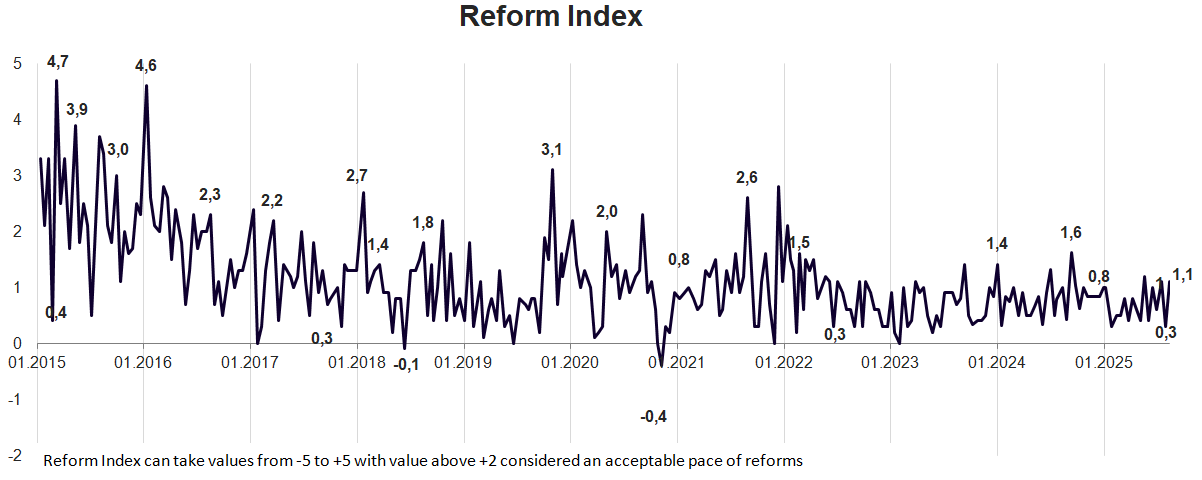

Issue 270 of the Reform Index, covering the period from July 28 to August 10, includes seven regulations. The overall Index score reached 1.1 points on a scale from -5 to +5. In the previous issue, the Index stood at 0.3 points.

The main development of this issue is the adoption of the factoring law, which received a score of +2.5 points from the Index’s experts. Among other notable reforms are changes in the anti-corruption sphere, including a law that launches the reform of ARMA. During the same period, the Verkhovna Rada also adopted a new law repealing Law No. 4555-ІХ, which had limited the independence of NABU and SAPO and became one of the most significant counter-reforms of the past decade.

Graph 1. Dynamics of the Reform Index

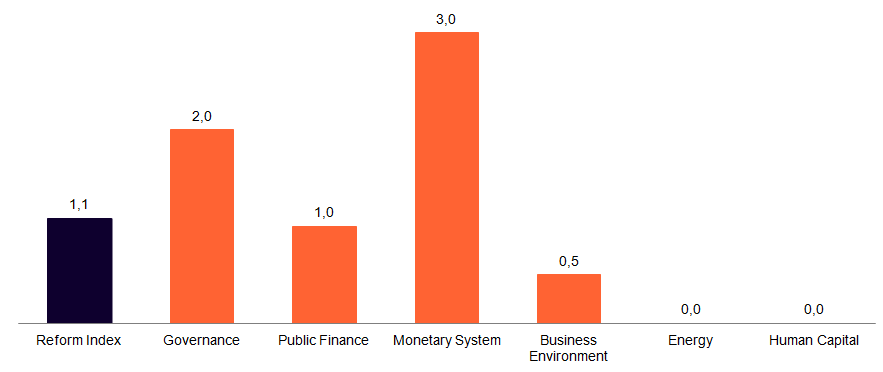

Graph 2. Values of the Reform Index and its Components in the Current Assessment Round

Factoring law, +2.5 points

Law No. 4466-ІХ updates legislation in the field of factoring. Factoring is a financial service that allows a company to sell a client’s debt to a specialized factoring company (a factor) and immediately receive most of the funds — without waiting for the client to repay the debt. Previously, such transactions were regulated only by separate provisions of the Civil Code. These rules were outdated and no longer met international standards. Because there was no state register of assigned debts, disputes and fraudulent schemes arose in which the same debt could be sold to several companies.

To prevent the double sale of a single claim, an electronic public register of assigned monetary claims will now be created, recording every debt transfer. In addition, a national digital factoring platform will be launched—an online marketplace where companies can list their monetary claims for open auctions.

Monetary claims related to public procurement — for example, when a contractor seeks payment for goods or services before the client transfers the funds — may be sold to a factor only through an electronic auction.

The law specifies that a factoring contract must include the key terms of cooperation, including payment procedures and deadlines, terms of the assignment of claims, obligations of the parties, and procedures for notifying the debtor. The parties may conclude a contract either with recourse, where the client remains liable to the factor if the debtor fails to pay, or without recourse, where the factor assumes all risks of nonpayment.

The factoring law takes effect on July 30, 2026 — but not before amendments to the Civil Code are adopted. Specific provisions—such as those concerning the disclosure of banking secrecy in cases involving aggressor states and related persons, as well as those aimed at protecting Ukraine’s interests in international courts — have already entered into force. However, it is not entirely clear why these norms were included in the final provisions of the factoring law rather than passed as a separate act.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Expert commentary

Ilona Sologoub, scientific editor at Vox Ukraine

“Today, factoring is regulated by Articles 1077–1086 of the Civil Code, which provide only a very general framework for this process, assuming that all essential conditions will be specified in the contract. As a result, the factoring market in Ukraine is very weakly developed, and its main players are large banks that possess the necessary legal capacity and access to extensive client data.

Unlike the Civil Code, which essentially conflates factoring with debt collection and places all potential risks arising from these relations on the factor, the new factoring law clearly defines the rights, obligations, and liabilities of the parties, as well as the essential terms of the contract, thereby specifying who assumes which risks when they occur.

In addition, the law provides for the creation of an electronic register of factoring agreements, allowing parties to view their contracts and verify counterparties. (This register must be established by the government before the law enters into force.) It also requires that factoring contracts be concluded based on auction results in an electronic system—apparently referring to Prozorro.Sale, although the system is not explicitly mentioned in the law. When public procurement is involved, factoring contracts must be concluded exclusively through an electronic auction.

The development of factoring is a very positive step. It will help address the problem of enterprises’ lack of working capital when supplying goods or services on deferred payment terms — an issue particularly relevant to public procurement, where payment delays can last for several months.”

Strengthening ARMA’s institutional capacity and new rules for managing seized assets, +2 points

In the summer of 2025, the President signed Law No. 4503-ІХ, which provides for the reform of the National Agency of Ukraine for the Detection, Search, and Management of Assets Derived from Corruption and Other Crimes (ARMA). The adoption of this law was one of Ukraine’s commitments under the Ukraine Facility. At the same time, it is worth noting that this step came later than planned — the law was to be adopted in the first quarter of the year, so the performance indicator for this commitment was effectively overdue.

The main innovations of the law concern the procedure for selecting and evaluating the head of ARMA. From now on, the head will be appointed through an open competition. The selection commission will include six members — three nominated by the Cabinet of Ministers and three by international partners, who will have a casting vote. The head will be appointed for a five-year term, without the possibility of reappointment.

Three years after the head’s appointment, the Commission for Independent External Evaluation of ARMA’s Effectiveness will conduct an audit of the agency’s performance. The commission will include three representatives from international partners approved by the Cabinet of Ministers — those that have provided Ukraine with technical assistance in the field of anti-corruption activities. At the same time, the agency will be required to publish quarterly data on the number, value, and condition of the assets it manages, as well as on revenues, expenditures, and management outcomes. Civil oversight will be exercised by the Public Oversight Council, consisting of nine representatives elected through online voting. Within ARMA, internal control units will also be established to conduct internal audits and identify corruption risks among employees.

The changes also affect the asset management system itself. The new provisions introduce an official process for identifying assets, preparing a preliminary management plan, and creating an asset pool. This means each asset must have an assessed value, a defined preservation procedure, and a clearly described management strategy. The transfer of assets to management will follow transparent procedures: all stages of the competitive selection process will be recorded in an electronic system, decisions will take into account companies’ financial capacity, experience, and reputation, and the results of competitions — along with the signed contracts — will be published on ARMA’s official website. Asset managers will be selected through an open and competitive procedure.

Expert commentary

Pavlo Demchuk, senior legal advisor at Transparency International Ukraine

“Law No. 4503-ІХ contains several positive elements. In particular, it standardizes asset identification procedures, strengthens the management of various types of assets, increases ARMA’s transparency, unblocks the management of corporate rights of companies linked to the aggressor state, and regulates issues related to sanctioned and seized assets.

In our view, its adoption is a critically important step toward ensuring transparent and effective management of seized assets, which directly affects Ukraine’s reconstruction efforts. However, amendments to the Criminal Procedure Code of Ukraine and the adoption of secondary legislation are still required to ensure the proper functioning of the updated asset management mechanism.”

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital. Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations