Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas.

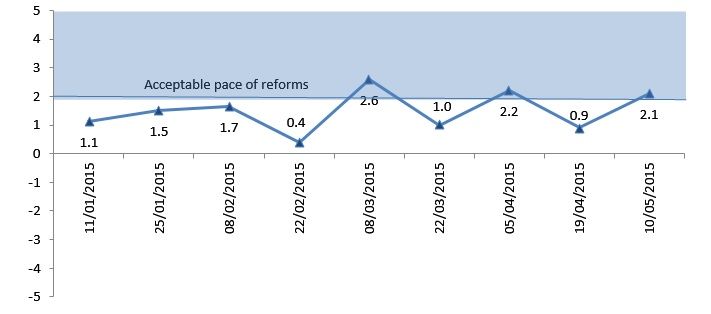

The Reform Index value for the 9th monitoring period (April 20th – May 10th, 2015) totaled +2.1 points out of the possible range from -5.0 to +5.0 points. This is one of the highest index values since the start of observations, which, in our opinion, meets acceptable pace of reforms. In this round experts positively valued reforms in public finance, industrial organization and trade policy, as well as in the energy sector.

Chart 1. Reform Index dynamics

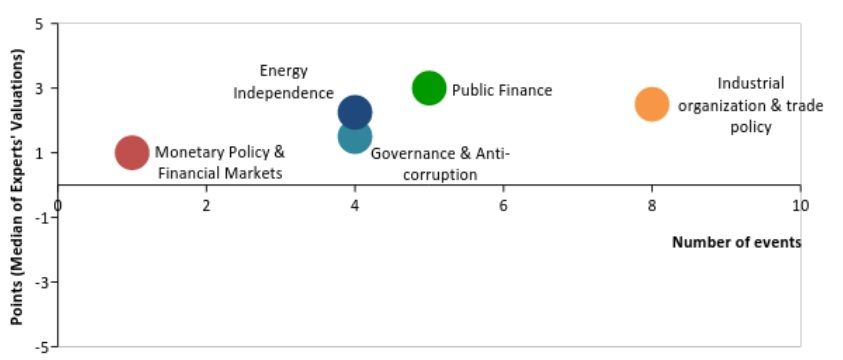

Chart 2. Reform Index and its components in the current round

Adoption of the law on the natural gas market (total score of +6.8 points in the sectors of Energy Independence and Industrial Organization and Trade Policy) was the most significant event in the last monitoring period. Among the positive aspects of the law, experts noted the creation of conditions for reforms of the gas market, harmonization of Ukrainian gas legislation with the European one, division of Naftogaz by activities, as well as ensuring non-discriminatory access to the gas transportation system for independent suppliers. Besides, the law on the gas market was one of the conditions of the IMF loan program.

Several other events received high grades as well. In particular, the law obliging budget controllers to publish information on the implementation of the budget scored +4.0 points as it was considered another step towards transparency of the public finance. The same grade was given to the law introducing the principle of tacit consent for taxpayer registration, which should lower entry barriers and accelerate the process of launching a new business. The law on protection of investors, which increases the protection of minority shareholders’ rights, was valued at +3.0 points. This law, together with the law on state investment (+2.0 points), was a part of the package of laws necessary to receive the World Bank loan. The law on holding the drugs procurement through international organizations scored +2.5 points as it reduces the opportunities for corruption schemes and increases the effectiveness of budget spending.

In the energy sector, in addition to the already mentioned law on the natural gas market, the experts welcomed the law on energy service companies (+2.3 points), which would help to raise energy efficiency. As a positive step towards local government reform, experts marked the approval of the methodology for the formation of capable territorial communities (+2.0 points). But they noted that overall reforms in the decentralization are carried out very slowly, which does not correspond to previously announced plans. Within the Monetary Policy and Financial Markets sub-index, the law on the tax regulation of FX loans restructuring received +1.5 points. According to experts, the law eliminates the tax obstacles to the restructuring of foreign currency loans, and will contribute to the gradual improvement of the quality of banks’ loan portfolios.

All in all, Public Finance direction received +3.0 points, demonstrating the greatest progress in the this round and the highest value for the sub-index since the start of observations. Industrial Organization and Trade Policy, as well as Energy Independence directions scored slightly lower (+2.5 points and +2.3 points respectively). At the same time, progress in Governance and Anti-Corruption direction was estimated at +1.5 points and Monetary Policy and Financial Markets received +1.0.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Chart 3. Value of Reform Index components and number of events April 20 – May 10, 2015

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations