Under the Ukraine Facility, a financial support program from the European Union, Ukraine is implementing a series of strategic economic reforms and sectoral development measures. These measures are expected to boost export volumes and strengthen the country’s position in the international market as a leading supplier of critical materials and high-quality products. We have decided to analyze the current state of Ukraine’s foreign trade, its export potential, and the possible risks that could threaten economic recovery.

To ensure stable financial support from the EU, Ukraine must implement a specific set of measures and reforms, achieve certain benchmarks, and undergo evaluation by its partners. Fulfilling these commitments is expected to help build a strong and resilient economy, bringing the country closer to the socio-economic development level of EU countries. One of the outcomes of the plan’s implementation should be an increase in exports, which will contribute to economic growth and post-war recovery.

Progress should be achieved through the development of relevant institutions, attainment of comprehensive digital transformation goals, inclusive development, and the implementation of the “green transition,” as well as the support of key economic sectors:

- Sectoral development: Ukraine will focus on developing specific economic sectors with high export potential, such as agriculture, energy, transportation, critical raw materials (including processing), and information technology. By investing in these sectors and enhancing their competitiveness, the government aims to increase exports.

- Infrastructure development: Developing transport, logistics, and trade infrastructure is crucial for facilitating exports, especially given Russia’s blockade of the Black Sea. Investments in increasing port transshipment capacities, building railway lines, and cooperating with partner countries to develop border crossing points can simplify the export process and reduce transportation costs, making Ukrainian products more competitive in international markets.

- Trade support: The Ukrainian government, in cooperation with international partners, will implement trade facilitation programs. These include providing financial support to small and medium-sized enterprises, compensating agricultural producers for demining costs, implementing mechanisms for war risk insurance, and more.

- Basic institutional reforms: Implementing structural reforms and improving the business environment are crucial for stimulating exports. These measures include reducing bureaucracy, increasing transparency in the regulatory environment, protecting intellectual property rights, and strengthening the rule of law. By creating a more favorable business climate, Ukraine can attract foreign investment and stimulate export-oriented industries.

What is Ukraine’s export potential?

Ukraine’s export potential can be considered in two main dimensions. First, there is an increase in export volumes (restoring the supply of goods to pre-invasion levels and further increasing volumes). For some goods, such as grain, export volumes have almost reached pre-war levels thanks to the operation of the “temporary transport corridor,” despite parts of Ukraine being mined and occupied. Second, there is a shift in the commodity structure toward a higher share of manufacturing and high-value-added goods. According to the aforementioned plan, the main focus is on developing five sectors, including agriculture and mining (considering the potential for mineral processing).

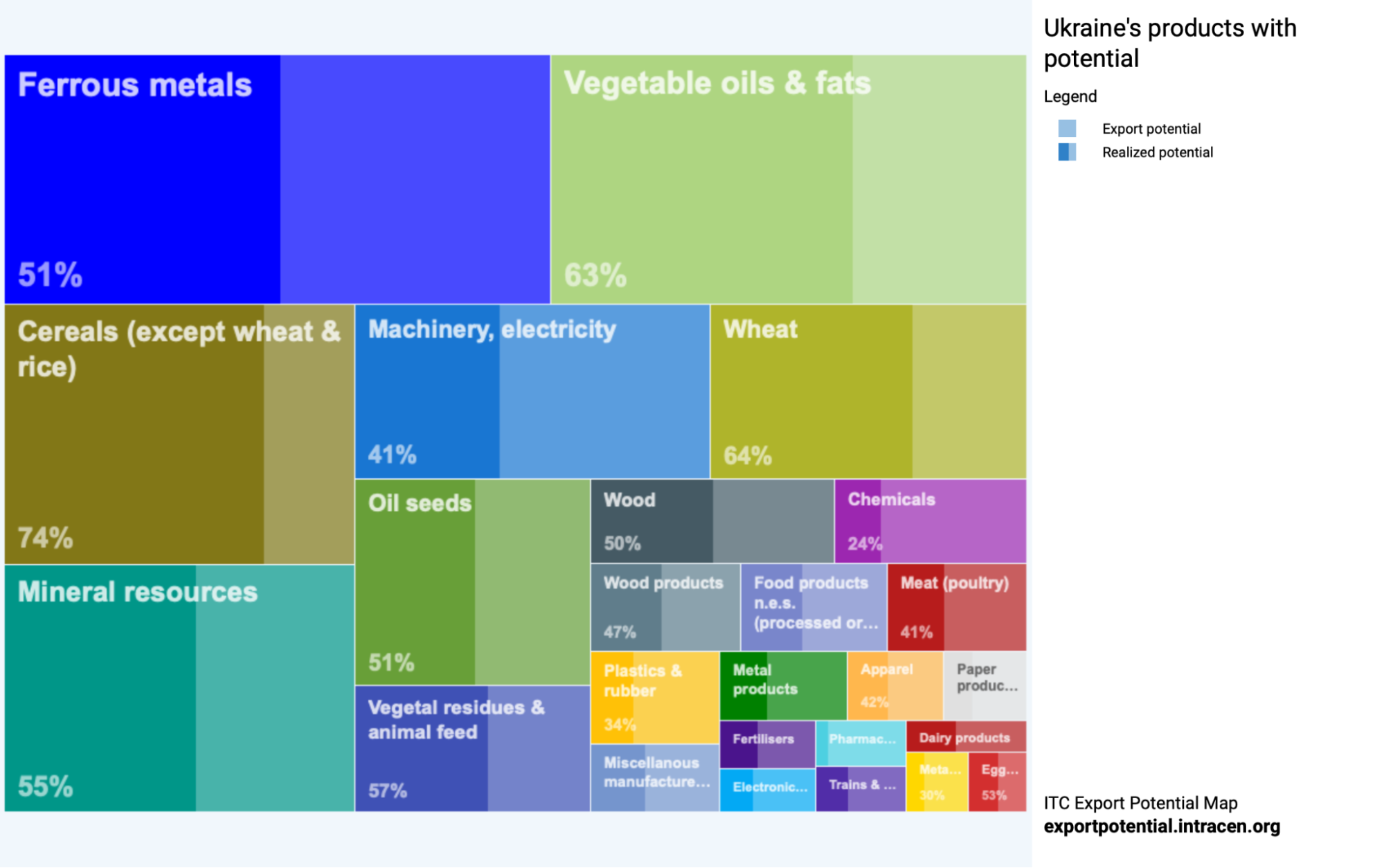

According to the International Trade Centre, Ukraine has an export potential of tens of billions of dollars. In absolute terms, we could demonstrate the largest volumes in the supply of ferrous metals, vegetable oils, grains, mineral resources, machinery and equipment, electricity, and more (see Figure 1). However, an important caveat is that these calculations were made considering data mostly before the full-scale war and, therefore, do not fully take its consequences into account.

For instance, the export potential in the segment of ferrous metals is estimated at $10 billion, with only 51% of this potential actually realized (meaning the actual export volume). Thus, there was significant potential for increasing exports of this product. However, Russia occupied and destroyed over a third of Ukraine’s steel production capacity. Therefore, in the foreseeable future of the next decade, the country is unlikely to restore pre-war levels of metallurgical production, let alone exceed them and realize this potential.

A more realistic scenario seems to be increasing the export of mineral resources, particularly iron ore products. On the one hand, there is demand for this product both in Europe and in distant countries like China, while domestic demand in Ukraine has significantly decreased due to the loss of production capacities. On the other hand, Ukraine has the capability to produce high-quality iron ore products that align with “green” transition plans. Implementing these plans is already on the agenda.

Additionally, the International Trade Centre calculations and the Ukraine Facility Plan highlight titanium ores and their processed products as having significant export potential.

Figure 1. Top 25 product categories with the highest export potential in Ukraine and the degree of export potential realization

Source: International Trade Centre

Note: The International Trade Centre has developed an econometric model to calculate export potential, i.e., the potential export value in 2028 based on demand and supply forecasts, market access conditions, and bilateral trade facilitation. The calculations are based on historical data on export performance from countries worldwide. Detailed methodology is available via the link.

The size of the cells reflects the value of potential exports (in $ billion); the percentages show the share of realized export potential—the ratio of the estimated actual export value to the potential export value.

The top sub-sectors with significant export potential also include agri-food sector products, which are considered promising within the Ukraine Facility framework. Specifically, these are sunflower oil, corn, wheat and meslin, and rapeseed. With proper support for the sector—investments in productivity growth, logistics development, reduction of trade barriers, and demining of territories—this potential can be realized.

Another segment with significant potential is machinery and equipment. Today, Ukraine is a manufacturer and supplier of automotive wiring harnesses with corresponding factories in the western regions. The volume of such product exports to European countries can be significantly increased.

Under equal conditions and before full-scale war, Ukraine had the potential to export a wide range of goods and services, from raw agricultural and mining products to high-tech products. However, the key items of foreign supply were and still remain raw materials and semi-finished products.

Trade results for 2023

Ukraine’s foreign trade results in 2023 continued to be influenced by factors directly related to the war on its territory, as well as the war’s indirect impacts. On the one hand, the Ukrainian economy suffered from attacks on energy and transport infrastructure and power outages at the beginning of 2023. The significant implications also came from Russia’s withdrawal from the “grain deal” until Ukraine, under the protection of its defense forces, organized its own “temporary maritime corridor.” This allowed for the revitalization of foreign economic activity.

On the other hand, the global economic slowdown observed even in Europe resulted in reduced demand for Ukrainian products. Given Ukraine’s limited ability to choose export markets, transporters’ blockade of western borders and European countries’ restrictions on the supply of agricultural products further undermined the footing of Ukrainian exporters.

Figure 2. Volumes of Ukraine’s foreign trade in 2014-2023, $ billion

Last year, Ukraine’s negative balance of foreign trade increased by 2.5 times, reaching its highest level since the beginning of Russia’s invasion in 2014. This result was driven by simultaneous growth in the value of imports and further contraction of exports. Specifically, imports almost returned to the level of 2021 when countries were recovering from the COVID-19 pandemic crisis and showing rapid restoration. It is likely that its value would have been higher if not for Polish carriers’ blockade of the western border. According to the NBU’s estimates, direct losses from imports alone in November 2023 amounted to $500 million. To illustrate, this is almost equivalent to the total value of drones imported into Ukraine last year.

Import of goods

In physical terms, imports in 2023 amounted to 26.8 million tons, which is 29% less than in 2022. However, in value terms, imports grew by 7% due to the importation of more expensive goods such as transport and electrical goods, pharmaceuticals and blood products, and food products, as well as increased purchases of drones, generators, and pipe products. This was made possible only with the financial support of our international partners, who provided grants and loans. Additionally, hidden imports, meaning goods for which neither the State Statistics Service nor the State Customs Service of Ukraine provide detailed statistics, increased manifold.

Figure 3. Commodity structure of Ukraine’s imports in 2019-2023, $ million

Source: State Customs Service of Ukraine

Note: Ukraine’s State Customs Service and State Statistics Service do not provide methodological explanations regarding goods without codes. It is likely that humanitarian aid or other goods, details of which are not to be disclosed, may be included here.

Traditionally, mineral fuels – oil and oil products and gas – occupied the largest share in Ukraine’s import structure. The leading suppliers of these products were Poland, Greece, India, Lithuania, and Slovakia. Ukraine halted imports of these goods from Russia and Belarus, while European countries and India had previously supplied them. Compared to 2022, the import of these products decreased by 39% in value terms due to cheaper oil and the refusal to purchase from the aggressor country.

Imports of other key commodity groups increased. Specifically, the growth in purchases of cars, mobile equipment, generators, batteries, transformers, trucks, tractors, and drones from abroad is directly related to military actions. On the one hand, this increase reflects Ukraine’s defense needs, and on the other hand, it reflects the consequences of mass rocket attacks on energy facilities, forcing the population to make emergency equipment purchases.

The increase in purchases of ferrous metals and fertilizers is linked to the decline in domestic production of these goods in Ukraine. Specifically, the occupation of metallurgical plants in Mariupol has led to a deficit of certain types of steel products, forcing Ukraine to procure them from Turkey and European countries (previously, we exported them). Although Ukraine increased its own fertilizer production by 81% last year, its volume remained almost half of what it was before the full-scale war, generating demand for imported fertilizers.

Export of goods

At the end of last year, Ukraine maintained the physical volume of exports almost unchanged, but export revenues fell by 18%. This can be explained by both a decrease in prices for a range of goods, primarily in the agricultural sector, and a change in the commodity structure of exports (see Figure 4).

Grain crops held the largest share of exports, at 23% (18% of the total export value in 2021). The decrease in revenue from grain exports is mostly due to the decline in world prices for corn, Ukraine’s main export item. Although Ukraine increased its wheat exports, this was insufficient to compensate for the decreased revenue from corn exports.

There was also a decrease in the volume of exports of oilseed crops (soybeans, rapeseed, and sunflower seeds). At the same time, a positive trend was the growth in the export of oil, i.e., processed seed products.

Figure 4. Commodity structure of Ukraine’s exports in 2019-2023, $ million

Source: State Customs Service of Ukraine

Revenue from the export of ferrous metals and ores decreased by over 40% last year. First, in 2022, the first two months accounted for nearly full-capacity operation of metallurgical enterprises. Second, last year, companies were forced to reduce production due to power outages, the explosion of the Kakhovka HPP, and unfavorable economic conditions in external markets. Third, companies began to utilize the opportunity for sea shipments within the framework of the “temporary corridor” closer to the end of the year.

Ukraine also reduced its exports of higher-value-added products such as electrical wiring, cables, and small kitchen appliances like electric kettles. This reduction is associated with decreased electronics imports by Hungary.

In 2023, Ukraine obtained 61% of its export revenue from selling agricultural products and foodstuffs, marking a significant portion of its exports. Following closely behind were ores, metals, and products thereof, contributing 16% of export income. Machinery, equipment, vehicles, and transportation means held the third position, accounting for 8% of exports. This marked a notable change from the pre-war year of 2021, when agriculture and metallurgy shared comparable shares at 41% and 34%, respectively. However, the export structure shifted dramatically, with the share of foodstuffs in revenue nearly quadrupling compared to that of metals.

The reasons for this situation are understandable. The territories where industrial enterprises are mostly located are either occupied or near the front line. Russia’s attacks on critical infrastructure objects have led to a reduction in production volumes, and even with a stable electricity supply, logistical difficulties such as the blockade of the Black Sea and western border prevent export growth. A shortage of human resources also limits production recovery opportunities.

Foreign trade in services

Last year, Ukraine reduced external trade volumes in services due to simultaneous decreases in imports and exports. However, since the beginning of the full-scale invasion, we have observed an atypical imbalance in favor of importing services for Ukraine.

The prevalence of service imports over exports emerged in 2022 due to a sharp increase in spending by Ukrainians abroad, associated with the outflow of refugees during the first year of full-scale war. It is precisely the expenses of Ukrainians on purchasing goods and services in recipient countries that constitute the volumes of service imports under the “Travel” category. Although this segment decreased last year, it still accounts for the lion’s share of Ukrainian spending on imported services, at 69%.

Prior to the start of the full-scale war, the Ukrainian IT industry was experiencing rapid growth, with its share in the structure of service exports increasing from 2% in 2010 to 44% in 2022. In 2023, the export of IT services decreased for the first time, which is attributed to power outages and cautiousness among foreign clients regarding ordering services from Ukrainian IT specialists (due to risks of mobilization and rocket attacks).

Figure 5. Structure of foreign trade in services in 2019-2023, $ million

Source: NBU

Note: Other business services include research and development, management services, consulting, trade-related services, and technical services.

The increasing share of the agricultural and food sector in exports requires attention and effective solutions. Perhaps, by implementing the Ukraine Facility Plan, we can return to increasing exports in processing industries and restore growth in the IT industry. Defense industry manufacturers also have significant export potential. The war has catalyzed the active development of the defense industry with a rapid increase in the number of arms manufacturers. However, currently, there is insufficient state funding to utilize existing capacities. A solution could be to export excess production abroad so that arms manufacturers receive working capital and investment funds, but currently, such exports are prohibited.

Limited optimism for 2024

The beginning of 2024 brings cautious optimism in terms of foreign trade (see Figure 6). After a decline in quarterly export volumes last year, Ukraine demonstrates a sharp recovery in indicators based on the results of the first three months of the current year. Moreover, according to the operational data of the Ministry of Economy, Ukraine reached pre-war levels of monthly exports in April, amounting to $3.3 billion (13 million tons).

Figure 6. Quarterly export volumes of Ukraine, $ million

Source: State Customs Service of Ukraine, Entrepreneurship and Export Promotion Office

Traditionally, key export drivers include grain (such as corn and wheat) suppliers and exporters of iron ore and ferrous metals. These companies have resumed sea exports crucial for re-entering markets in the Middle East, America, and Asia. Meanwhile, machinery exports dropped out of the top 10 commodity groups.

In the metallurgical products segment (iron ore and steel products), an increase in export volumes can be expected this year thanks to the operation of the “sea corridor” under the protection of Ukrainian defense forces. However, limiting factors to consider include weakened demand in Europe and China, reduced economic efficiency of sales due to expensive logistics, and the risk of production volume restrictions.

Expectations in the agricultural segment are less optimistic. According to experts’ estimates, the volume of the harvest may decrease in 2024 due to a reduction in the sown areas of certain crops against the backdrop of an unfavorable price situation in the international market and lower yields. According to preliminary estimates for the 2024-2025 marketing year, this will affect export volumes, which may decrease to 43.7 million tons compared to the expected 53.1 million tons in the 2023-2024 marketing year.

Even in the short term, the record volume of grain exports achieved in April 2024 (which even exceeded pre-war levels) will not be repeated in May, as the available volumes of wheat for export have already been sold, and those of corn have been contracted.

Key risks for 2024

The importance of restoring export activity is undeniable. On the one hand, exports are a source of foreign currency inflows necessary to support the exchange rate, finance defense, and reconstruction efforts. On the other hand, access to foreign markets allows producers to increase capacity utilization, expand production volumes, and enhance their influence in international markets. From this perspective, stimulating export activity reflects not only an economic but also a geopolitical aspect, providing additional means to strengthen Ukraine’s position in the world.

However, in the context of geopolitical tensions and uncertainty associated with the war with Russia, Ukraine’s export opportunities face serious challenges. The expansion of the conflict zone threatens not only physical infrastructure but also the functioning of export channels and the security of transportation routes. These circumstances, along with potential economic constraints from Western partners (such as restrictions on imports or transit of agricultural products from Ukraine), create uncertainty about the future export potential and require careful risk analysis and strategic decision-making.

Among the risks for export growth this year are:

- Escalation of hostilities and occupation of new territories. Although the Ukraine Facility Plan was developed with the assumption of the end of hostilities by the end of 2024, as of May 2024, the aggressor country continues to build up its military potential and forces for further advancement, as indicated by both Ukrainian and international sources. The occupation of new territories by Russia, including the complete seizure of the Donetsk region, could lead to further degradation of the industrial sector. Other consequences of the intensification of hostilities and occupation include the destruction of infrastructure and further population migration.

- Shelling of energy and transportation infrastructure. Mass rocket attacks on critical infrastructure objects and damage to power grids can lead to both restrictions on electricity consumption by industrial consumers and complete production shutdowns. Attacks on transportation infrastructure can lead to disruptions in raw material supplies and increased costs for recovery. Consequently, export volumes will decrease.

- Further mobilization; population migration abroad. Increasing the volumes and pace of mobilization can deepen the deficit of human capital, reduce productivity, and increase labor costs, which in turn can lead to a decrease in enterprises’ export activity. Large industrial enterprises are already facing limitations in expanding production due to a labor shortage and, in an attempt to adapt to the existing conditions, are employing more women.

- Blockade of the western border. The blockade of the border with EU countries has led to both a reduction in exports by road transport and a decrease in customs revenues to Ukraine’s state budget. Consequently, the resumption of the blockade may result in delays in deliveries of products to foreign customers, actual reduction in supply volumes, and increased transportation costs.

- Implementation of trade restrictions or cancellation of preferential trade terms. The suspension of all import duties and trade defense measures by the EU for Ukraine in the spring of 2022 proved to be a lifeline for Ukrainian exporters, who, in the conditions of the maritime blockade, could only supply goods to Europe or through European countries. The EU has already extended preferential trade terms twice, most recently in March 2024, but with conditions to protect its agricultural market. Abandoning preferential trade terms or introducing trade restrictions could lead to a reduction in export volumes due to restricted access to markets.

- Suspension of the “temporary corridor.” Closing the “temporary corridor” in the Black Sea would return Ukrainian exporters to the situation of summer 2023 when Russia withdrew from the “grain deal,” and an alternative maritime route was not yet secured. Although Ukraine has since continued to develop alternative transportation routes via the Danube or through ports in Romania and Poland, this could lead to a significant increase in delivery times and costs, as well as a restructuring of logistic chains that would be less efficient. The export of agricultural products, ores, and black metals critically depends on the ability to export by sea.

- Further weakening of the global economy, particularly in Europe. Decreased demand for goods from Ukraine due to economic hardships in Europe could lead to a reduction in export volumes and a decrease in production levels. With the ability to transport goods by sea, this risk could be mitigated by redirecting exports to markets in the Middle East, America, and Asia.

We created this material as a participant in the Recovery Window Network. Find out everything about the recovery of affected regions of Ukraine on the unified platform at recovery.win

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations