The crisis fall in investment in 2020 in Ukraine was much deeper than in the EU. However, the Ukrainian central bank cannot support quantitative easing lending like developed countries, because the problem is not a lack of liquidity, but a few quality borrowers. In this article we consider which sectors are the most attractive for Ukrainian banks despite the pandemic.

In 2020, the decline in investment in Ukraine was impressive both historically and internationally. Data for the full year are not yet available, but for the first three quarters investment demand (by which we mean “gross fixed capital formation”) fell by 23% compared to the first three quarters of 2019. Reduced investment lowers the potential for economic development in the future.

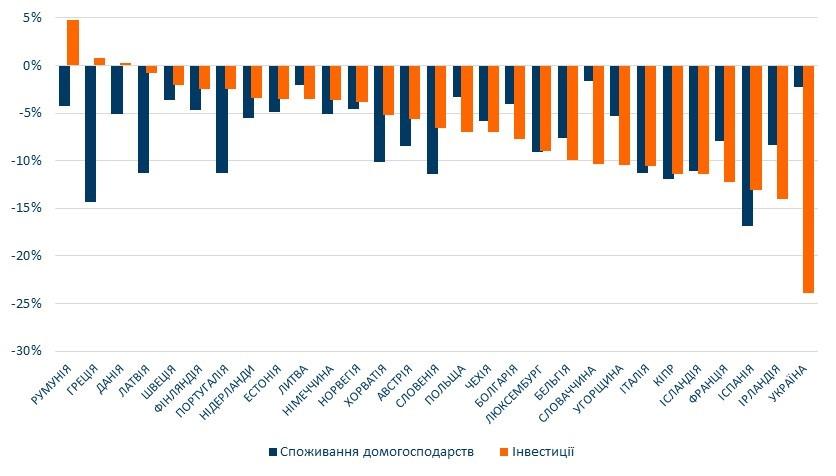

The decline in investment in Ukraine was much higher than in neighboring countries, and in particular in the EU (Fig. 1). This means a decrease in the already low competitiveness of the domestic economy (while consumption and exports in Ukraine decreased significantly less than in the EU).

The share of investment in GDP for the first three quarters of 2020 was 12.6% (in the corresponding period of 2019 – 16.2%). For comparison, in the EU countries this share is about 22%. Thus, the crisis of 2020 for Ukraine became first of all a crisis of investments.

Figure 1. Change in household consumption and investment in Ukraine and the EU countries in January-September 2020, % per annum

Source: data from state statistical services.

Investment in Ukraine declined primarily in the private sector. Public investment was high, in part due to increased infrastructure upgrades. About UAH 90 billion, which is almost 2% of GDP, was spent on road construction alone, as the government decided to use a “Keynesian” recipe for overcoming the crisis – that is, increasing government spending. Investment in infrastructure, of course, contributes to future economic development, but the multiplier of activity in the construction industry is quite low (for example, the National Bank rated it at 0.96).

Why have investments in developed economies fallen less than in Ukraine? What role did lending play?

The Coronavirus Crisis had little effect on the share of investment in GDP in most European economies. The statistical explanation is the outpacing decline in population consumption in these countries. Another factor is quantitative easing and fiscal incentives. These are both direct subsidies to enterprises and households, and indirect ones – the purchase of shares or bonds of enterprises on the market by central banks. These measures supported the value of firms and ensured their operating and investment activity.

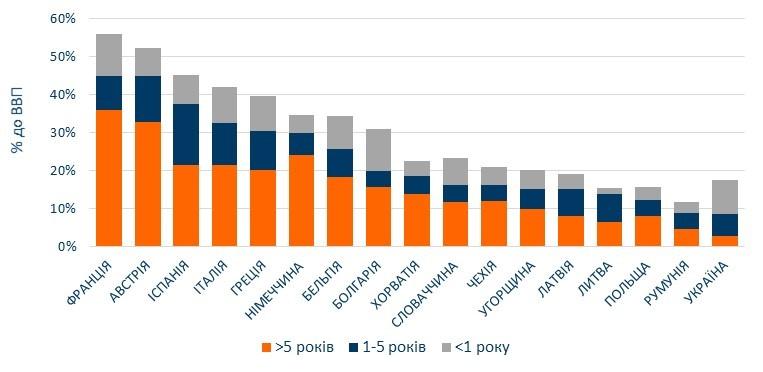

However, for developed economies, improving companies’ balance sheets through quantitative easing was not an end in itself. “Healthy” balance sheets helped to mitigate crisis risks and maintain lending rates. Lending has traditionally played a significant role in the investment processes of developed countries. At the same time, the structure of loans is dominated by long-term loans. For example, in Austria and France, loans to corporations with a term of more than 5 years account for 33-36% of GDP and 63-64% of total loans. This is facilitated by low (real) credit rates.

An unconditional comparison of the situation in developed countries and Ukraine is somewhat naive, as the structural conditions of these countries differ too much. However, in Ukraine 51% of loans to corporations have a duration of up to 1 year (the purpose of such lending is mainly to address the current needs of enterprises), and the share of long-term (investment) loans over 5 years is less than 3% of GDP (Fig. 2 and 3 ).

Figure 2. Volumes of loans granted to non-financial corporations by maturity in individual European countries *

* ranked according to the decline in the share of medium- and long-term loans

Source: own calculations based on data from state statistical services and central banks.

In contrast to the EU countries, in Ukraine the main source of investment financing is the own funds of enterprises (about 70%). High dependence on profits makes it easy to understand the reasons for falling investment in 2020 – falling profits or even losses deprive of the opportunity to invest. That is, the investment crisis in Ukraine is caused not only by pessimistic expectations and reduced savings, but also by a lack of funds for investment. In 2019, only 7.5% of investments were secured by loans.

Who and how much do banks in Ukraine lend to?

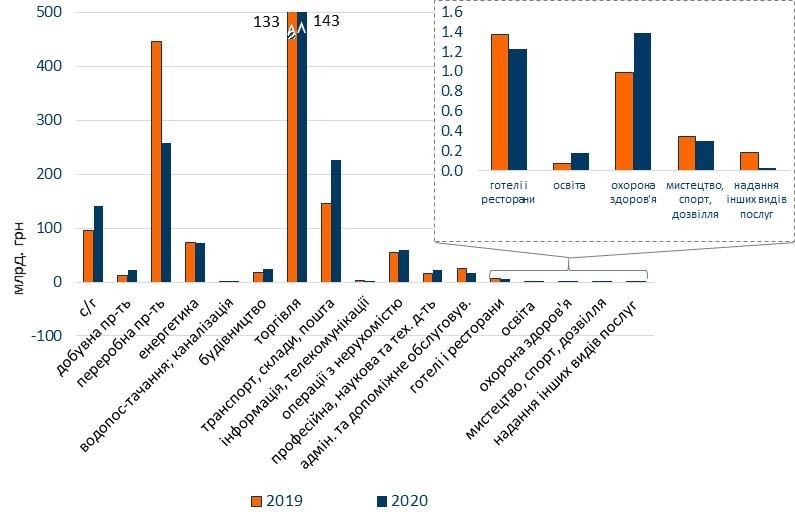

To answer this question, we consider the NBU data on new loans to non-financial corporations. We compare the volume of loans issued (Fig. 3) and rates on them (Fig. 4) for 2020 and 2019.

Trade remains the main borrower – trade enterprises in 2020 received 65% of newly issued loans compared to 62% in 2019. The volume of trade loans increased by UAH 112 billion (8%). The reduction of rates for the trade sector from 14% to 9% per annum reflects its relative resilience to the crisis. In fact, retail trade in 2020 grew by 8.4%, wholesale – by 2.9%.

The next absolute increase in lending was the direction of courier activities: loans to transport, postal and courier companies in 2020 increased by UAH 82 billion compared to the last year. In relative terms, growth was 56%. Finally, lending to agriculture increased by UAH 44 billion (46%). The 5-7-9 program helped a lot here. Agricultural enterprises were its main beneficiaries and under the program were able to refinance previous loans at 0%. Refinancing of previous loans amounted to 62% of the UAH 17.4 billion issued in 2020 under the program.

Figure 3. Volume of new loans by economic sectors in 2019 and 2020

Source: own calculations based on the NBU data.

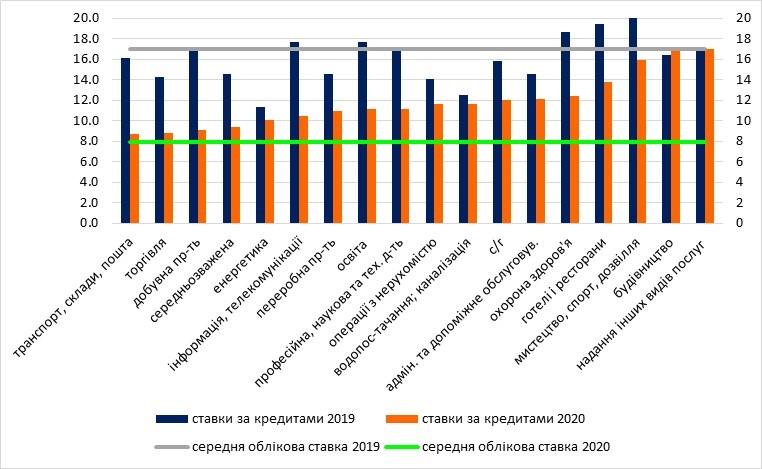

Figure 4. Refinancing rate and rates on new loans to non-financial corporations by type of activity, % per annum

Source: own calculations based on the NBU data.

Lending to the extractive industry was relatively small (UAH 23 billion in 2020), but its volumes grew at a high rate (93% per year). On the other hand, financing of the processing industry decreased by 42% to UAH 257 billion.

Lending to hotels and restaurants, the leisure, sports and other services sectors decreased significantly in 2020, primarily due to the vulnerability of these sectors to epidemiological constraints.

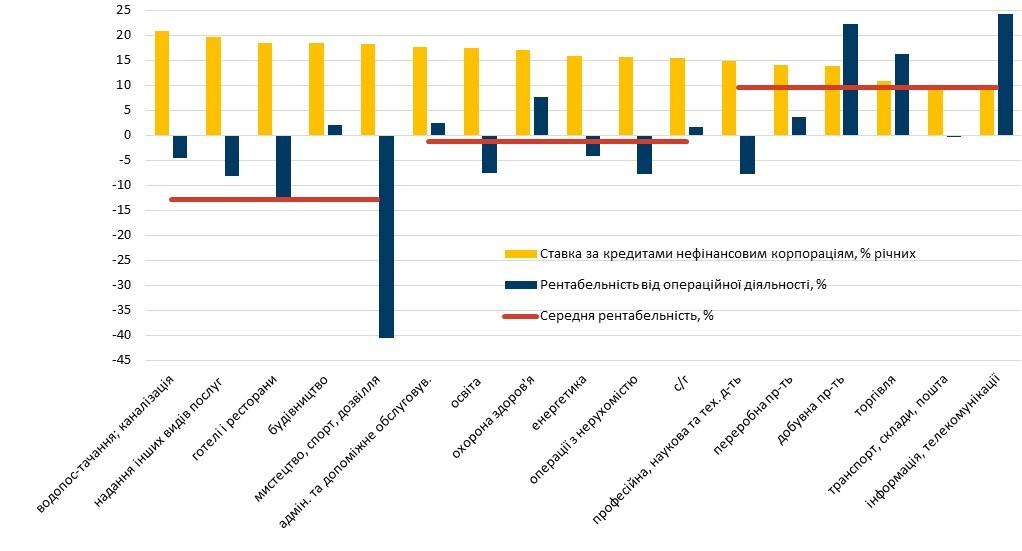

One of the factors of different interest rates for different sectors is the profitability of the industry (Fig. 5). More profitable areas receive loans at lower rates.

Figure 5. Loan rates by sectors of the economy and the level of profitability of such sectors in January-September 2020

Source: SSSU, NBU and own calculations.

How to set investment lending in motion: what can monetary policy do and what is beyond its scope?

In March 2020, the National Bank of Ukraine introduced long-term refinancing (for up to 5 years). Such a mechanism was to support bank lending by enhancing the effect of other measures, such as lowering the discount rate to 6% per annum and introducing incentive reserve ratios. These changes have given some impetus to lending to non-financial corporations for more than a year.

Risky and non-transparent business is not only an obstacle for non-traditional monetary instruments, but also limits the effectiveness of further reduction of the discount rate. As can be seen from Fig. 4, lending rates for many industries in 2019 were lower than the NBU discount rate, and in 2020 are very close to the discount rate.

Therefore, monetary easing alone is not enough to further reduce the cost of lending. It is necessary to implement measures that will reduce another component of the rate — credit risk. These are primarily measures aimed at improving the quality of institutions in Ukraine — building an effective judicial system for effective protection of property rights. As well as reducing political interference in business and corruption.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations