A discussion of real systemic risks and problems of dollarization caused by national currency devaluation, inflation, asset & currency substitution and the resulting search for sustainable policy through effective monetary and fiscal measures. An article that tries to answer key central bank and government questions on monetary economics in Ukraine

Abstract: What is Dollarization?

The crises that shook the global economy over the last three decades, and the Ukrainian economic collapse in particular, illustrate the dire need to reassess monetary theory used in pursuing chosen exchange rate regimes, counter-inflation regimes, macroprudential / regulatory oversight and clearing system support. At the same time, fiscal policy requires the same level of critical attention, especially in maintaining a healthy national budget and in implementing a sustainable debt management system. Key macroeconomic elements rooted in the real economic sector and in export-oriented potential remain vital, but they remain dependent on certain areas of financial stability and consumer / supplier confidence.

Throughout the history of economics, there are numerous examples that illustrate the dependence of financial stability on minimization / mitigation of dollarization, inflation and balance sheet effects. Inflation-induced dollarization is very high on the list of “horrors,” that drive the nightmare of thousands of policy-makers and bankers every single day. So what is dollarization? Let us define modern dollarization using the following definition:

“De facto dollarization represents the situation of a foreign currency being used alongside the domestic currency as means of exchange (for transaction purposes, i.e., as currency substitution) or as means of saving in hard currency (i.e., as asset substitution)” [1].

The above definition is an aggregate of the case of asset substitution and the case of currency substitution, illustrating complete structural dollarization in an economy. This article aims to explore the issue of dollarization in Ukraine, its causes, its key risks and the possibility to implement sustainable de-dollarization measures on the part of the Central Bank and the local government.

Inflation, Devaluation and Dollarization

Traditionally, the key drivers of asset and currency substitution were economic instability, high inflation rates (loss of confidence in the national currency) and fiscal woes. Many emerging markets experienced numerous cases of hyperinflation over the course of history. In these economies, dollarization became rampant, as both the local population, and local businesses, tried to hedge the risks associated with domestic-currency assets. Economists Alvarez-Plata and Garcia-Herrero made an interesting observation in 2007 that some countries managed to display good results in subduing inflation, but dollarization levels continued to increase in these economies nevertheless. Evidence shows that only a very minimal quantity of economies have managed to de-dollarize. A logical conclusion arises that once dollarization is heavily engrained in an economic model, it is impossible to change course without a complete overhaul of the national economic paradigm and without a complete restart of key macroeconomic drivers. With a lack of developed capital markets and constantly-high inflationary expectations the local population and businesses integrate asset substitution into everyday operations. The logic is that FX assets provide insurance. Thus, the foundation for catastrophic balance sheet and endgame effects is laid.

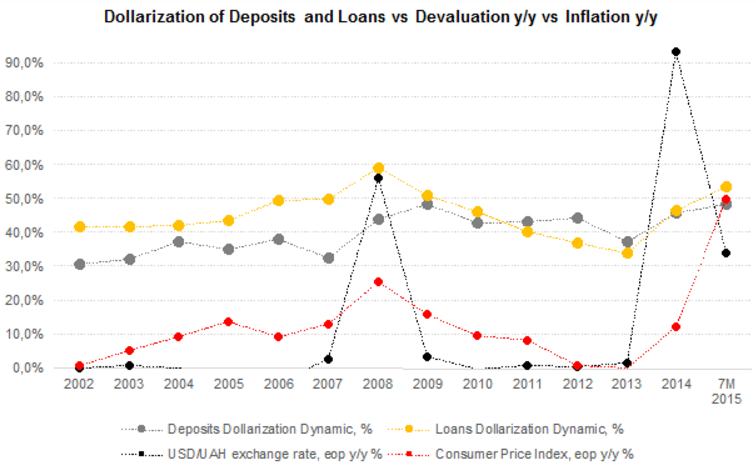

Acceleration of the Consumer Price Index in 2014 and 2015 (see chart below) proved to be a major cause of concern for Ukraine and the local population. Rapid devaluation of the national currency, heavy reliance on imports in certain strategic areas, the war and loss of territory in the East and rapid price hikes in public utilities, oils & fuel, and food & nonalcoholic beverages, drove the CPI forward and contributed to a severe loss of consumer confidence in the country and to substantial loss of confidence in the UAH. The cycle of the previous crisis of 2008-2010 had repeated, but with more gusto this time as the national currency devalued by 93.5% in 2014 and by 34.0 in the period of January-August 2015. Logically, the CPI hit 49.6% y/y in the period of January-August 2015. As the grounds for asset substitution were set in the previous crisis of 2008-2010, the dangerous dynamic only solidified this time around. The year 2014 set the grounds for currency substitution trends as well.

Similar trends hit a number of countries in the 1990s. According to IMF data, Vietnam (inflation 67% in 1990), Philippines (inflation at 14% in 1990), Israel (inflation at 17% in 1990), Chile (inflation at 26% in 1990) all saw moderately high inflation rates and rising dollarization dynamics. Countries like Peru and Argentina were in “total annihilation” due to hyperinflation in 1990 (7485% and 2314% respectively). In the wake of the Asian Crisis in the late 1990s and the Russian Default, a dangerous cycle of high inflation hit Indonesia (inflation at 58% in 1998) and Russia (inflation at 86% in 1999). These countries had one important common trend: rampant dollarization in comparison with the developed world.

A classical approach to analyzing dollarization was looking at it as a store of value in the process of asset substitution. In the past, dollarization was mainly measured by the percentage of domestic residents that held FX assets and not FX liabilities. The late 1990s illustrated that systemic risks and balance sheet effects came from liability dollarization even more than from asset dollarization. As private and public sectors borrowed more and more in FX currencies, these economies became more exposed to external shocks and systemic shifts.

For example, in Indonesia “the private sector was highly exposed to short-term foreign-currency denominated debt, which exceeded the country’s stock of international reserves. As these loans were mainly used to make investments in the nontradables sector, the large exchange rate devaluations during the crisis led to the explosion in the domestic currency value of the dollar debt– the so-called balance sheet effects – and thus to severe balance-of-payment problems” [2].

Both asset dollarization and liabilities dollarization have to be taken into account, especially for Ukraine, which saw a rapid rise of risks due to systemic and external shocks, and due to dramatic devaluation of UAH in the last cycle. One might say that devaluation is the key contributor to the higher dollarization rates in Ukraine and that inflation was secondary. Some analysts will prematurely conclude so. But one must not be hasty in conclusions. One must consider the effects for the national economy and financial system. As dollarization rates rise, no matter which contributing factor is primarily stronger, systemic risks rise, vulnerability to external shocks rises, and balance sheet effects become more profound.

The dollarization chart below shows that the key contributor to the rise of the dollarization ratio in Ukraine was – the devaluation of the national currency. Yet, considering the rapid loss of local purchasing power amongst households, the record rate of banking institutions bankruptcies and liquidations, the prominent role of imports in strategic areas (energy, heating, oils, fuel, and even consumer electronics), one must understand that a logical flight to FX assets will be prominent amongst domestic residents in Ukraine, a tendency illustrated by the periods of economic and financial downturns and collapse in 2007-2008 and in 2013-2015 respectively.

The 2008 crisis proved that the dominating trend of liability dollarization had set the country up for a dramatic shock. The above chart also illustrates the fact that after the crisis of 2008, liability dollarization levels were decreasing progressively until the catastrophic devaluation of 2014. With dollarization of assets and liabilities hitting 48.2% and 53.3% respectively in the period of January-August 2015, and with the CPI at 49.6% y/y, the Ukrainian economy and financial system are set on very dangerous grounds, where further shifts in devaluation and inflation can lead to unforeseeable consequences. As liability dollarization surpasses asset dollarization the structural damage to the economy and the financial system can be severe in the events of systemic or external shocks. Without proper attention on the part of the Central Bank, and the government, the situation can deteriorate rapidly into a “snowball” effect and lead to rapid rise of toxicity in the assets held by banks (as was the case in Indonesia in the late 1990s).

As an example, in a span of almost a decade, Israel managed to lower its dollarization rate from 28% in 1990 to 19% in 2000, while Chile managed a decrease from 19% to 9% in the same period. Indonesia managed to decrease its dollarization rate from 20% in 1995 to 15% in 2005.iii Countries like Vietnam, Peru and Russia experienced more difficulties in the last 30 years. Thus, a dire need arises for immediate measures to be taken in Ukraine in the vein of mentioned successful examples and economic cases.

Risk Mitigation and Tailoring Monetary Economics

It has been widely accepted that dollarization makes monetary policy much more difficult, and eats away at its potential effectiveness. As domestic residents search for safer and more stable means of payments and transaction facilitation, they often end up going down the currency substitution route. In parallel, as the same domestic residents search for secondary means to hedge against risks of devaluation & inflation, they often find themselves in the asset substitution lane. The proverbial “perfect storm” is when both searches lead to dominant dollarization in both asset and currency substitution.

Much analysis of accumulated data in relation to currency substitution shows that there are substantial complications of monetary and fiscal policies due to increased volatility in money demand and in exchange rates. Thus, illustrating the problematic relationship between currency substitution and exchange rate volatility [3]. In asset substitution, FX assets become popular investments as their price decreases (in an upturn economic cycle). Thus, the demand for value-storing instruments will be affected by monetary expansion, exchange rate volatility and inflation. Monetary policy is complicated by the weakened control over the general money supply in dollarized economies – because the appropriate authorities (the Central Bank) lack direct control over supply and emission of FX currencies. Balance sheet operations through expansionist measures would be constrained. In such cases, addressing dangers of inflation and using market-friendly operations to induce change can be lackluster.

When considering how to tailor the monetary policy to facilitate de-dollarization, regulators must decide which monetary policy “anchors” or “targets” to choose. Targets must be intermediate and have certain systemic value and influence. Traditionally, monetary policy was built around exchange rate targets (aka FX Rate Rule) or monetary aggregate target. Of course, the FX Rate Rule severely restricts monetary policy (as the Ukrainian historical experience indicates) as the authorities have to intervene to maintain a certain FX rate level in correlation with the preannounced nominal anchor. Yet, more and more countries have begun to utilize the practice of inflation targeting.

There are important positive aspects of inflation targeting – as it focusses on price stability and facilitates a return of consumer confidence and overall stabilization of the domestic currency as an instrument of value storing. Inflation targeting is also advantageous, because it does not necessitate a constant need to intervene in the markets with substantial resources. Relationship between money and inflation does not play an important role in this monetary policy. Yet, there are number of risks and negative aspects. The Central Bank needs to understand that dollarized economies do not have the same strengths as non-dollarized counterparts. There are inherent dangers with import prices affecting retail and consumer prices due to Exchange-rate pass-through (ERPT), there are substantial dangers of cross-border inflation transmission (same reason of ERPT), and vulnerability to balance sheet effects is greater. With the required flexible FX rate – costs will increase due to balance sheet effects and due to an increased level of exposure to external shocks. These factors can lead to a rapid loss in quality of assets in the banking system (rise of toxicity) and to a “domino effect” in the local financial markets and overall banking system. Such factors take away important control mechanisms over inflation from the hands of the Central Bank.

Positive examples of de-dollarization and inflation targeting are Peru, Chile and Israel. Peru’s key success factor in its inflation targeting monetary policy was the fact that the local authorities managed to mitigate FX-related risks and minimize exposure to external shocks through the facilitation of de-dollarization on a national level. The example of Chile illustrates the use of local hybrid instruments as a means to provide a hedging tool against risks of inflation, in conjunction with the Central Bank’s inflation targeting policy. Chile managed to increase investor confidence and develop its financial markets through the use of derivative instruments indexed to the local Consumer Price Index. It allowed for a strong hedging capability for the investor, but at the same time it gave the local government and Central Bank more room to maneuver without extreme reliance on FX reserves and FX proceeds from exports. Encouraging the domestic bond market to use the local currency is another important complementary tool to inflation targeting. Israel is a successful example of dealing with inflation through effective de-dollarization. Through the implementation of a local debt issuance policy entered on the domestic currency, Israel initially had to deal with the difficulties of paying higher costs and rising interest rates. Yet, as the composition of locally-issued debt changed structurally, an effort was made to lower interest rates alongside the efforts to ensure price stability. Inflation targeting brought positive results and eventually interest rates declined. To sweeten the deal, Israel used CPI indexation.

Policy Recommendations for the Central Bank and the Government

- For Ukraine, an approach to sustainable de-dollarization must be developed and implemented, preferably through market-friendly operations and through the development of local financial markets (to slow-down the dollarization of the local debt market). It is vital to shift the local debt markets and the local household orientation from an FX-based orientation to a local currency orientation, even if the initial costs are higher. Structural changes in composition of the total public debt, the local corporate debt and the local household debt have to be facilitated. A legal framework needs to be developed to introduce real hedging instruments in Ukraine in the form of derivatives and other hybrid securities. Local capital markets need to be reorganized, unified and readdressed and institutional investors have to be brought into the market “en masse.”

- The government (represented by the Ministry of Finance) and the Central Bank need to develop alternative investment instruments specifically for institutional investors and for long-term oriented corporate entities (requiring risk minimization). Indexed derivatives and instruments attached to the Consumer Price Index are an option in this case. Yet, the success of implementation of such instruments depends on the local pension reform and on the local legal framework. An immediate pension reform is needed in order to bring in a structural shift in the investment of long-term capital by bringing in pension funds into the picture and in order to decrease the “mechanical” fiscal pressure upon the state budget.

- The National Bank of Ukraine has to accept full accountability and responsibility to pursue an orientation of price stability through its inflation targeting monetary policy. This means that public communication of targets and anchors must be clear, structured and objective. Deviations must be addressed in a transparent fashion. The National Bank of Ukraine has to use reserve requirements effectively and sway the banking system towards a more sustainable ratio of FX assets covering FX liabilities. At the same time the regulator can influence the local monetary base.

- In order to mitigate risks associated with Exchange-rate pass-through, all efforts have to be cross-institutional and cannot be placed fully on the shoulders of the Central Bank. A close cooperation with the Ministry of Finance (and State Treasury) will be absolutely critical to ensure policy effectiveness and rapid legal framework implementation.

- The case for privatization of State-owned Enterprises (SOEs) has to advance forward. An effective SOEs sell-off will contribute to overall government income and will help lower fiscal inefficiencies in government finance. The issue of the NAK “Naftogaz” fiscal deficit has to be resolved through new restructuring and reorganization measures (with an integration of new corporate governance standards and special financial “anchors” for the monitoring of the effectiveness of respective measures). These particular measures need to be implemented in a short-medium timeframe of 12 to 36 months – before Ukraine returns to international debt markets in accordance with the IMF’s EFF Program.

Conclusion

Ukraine has a long road ahead, and dollarization poses a series of systemic risks – that can make this road difficult and dangerous. It is a fact today that issues of devaluation, inflation and dollarization go “hand in hand” and have to be addressed on the foundation level, which is represented by full adherence to price stability and encouragement of a structural shift in asset/liability denomination to local currency. Without proper monetary credibility and without confidence in the local currency and local debt markets, this country will not be able to rise from the ashes of the past. It’s not just a shift in the economic, monetary and fiscal paradigm that is needed today, but a completely new paradigm itself, one based not only on best practices from history, but also on disciplined reforms. Regulation should be fair, and should be transparent. It should not hamper the development of financial markets. It should facilitate the development of transparent and effective local markets, where risk is priced in an objective manner, and where dangers of dollarization distorting the said pricing are minimized through indirect mitigation and rule of law. Ukraine needs certainty today. Key partners, investors and creditors need this certainty.

Notes

[1] Levy Yeyati, Eduardo. 2006. “Financial Dollarization.” Economic Policy, pp. 61-118

[2] Patricia Alvarez-Plata and Alicia Garcia-Herrero. 2007. “To Dollarize or De-Dollarize: Consequences for Monetary Policy”

[3] Calvo, Guillermo, and Carlos Végh. 1996. “From Currency Substitution to Dollarization: Analytical and Policy Issues,” in Money, Exchange Rates and Output. Guillermo Calvo ed: MIT Press, pp. 153-75

Central Bank Week

Inflation Expectations in Ukraine: a Long Path to Anchoring (Olivier Coibion, UT Austin and NBER, and Yuriy Gorodnichenko, UC Berkeley and NBER, VoxUkraine co-founder)

How Ukraine’s Central Bank Wrecked the Country’s Nascent Economic Recovery in 2011 and Why It Should Not Do It Again (Andrei Kirilenko, Professor of the Practice of Finance at the MIT Sloan School of Management, Visiting Professor of Finance at the Imperial College Business School)

Tax Reform in the Light of Macroeconomic Stability: the NBU Perspective (Dmytro Sologoub, Deputy Governor at National Bank of Ukraine, and Serhiy Nikolaichuk, Director of monetary policy and economic analysis department at NBU)

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations