Ukraine’s aspiration to join the EU remains a key driver of reform. In the summer of 2024, bilateral screening of Ukrainian legislation began to assess its alignment with EU law.

The outcomes of this process will significantly shape the legislative priorities of Ukrainian authorities over the coming year. For instance, in December 2024, Ukraine and the European Commission held a meeting focused on the chapter concerning intellectual property. During the discussion, EU representatives reiterated that Ukraine must complete the launch of the High Court on Intellectual Property. And while we await the implementation of the reforms required for accession, let’s take a look back at what was accomplished in the fourth quarter of last year.

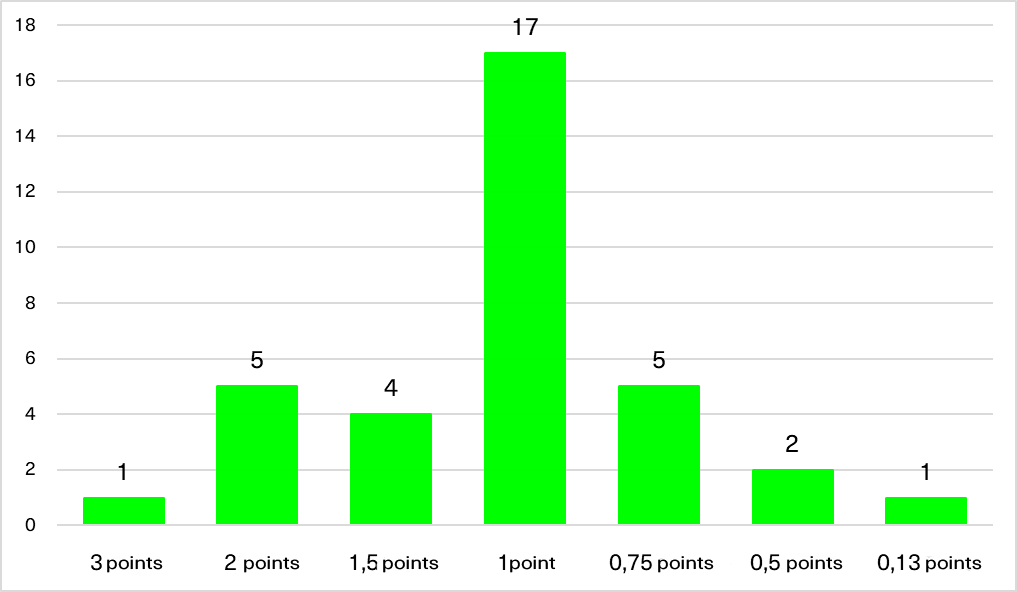

The review covers 35 significant regulations. The good news? Not a single one qualifies as anti-reform.

Chart 1. Distribution of regulations by assigned score, Q4 2024

Source: Issues 249–254 of the Reform Index

Top reforms

Violations in the disability assessment system had long gone unaddressed, so it is no surprise that reforms in this area received high marks from experts. The Cabinet of Ministers’ resolution introducing new operating rules for the Medical and Social Expert Commission (MSEC) fell under two Reform Index subcategories — healthcare and the fight against corruption — and earned +3 points (on a scale from -5 to +5) thanks to its broad impact. As of January 1, 2025, Ukraine has implemented a new system for assessing individuals’ daily functioning, replacing traditional medical-social examinations. An electronic platform will randomly assemble an expert team of doctors based on the patient’s condition. The doctors will not know whom they are evaluating until the session, and patients will not know who will be evaluating them. Depending on their condition, patients can take part in the assessment in person, online, or by simply submitting documents. An additional +2 points came from a law that allows individuals to attend expert sessions with a lawyer, record the proceedings on video, and, if needed, appeal the doctors’ decision within a month of receiving the results.

Two laws introducing European customs standards also received high marks, earning +2 points each. The first law requires the creation of a selection commission to appoint the head of the State Customs Service (SCS). The commission must include experts with verified professional competence – at least five years of experience in law, economics, and/or anti-corruption fields. The head of Customs is now empowered to appoint their own deputies and dismiss mid-level managers–including heads of customs branches and department directors–without approval from the Minister of Finance. Greater managerial freedom is paired with stronger oversight: the performance of the Customs Service will be evaluated by independent auditors. A negative audit conclusion will serve as grounds for dismissing the SCS head.

The second law concerns customs procedures and introduces the right to priority border crossing via the “eQueue” electronic service for companies engaged in international transport under the Common Transit Procedure (CTP) or with a customs transport document (TIR carnet). Carriers with Authorized Economic Operator (AEO) status are also eligible to use the simplified border crossing option. Additionally, the Customs Code now formally defines two types of customs representation: direct and indirect. In the direct model, brokers act on behalf of their clients, and the clients bear responsibility for any violations during customs clearance. In the indirect model, both the broker and the client share responsibility for the accurate payment of customs duties.

The Convention on the Common Transit Procedure provides the framework for the movement of goods between 37 countries: EU member states, countries of the European Free Trade Association (EFTA)—Iceland, Norway, Liechtenstein, and Switzerland; Turkey (since December 1, 2012); North Macedonia (since July 1, 2015); Serbia (since February 1, 2016); the United Kingdom (since January 1, 2021); Ukraine (since October 1, 2022); and Georgia (since February 1, 2025). The Convention is underpinned by the IT system NCTS (New Computerized Transit System), an IT platform that facilitates the exchange of customs data among participating countries. The common transit procedure operates on the principle of “one transport vehicle – one declaration – one guarantee.”

Experts gave a positive assessment of the law aimed at increasing transparency in the procurement of construction services (+2 points). Olha Melnyk, a lawyer at the Anti-Corruption Action Center, explains: “Eighty percent of clients commissioning high-cost construction projects did not disclose prices for building materials—amounting to massive sums.” Under the new rules, contracts for construction services must now include details on the cost and quantity of materials, their country of origin, and prices for related services such as storage and transportation.

Another reform that ranked among the top changes of the quarter was the expansion of the Accounting Chamber’s powers (+2 points). In addition to auditing state budget funds, the Chamber’s auditors will now be authorized to review local budgets, state and municipal enterprises, and grants and loans from foreign governments and international organizations. To uphold the quality of this agency’s operations, the law introduces a provision requiring the Chamber to undergo external evaluations over the next five years to verify compliance with international audit standards. Several provisions also enhance the Chamber’s political independence. Its powers can no longer be terminated due to the expiration of a parliamentary term or the declaration of martial law or a state of emergency. The institution’s leadership will be selected through a competitive process involving an advisory group that includes international experts.

All expert evaluations of the regulatory acts from the Reform Index are available at the link.

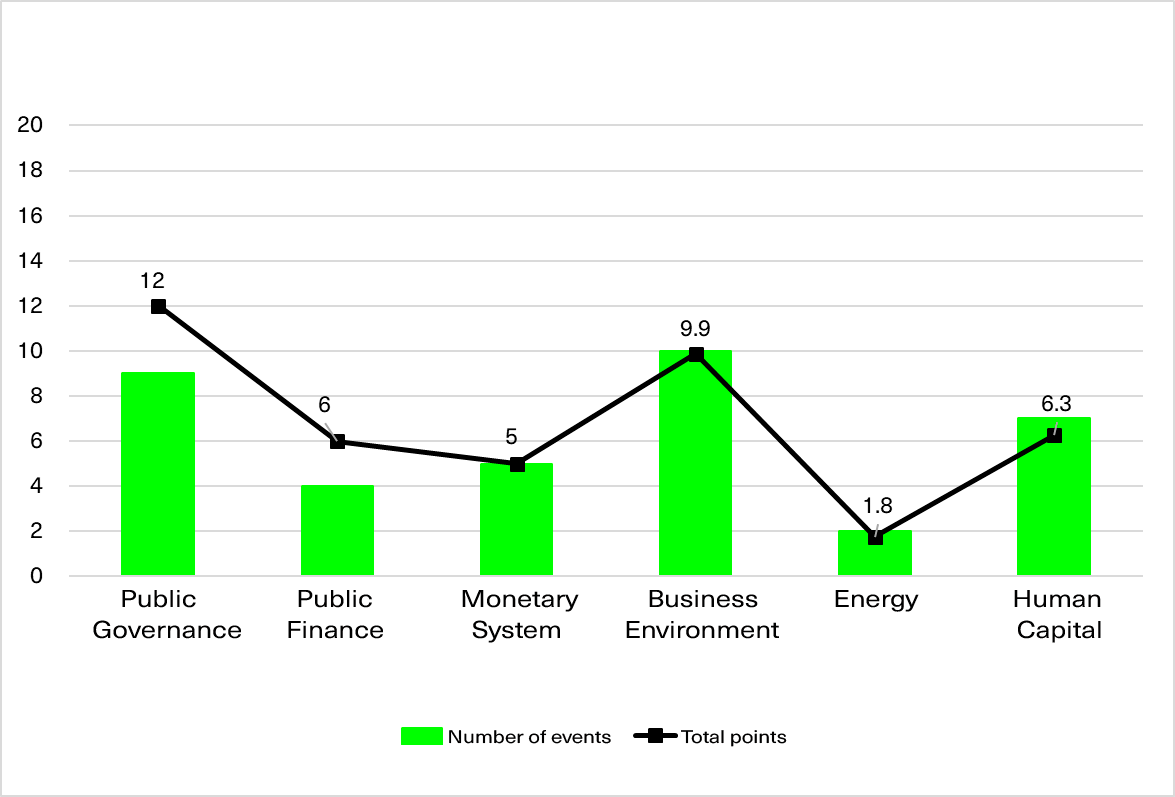

Progress by Reform Index areas

In the fourth quarter of 2024, changes were recorded across all six monitored areas, with the most progress seen in public governance, business environment, and human capital.

Graph 2. Total event scores by area, Q4 2024

Source: Issues 249–254 of the Reform Index.

Note: The event “Non-bank financial institutions must establish inclusive units” falls under two categories: “Monetary System” and “Human Capital.” The event “New operating rules for MSEC and criteria for determining disability” is included under both “Governance” and “Human Capital.” Therefore, while the total number of events is 35, their combined count in this chart is 37.

Public governance

Nine significant changes occurred in the area of governance in the fourth quarter of 2024. Three of them—related to customs regulations and the overhaul of MSEC—were listed among the top reforms. These changes contribute meaningfully to Ukraine’s fight against corruption. However, they are not the only legislative acts that advance anti-corruption efforts.

At the end of the year, Parliament passed laws (4111-ІХ and 4112-ІХ) introducing international standards for combating bribery and corruption involving public officials. For instance, if an owner or a supervisory board member commits a criminal offense on behalf of or in the interest of a company—or fails to take preventive measures that could have stopped corruption—the company may face fines or restrictions on its activities. In cases of bribing a foreign official, the company may be barred from participating in the privatization of state property, defense procurement, or managing funds from international technical assistance projects.

Another law introduced plea agreements in corruption cases. Courts are now permitted to impose a reduced prison sentence if the accused exposes accomplices and compensates for the damages caused. As an additional punishment, the court may confiscate the offender’s property or impose a fine–even if such penalties are not explicitly provided for in the relevant articles of the Criminal Code.

After nearly four months of delay, the President signed a law on public consultations in October. The law will take effect once martial law is lifted. At that point, all local self-government bodies and executive authorities will be required to conduct mandatory public consultations when making decisions. To prevent these consultations from becoming a mere formality, authorities must report on the consultation process and explain why specific proposals were accepted or rejected. The law provides for various formats–including online consultations, targeted outreach, and public discussions–to ensure broad participation. However, the law does not apply to draft legislation submitted by members of Parliament (unlike government-initiated bills, which are subject to such procedures). “Parliamentary bills often lack explanatory notes and proper impact assessments. The current version of the Law of Ukraine ‘On Public Consultations’ fails to address a critical issue for Ukraine—the absence of mechanisms for the public to give feedback on draft laws proposed by MPs,” explains Yevhen Shkolnyi, an expert at the Centre of Policy and Legal Reform.

Business environment

Ten changes took place in this area in the fourth quarter, including the above-mentioned simplification of customs procedures for international carriers.

The government is also working to harmonize the protection of intellectual property rights. For example, an order from the Ministry of Economy updated the rules for registering inventions and utility models. Key changes include the option to submit applications electronically; prioritization of applications in key sectors such as green energy, transport, nanotechnology, biotechnology, and national security and defense; screening applicants for sanctions; and a formal procedure for third parties to file objections to an invention’s registration. The updated rules align with the provisions of the Patent Cooperation Treaty (PCT) and the Patent Law Treaty (PLT) and represent a step forward in the European integration process.

To support the rapid recovery of businesses during wartime, a law on preventive debt restructuring was adopted. This mechanism allows debtors to revise their obligations without declaring bankruptcy. To restore financial solvency, a debtor must develop a restructuring concept and plan. Measures may include deferring debt repayments, attracting new financing, selling off assets, or having the legal entity’s owners assume responsibility for obligations. A commercial court decides whether to initiate a preventive restructuring process. The law was one of the benchmarks under the Ukraine Facility Plan and implements EU Directive 2019/1023.

A significant update is also coming to the pharmacy sector. All pharmacies are now required to join the state “Affordable Medicines” program, which allows patients to receive medications from the state either free of charge or at a partial cost. Previously, only hospital pharmacies were obligated to participate, while others could join the program voluntarily.

A number of changes were introduced in the agricultural sector. First, lawmakers extended the deadline for formalizing undistributed land shares that remain in collective ownership until 2028 (previously set to expire on January 1, 2025). Second, the list of eligible users of the State Agrarian Register was expanded. As a result, not only agricultural producers but also water user organizations and representatives of the agro-industrial complex will be able to receive state support through the register. The adoption of this law is part of Ukraine’s commitments under the Ukraine Facility. The plan stipulates that by mid-2025, Ukraine must adopt legislation requiring that state support be provided exclusively through the State Agrarian Register. Third, an export security regime was introduced for grain and oilseed crops. As of December 1, 2024, exporters are no longer required to obtain licenses or undergo verification—meaning it no longer matters whether they have previously conducted such operations or when they were registered as taxpayers. However, exporters must be registered VAT payers. Another innovation is the introduction of minimum allowable prices: the price declared in the customs documentation may not fall below the minimum price published on the website of the Ministry of Agrarian Policy. These prices will be updated monthly and set in U.S. dollars.

The State Agrarian Register was established in 2022 to systematize information on support for Ukrainian agricultural producers. As of fall 2024, more than 175,000 Ukrainian farmers were registered in the system. Each producer has a personal electronic account that automatically pulls data from other state registries, including information on business activities, land holdings, livestock, and more. The account displays available support programs the producer is eligible for and allows them to submit an online application to participate.

Parliament updated the food industry regulations with a new law restricting the use of palm oil in food products. It will be prohibited in traditional dairy products, baby food, and confectionery items. Products containing palm oil must feature clear labeling that indicates the amount used—the content must not exceed 2 grams per 100 grams of total fat in the product. Items that violate these rules will be withdrawn from sale and may be transferred to animal shelters or zoos–or destroyed if redistribution is not possible.

Human capital

In the fourth quarter, we recorded seven important developments in the area of human capital. These include the previously mentioned changes to the operation of medical and social expert commissions, as well as a range of measures aimed at supporting military personnel, veterans, and Ukrainians affected by the war. During this period, the government launched a comprehensive e-service to provide state support for service members, veterans, and their families. Through the Diia web portal, without submitting any additional documents, military personnel can apply for war-related disability status, disability pensions, one-time financial assistance for injuries sustained during the war or the Anti-Terrorist Operation (ATO), utility discounts, and other state services. Similar to the eDocument in Diia, which functions as a full-fledged digital ID in Ukraine, the e-Veteran Certificate has been officially recognized as the primary document confirming veteran status. While the shift away from paper documents has clear benefits, it also presents risks. Yuliia Markuts, head of the Center for Public Finance and Governance Analysis at KSE, warns of “risks associated with potential cyberattacks that could compromise the register’s security and lead to data leaks. If the register temporarily goes offline, it may delay confirmation of veteran status, affecting access to benefits and other social guarantees.” In addition, not all veterans may own smartphones, making it important to maintain alternative methods for verifying veteran status.

In December, the President signed a law on the protection of victims of sexual violence during wartime, introducing the concept of “armed conflict-related sexual violence” and establishing a mechanism for urgent interim reparations for survivors. These reparations include financial compensation, informational support, access to free rehabilitation, and temporary shelter for safe living conditions.

Another step toward strengthening social protection for those affected by the war was the adoption of a law granting internally displaced persons the same priority right to compensation for destroyed housing as combat veterans, persons with disabilities, and large families.

The push for greater inclusivity also reached financial institutions. National Bank of Ukraine (NBU) has mandated that by March 31, 2025, at least half of all branches providing financial services must be accessible to people with limited mobility—such as individuals with musculoskeletal conditions or parents with strollers—as well as persons with disabilities. Financial institutions are also required to publish information about accessible branches on their websites and in mobile apps.

Who is the biggest reformer?

After nearly two years of the Cabinet of Ministers leading the reform process, the Verkhovna Rada has reclaimed its role as the main driver of reforms—though the gap with the Cabinet remains narrow.

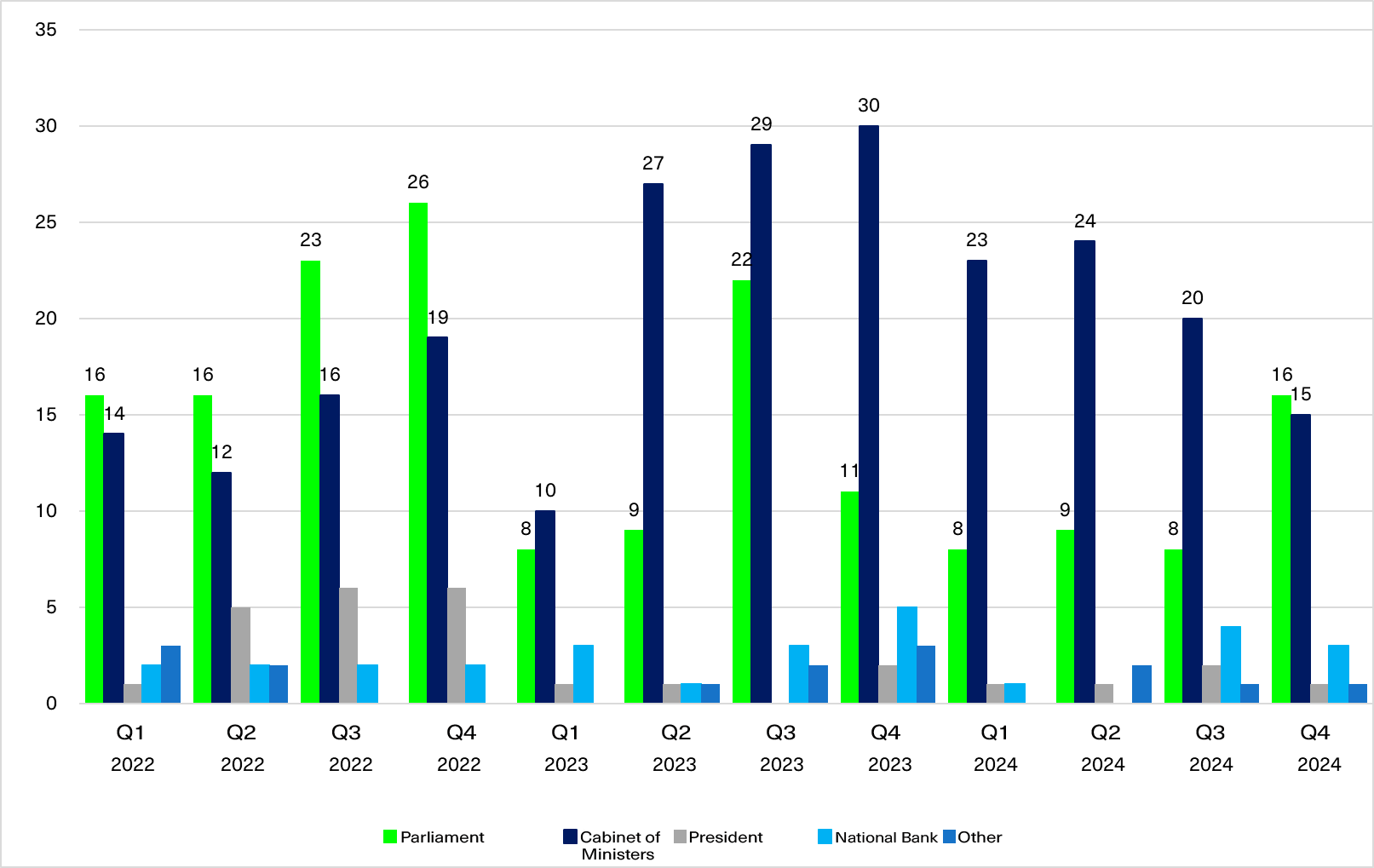

Graph 3. Distribution of adopted reforms by initiating body, Q4 2024

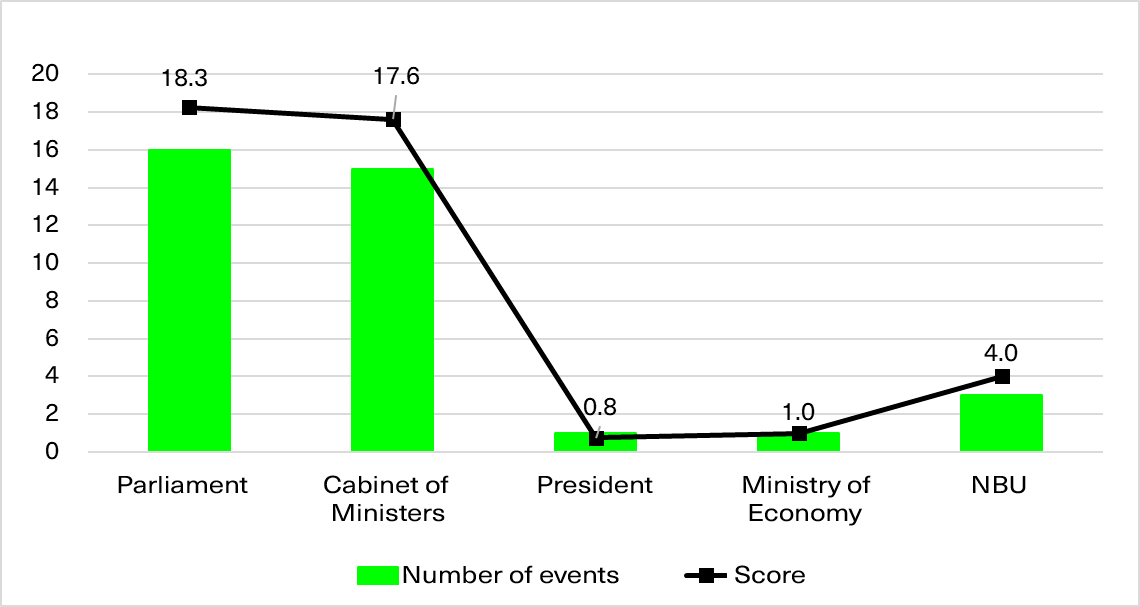

In the fourth quarter of 2024, the Verkhovna Rada was responsible for 16 reforms, while the Cabinet of Ministers initiated 15 important changes. The National Bank of Ukraine accounted for three reforms, and the President and the Ministry of Economy initiated one reform each.

Graph 4. Reform initiators, Q4 2024

Source: Issues 249–254 of the Reform Index. The total number of events shown in the chart is 36, as the law on protecting the interests of land share owners is attributed to both the Verkhovna Rada and the President, who submitted proposals to the law before its final adoption.

In the fourth quarter of 2024, compared to the previous quarter:

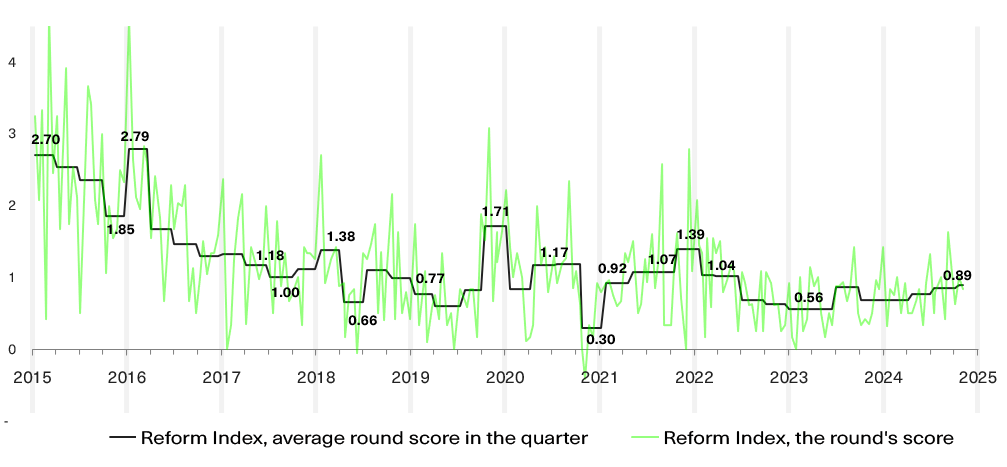

- The number of reforms remained unchanged at 35;

- The average round score stayed low at 0.89 points (0.86 in Q3) on a scale from -5 to +5;

- The average score per event was also nearly unchanged—1.2 points, compared to 1.3 in the previous quarter.

Graph 5. Average quarterly Reform Index score

Source: Issues 1-254 of the Reform Index

In the fourth quarter, the Verkhovna Rada emerged as the main driver of reforms, with the Ukraine Facility plan and the goal of aligning Ukrainian legislation with EU standards serving as key guideposts. Several reforms were also implemented in response to challenges brought on by the war and the urgent need to ensure adequate social protection for Ukrainians. Ukraine will continue to face the challenge of balancing fiscal responsibility with the imperative to support those affected by the war.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations