were limited.

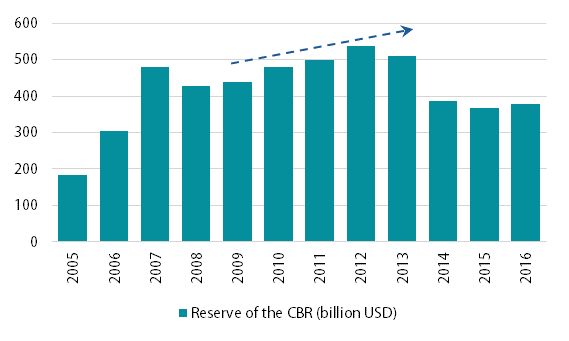

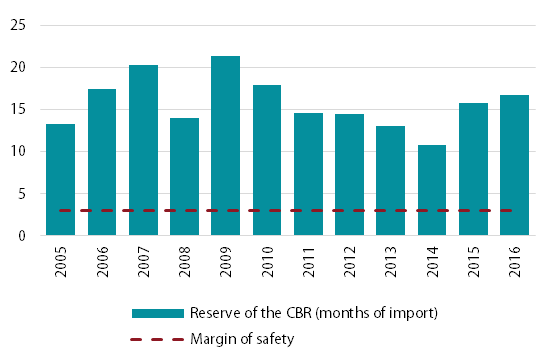

Owing to the growth of global oil prices and a stable surplus of foreign trade, in early 2014, Russia had 500 billion USD [6] in its reserves (Fig. 4): they covered 250% of the short-term foreign debt and 13 months of import [7]. With its large reserves and unlimited influence over the controlled giant corporations [8] and monopoly banks, the Kremlin had much more room for maneuvering in critical conditions than the Ukrainian government.

Figure 3. Foreign exchange reserves of Ukraine

* The end-of-year amount of reserve.

Sources: NBU, IMF, Dragon Capital estimates

Figure 4. Foreign exchange reserves of Russia

* The end-of-year amount of reserve.

Source: CBR

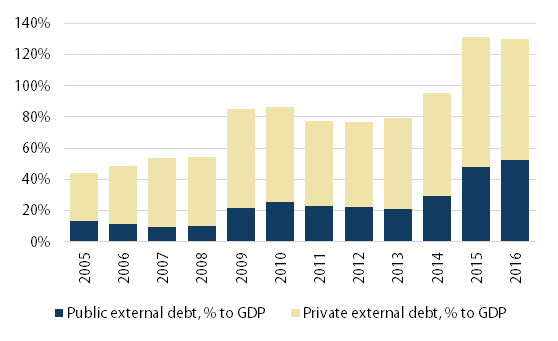

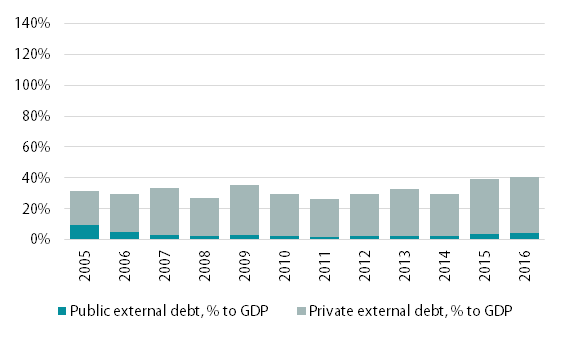

However, the problems of Ukraine were much deeper. As a result of an uncontrolled build-up of the public debt during 2008-2013, the public and the government-backed currency debts reached 43.8 billion USD or 24.4% of GDP by the end of 2013 (the public and the government-backed debts). The devaluation of hryvnia became a strong blow to the solvency of our state under such conditions. It is the devaluation and the subsequent fiscal crisis that forced Ukraine to conduct restructuring of Eurobonds in 2015, as a result of which an agreement with the creditors’ committee was reached to write off the fifth part of the debt and to impose a four-year moratorium on the primary loan.

Russia’s total external debt was small compared to GDP: in late 2013, it reached 33% of GDP (Fig. 6), and there were no urgent issues with its payment.

Figure 5. Dynamics of the Ukrainian external debt

* The end-of-year amount of debt.

Source: Ministry of Finance of Ukraine

Figure 6. Dynamics of the Russian external debt

* The end-of-year amount of debt.

Source: CBR

The balance of payments crisis in 2014-2015

In 2014, Ukraine lost some of the territories that provided a large share of the gross value added and export [9].

The flight of capital of Viktor Yanukovych and his supporters made this blow even harder. New foreign investments or borrowings in the markets were out of the question due to a high economic and political uncertainty.

The war and the accumulated imbalances affected the financial account of Ukraine’s balance of payments, while Russia suffered from the Western sanctions: the inflow of direct investments into Russia has fallen tenfold in two years. Even those companies and banks not subject to sanctions struggled to get foreign financing, as the Western banks feared that worsening of the economic situation in Russia or potential further sanctions would lead to losses. [10]

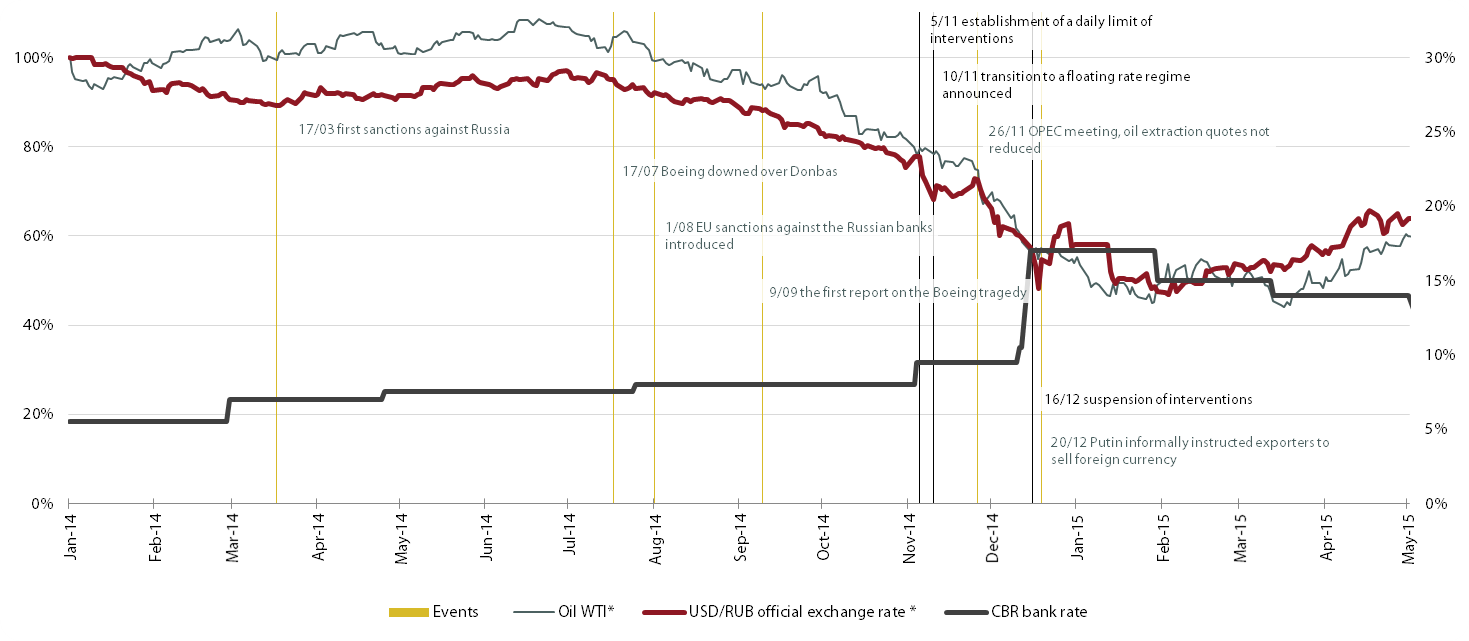

Each political event affected the exchange rates of national currencies (Fig. 7 and 8). In addition to political factors and the war, the situation was significantly aggravated by the state of affairs in the global markets. Before the crisis, one third of Ukraine’s exports belonged to ore and metals, whereas in Russia more than half of exports were connected with oil, oil products, and gas. Both commodity markets rapidly collapsed in 2014. In general, the drop in global prices of raw materials has affected the currencies of all commodity-dependent countries.

Figures 7 and 8. The impact of political events and actions of central banks on the fluctuation of exchange rates of the Russian and Ukrainian currencies in 2014-2015

* Black lines correspond to the actions of central banks, yellow ones – to the political events.

Sources: NBU, CBR.

The total outflow of capital from Ukraine on the current and financial accounts of the balance of payments in 2014 amounted to 13.3 billion USD or 10.1% of GDP. The central bank could counter this tsunami only with strict administrative restrictions and a program of cooperation with the IMF, which has become the last resort for the country’s economy. Net inflow of direct investments in 2014 decreased five-fold – from 4.5 billion USD to almost 1 billion USD, although in 2015 it rose again to 3 billion USD (3.4% of GDP), but only owing to the “forced” follow-on capitalization of foreign banks, while investments in other sectors remained minimal.

In 2014, Russia lost a total of 8 billion USD in the current and financial accounts of the balance of payments. However, in comparison with the size of its economy, which is much larger than Ukrainian, the outflow was not that big – only 0.4% of GDP. The inflow of direct foreign investments has decreased tenfold over the period of 2014-2015 – in 2015 they amounted to 6.5 billion USD (0.04% of GDP).

In response to the crisis of the balance of payments, both Russia and Ukraine sold currency from the reserves. Ukraine also had extra Naftogaz obligations: it had to repay Eurobonds, cover the debt to Russia for natural gas, and obtain funds to purchase gas for the next season. Ukraine was forced to introduce “draconian” currency restrictions. Both Ukraine and Russia have raised interest rates (albeit to varying degrees) to support exchange rates. And in both cases, their currencies have devalued (Table 1).

Table 1. Some indicators of the foreign exchange markets of Ukraine and Russia

| Indicator | Units of measurement | Ukraine (2014-2016) | Russia (2014-2016) | ||||

|

|

2014 | 2015 | 2016 | 2014 | 2015 | 2016 | |

| Current account balance | billion USD | -4.5 | -0.2 | -3.8 | 57.5 | 69.0 | 25.0 |

| % of GDP | -3.5 | -0.2 | -4.3 | 2.8 | 5.2 | 2.0 | |

| Balance of the capital and the financial accounts of the balance of payments | billion USD | 9.1 | -0.6 | 5.1 | -173.1 | -70.3 | -13.9 |

| % of GDP | 6.6 | -1.1 | 5.9 | -8.5 | -5.3 | -1.1 | |

| Currency reserves (2014 – beginning of the year /2015 – minimum rate / 2016 – end of the year) | billion USD | 20.4 | 5.3 | 15.5 | 509.6 | 351.7 | 379.1 |

| months of import | 2.4 | 1.0 | 3.6 | 24.3 | 9.8 | 16.7 | |

| Volume of exchange market interventions | billion USD | -9.2[11] | -0.2 | 1.6 | -83.1 | 7.2 | 0.0 |

| months of import | -1.5 | 0.0 | 0.4 | -2.3 | 0.3 | 0.0 | |

| Interest rate of the central bank (2014 – beginning of the year /2015 – maximum rate / 2016 – end of the year) | % | 6.5% | 30% | 14% | 5.5% | 17% | 10% |

| Devaluation of the national currency exchange rate to US dollar over 3 years | % | 67% | 58% | ||||

| Drop in the price of the main export commodity over 3 years | % | 41% | 46% | ||||

Source: NBU, CBR

“Foreign exchange” history of Ukraine in 2014-2017: politics and economy

Decision-making factors in the monetary policy of the Ukrainian central bank were not limited with economic factors. Having sold a certain amount of currency from its reserves, the Russian central bank quickly allowed the ruble to go down in value, while the NBU was struggling. First, Stepan Kubiv, and then Valeria Hontareva tried to maintain the hryvnia exchange rate by selling reserves and introducing administrative restrictions under the influence of political factors. Stepan Kubiv (whose term of office coincided with the outflow of funds of the “old elite,” the annexation of the Crimea, and the outbreak of the war) looked towards the presidential election in May 2014, while Valeria Hontareva (who took the office in the times of the most active military actions and the collapse of global commodity markets) tried to keep hryvnia from falling at least until the parliamentary election scheduled for October 25, 2014.

Although attempts were made to stabilize the exchange rate of hryvnia, by the presidential election in the spring of 2014 the objective circumstances turned out to be insurmountable, and even the IMF program could not neutralize the negative: hryvnia weakened from 7.99 UAH/USD in 2013 to 11-12 UAH/USD on the eve of the election. When the election was over and the political risk lowered, the catastrophic decline in commodity prices, the closure of the Russian market, and the escalation of military operations in the Donbas remained a heavy burden for Ukraine. The National Bank was raising its rate very carefully (from 9.5% in May to 12.5%, and then to 14% in November), actively selling, at the same time, the currency from the reserves (including that of Naftogaz, see Table 2), and maintaining the official rate.

Severe restrictions were also imposed on the purchase of foreign currency on the interbank foreign exchange market of Ukraine and on its transfer abroad for certain transactions; on the purchase of foreign currency by the authorized banks on behalf of legal entities and individual entrepreneurs, including the withdrawal of dividends and import transactions; on the keeping of foreign currency proceeds and foreign currency on company accounts; on dispensing cash from bank accounts to the public. Due to these restrictions, in summer 2014, a “black” market of foreign exchange cash emerged – according to the estimates, in 2015, it was 18 times bigger than the official market [12]. This is indirectly evidenced by an increase in the number of currency exchange offices and the emergence of websites with informal advertisements about purchase and sale of foreign currency.

At the same time, absolute temporary moratorium on cash withdrawals has not been imposed (as it was during the Orange Revolution), individual deposits in hryvnia flowed from the banks to the foreign exchange market, and the NBU had to cover this outflow by refinancing banks. In 2014, the volume of refinancing amounted to 115 billion UAH, while in 2015 – to 17 billion UAH (loans issued for a period of more than 30 days). Refinancing of banks is heavily criticized, especially that of “Delta” (which still owes 8 billion UAH), “Nadra” (9.8 billion UAH), “Khreshchatyk”, and others which received refinancing, and yet were declared insolvent. Of 132 billion UAH of refinancing provided in 2014-2015, about one third of the funds (36%) were given to those banks. A separate analysis is needed to assess how much it is and whether it was a good idea to refinance these banks.

By October 2014, hryvnia reached the rate of 12.95 UAH/USD, while the reserves decreased from 17.9 billion USD in May to 12.5 billion USD in late October 2014, despite the IMF support (in particular, in March-October, the IMF issued a loan of 4.6 billion USD). Parliamentary election has passed – in a week after the election, the exchange rate was maintained only by the NBU interventions. When the rate was “set free”, it quickly reached 15 UAH/USD. The reserves of the National Bank were melting, having dropped to 5.6 billion USD as of February 2015 after the settlement of Naftogaz debts.

Table 2. Some factors in the changes of the NBU reserves in 2014-2015

| Factor | 2014 | 2015 |

| Net payback / build-up of debt | -5.9 | 5.1 |

| in particular: | ||

| to the IMF | 0.9 | 5.1 |

| debt of Naftogaz | -3.1 | 0.0 |

| Net interventions | -9.2 | -0.2 |

| in particular: | ||

| sale of currency for Naftogaz | -5.5 | -1.5 |

| Other | 2.2 | -0.5 |

| Change over the year | -12.9 | 4.4 |

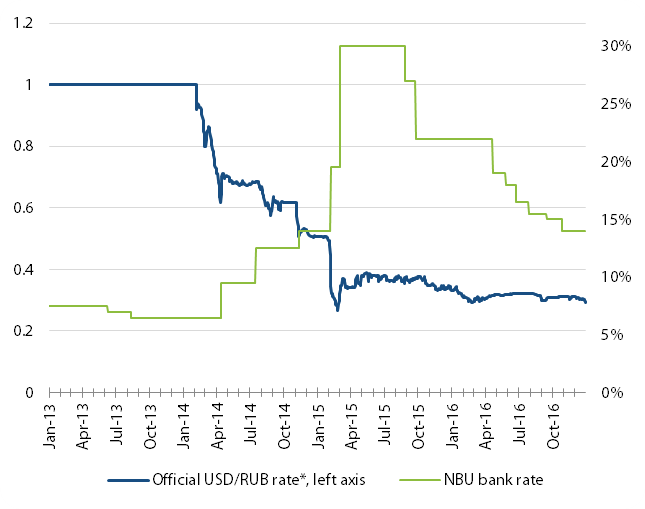

Only then did the NBU take a radical step: set hryvnia free and allowed it to devalue literally in one day – on February 5 – from 16 UAH/USD to 25 UAH/USD, simultaneously raising its rate from 14% to 19.5%, and then to 30% in March 2015. Until that moment, it increased its rate very carefully and much later than required by the circumstances (for example, in 2014, the rate was increased for the first time in April – two months after the tragic events in Maidan and the flight of Yanukovych; one month after the declaration on the independence of the Crimea was signed – see Fig.10).

In 2016, inflation fell to 12.4% compared with 43.3% in 2015, and the economy started to climb up. The National Bank managed to increase foreign exchange reserves to 15.5 billion USD in late 2016, while hryvnia stabilized starting from February 2016 within the range of 25-28 UAH/USD. The interest rate was reduced from the maximum of 30% to 22% in the autumn of 2015, and then, gradually, to the current 13%. The National Bank started to loosen currency restrictions, although very slowly.

By the way, the interest rate policy of the Central Bank of Russia was similar, yet somewhat milder due to more favorable conditions (Fig. 9 and 10). The rates were increased earlier (post factum it seems that it was done in a more timely manner than in Ukraine). In 2014, a gradual transition from a managed float regime to a free exchange rate took place. There were no restrictions on foreign exchange operations in Russia; the Kremlin [13] only insisted that the largest exporters do not withhold currency abroad or keep currency balances on their accounts. Given the degree of governmental control over the economy, such “insistence” has played the role of formal restrictions.

Figure 9. Dynamics of the exchange rate and the NBU rate in 2013 – 2016

* For convenience of comparison, normalized average annual data of the exchange rate is shown: the ratio to the rate as of 1.01.2013.

Source: NBU

Figure 10. Dynamics of the exchange rate and the CBR rate in 2013 – 2016

* For convenience of comparison, normalized average annual data of the exchange rate is shown: the ratio to the rate as of 1.01.2013.

Source: CBR

Conclusions and recommendations

Thus, the Ukrainian currency has survived the most dangerous stage of the crisis, and we consider it a success, because it could have been much worse. High interest rates, severe currency restrictions, and unprecedented cleansing of the bank system have affected the businesses and become a bitter pill for the economy. Valeria Hontareva, albeit involuntarily, has became the first Ukrainian head of the central bank to abandon the harmful practice of a fixed rate and initiate a transition to the inflation targeting policy. The situation in which Ukraine found itself demanded other tough and politically complex decisions. As a result of the joint positive impact of the tight fiscal policy of the Ministry of Finance, the monetary policy of the National Bank of Ukraine, the fulfillment of certain conditions of the IMF program by the government, and the recovery of raw material prices, the Ukrainian economy and currency have finally stabilized.

Monetary policy is not an exact science, therefore, debates about Ukrainian decisions might continue in academic and expert community for a long time, and not only among Ukrainian professionals. It may be said that this bitter pill could have been given in a smaller dose or at some other time; that currency liberalization should have been carried out more rapidly, at least with regard to trade operations, to ensure support of exporters; that there might have been a different interest rate that would have been enough to stop hryvnia from falling; and that under normal geopolitical circumstances a presidential or a parliamentary election cannot act as a benchmark for the monetary policy of the central bank. However, there was no other remedy available at that time – and both international and Ukrainian experts agree on this. Ideally, in times of a crisis, other authorities (including tax officials, customs officers, law enforcement agencies, and courts) should also assume responsibility for economic stability, ensuring the most favorable business environment. Unfortunately, this was not the case in Ukraine.

In April 2017, Valeria Hontareva resigned. Although a new head of the central bank is expected to take up her office in May, we would like the NBU monetary policy to follow the same direction in the future. This includes the following tasks:

- To maintain the inflation targeting policy as opposed to the policy of a fixed exchange rate well-known in Ukraine. It is inadmissible to permit the accumulation of new imbalances in the current account of the balance of payments, especially while the equilibrium is unstable, and reserves are too small to cover the import and the short-term debts of the state.

- To refrain from refinancing and “financial stimulation” of certain industries or enterprises under political pressure. This risk is one of the most dangerous ones for the sustainable development and long-term stability of the country.

- To continue currency liberalization, making hryvnia freely convertible in the long term. This will require reforms not only from the NBU: investment attractiveness of the country, which is a prerequisite to capital inflow, requires a drastic reform of courts, law enforcement agencies, customs, and tax administration, as well as a proper attitude towards the investors at the local level. It is currency liberalization and integration into the European economic and financial space that will allow Ukraine to become a full-fledged participant of the globalized economy, Ukrainian enterprises – to integrate into the value chains, and the citizens – to ensure reliable savings.

- Under no circumstances to yield to political pressure (either maintaining the rate, or monetizing internal governmental bonds to finance the budget deficit). We have seen that the consequences of belated decisive actions in view of the coming elections can be destructive. The monetary policy of the central bank shall be independent, since both the economy and the welfare of millions of citizens depend on it.

Notes:

[1] In the further analysis of two central bank policies, we should take into account a number of factors that distinguish conditions in which certain monetary instruments were used, and which policies were used previously. Opportunities of two states to control situation were not equal. Ukrainian economy is more open and dependent on foreign markets (Ukraine’s foreign trade turnover in 2010-2013 was equal to 99-110% of GDP, Russia’s – 47-48% of GDP), the share of the state in the banking sector and the economy in Ukraine was smaller, and so was the possibility of “manual” control. In addition, the “margins of safety” and currency regimes were different, which will be described in more detail in the text.

[2] The ruble was in the “managed float” regime (CBR de facto targeted ruble rate within a trading band to the currency basket of euro-dollar): trading band moved in the case when keeping the course within it required selling more currency than the central bank considered it appropriate

[3] According to IMF methodology (p.23), the measure of sufficiency of reserves for economies with less open capital account is the ratio of imports coverage (reserves should cover at least 3 months of imports), and for countries that have access to markets – short-term debt coverage (100% of short-term debt).

[4] Credit is known as “Yanukovych’s debt”. On December 17, 2013, Vladimir Putin agreed to give Ukraine a discount on gas and a credit of 15 billion dollars. The first tranche of this credit Russia made in the form of a purchase of Ukrainian Eurobonds.

Bonds worth 3 billion dollars were put into circulation on the Irish Stock Exchange with a low coupon of 5% (at the time Ukraine paid 8-10% per annum on global financial markets and had relatively low national rating B-). Because this operation was economically disadvantageous for Russia, it is considered that that the grounds for granting such a loan were political concessions of Ukraine (refusal to sign the Association Agreement with the EU’s, accession to the Customs Union and EurAsEC).

Second tranche was of $ 2 billion scheduled for the end of February 2014; the prospectus of “ukrainian eurobonds” even appeared on the Irish Stock Exchange, but Russia did not buy the government bonds of Ukraine (every possible secret agreement in December 2013 lost it’s value after Yanukovych’s escape).

[5] Naftogas of Ukraine. Annual report, 2014, p. 139.

[6] Russia’s central-bank governor // The Economist. – 16/4/2016

[8] According to the Russian Antimonopoly Service, public enterprises and the State generate 70% of GDP; while according to MEDT, the estimated share of public sector in the Ukrainian economy is 10-11%.

[9] Part of the Donetsk and Lugansk regions (which produced 17% of GDP and provided for 30% of exports in 2014) has become a field of fierce fighting. Crimea, which produced 3% of GDP and 1% of exports an average, was annexed. As a result, in the 2014-2015 Ukraine has experienced more than a 15% drop in GDP and 40% fall in exports.

[10] Frozen: the politics and economics of sanctions against Russia. Policy brief // Centre for Economic Reform, March 16th 2015

[11] 5 billion of which were sold directly to Naftogaz for debt repayment

[12] According to official statistics, in 2015, the monthly purchase of currency by population was about 60 million dollars, while our evaluation indicates the monthly demand for foreign currency of 1.2 billion dollars. /

[13] In late 2014, Putin convened a conference of major exporters (public and private) and advised them not to keep foreign currency proceeds. Subsequently, the Russian government issued a decree which ordered the five major exporters ( “Gazprom”, “Rosneft” ALROSA “Zarubezhneft” and producer of diamonds “Crystal” – all public) to reduce the amount of free cash

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations