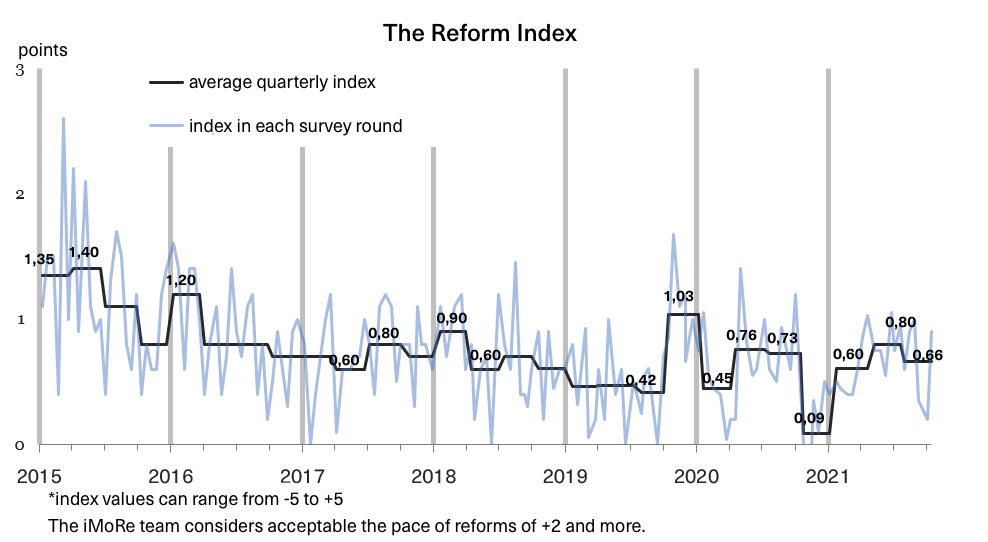

In the third quarter, the Reform Index recorded several changes in urban planning and another attempt to create bona fide judicial self-government. In this period, tax amnesty laws were passed, which received contraditionary scores from experts.

Almost for the first time, we did not record any significant reforms (in the Index, we consider a reform to be significant if it receives over +2 points in the range from -5 to +5). Still, in the three months, the authorities adopted two anti-reforms. Read on for more details.

Among all the regulations, the Reform Index experts identified 39 potential game changers for the country’s economy. That is close to results in the previous quarter where we recorded 35 important changes.

Among the 39 reforms, 35 got favorable reviews, two received zero points from the experts, with two more being anti-reforms. The average event score in the third quarter is +1.0 points( in the range from -5 to +5), the same as in the previous quarter.

Key changes

In the third quarter, no event received more than +2.0 points, which, in our opinion, separates significant reforms from less important ones. However, seven reforms got 2 points each. Here are their brief descriptions.

Agricultural insurance

✓ The law on state support for agricultural insurance (Reforms Index No.165, +2 points) aims to expand the practice of offering the agricultural producers insurance against risks associated with adverse weather, plant and animal diseases, and theft. Currently, “only up to 1 million hectares of crops are insured in Ukraine, with almost 21 million hectares cultivated by commercial agricultural enterprises,” noted Oleh Nivyevskyi, the Kyiv School of Economics professor. The reason is a lack of attractive insurance offers from private companies. The law updates the mechanisms of state support for agricultural producers of arranging insurance for their products and sets the amount of partial reimbursement of insurance payments by the government at up to 60%.

Declaration of assets

✓ The law enforcing legal liability for false declarations (Reforms Index No.165, +2 points) is the new attempt to establish criminal liability for false declarations. The first attempt was made in 2014, but the Constitutional Court declared these provisions unconstitutional in 2020. The new law establishes criminal liability when declarations fail to include income of UAH 4.5 million or more.

Corporate governance

✓ The law improving corporate governance in banks (Reforms Index No.166, +2 points) brings Ukrainian legislation closer to EU standards. In particular, it explicitly defines the powers of banks’ supervisory boards. It requires that bank founders and owners of substantial participation provide the NBU with all the documents available affirming their good standing. It also expands the NBU’s power to assess whether the banks’ supervisory board members have appropriate qualifications and require that the bank board’s or management’s composition be changed should they fail to ensure their institution’s effective management. Besides, the law brings the number of the NBU Council members from 6 to 7 persons and somewhat reduces the NBU Supervisory Boards’ power.

Judicial reform

✓ The Law on the procedure for electing members of the High Council of Justice (HCJ) (Reforms Index No.166, +2 points) introduces a preliminary assessment of potential candidates to HCJ during the selection process. It initiates a one-off evaluation on whether the current members meet the criteria of professional ethics and integrity. One of the stages in selecting HCJ members will be the assessment of their integrity by the Ethics Council. Candidates without a positive review will not be able to occupy positions with the HCJ.

The Ethics Council consists of 6 members (three from among judges or retired judges are to be proposed by the Council of Judges of Ukraine, one by the Council of Prosecutors, one by the Council of Advocates, and one by the National Academy of Legal Sciences of Ukraine). All of them should have 15 years of experience in the legal field and an impeccable reputation. However, the first Ethics Council (i.e. the one to be appointed now) will comprise three judges (or retired judges) and three representatives proposed by international organizations. These representatives are to ensure the openness and integrity of the process for appointing the HCJ. That is why the Congress of Judges has been blocking the appointment of the Ethics Council by not electing its three candidates.

✓ The law on resuming the work of the High Qualifications Commission of Judges (HQC) (Reforms Index No.166, +2 points) changes the principles of forming the commission since the previous commission’s composition compromised itself and was dissolved by law in 2019. The new law provides for the creation of a competition commission for two years to select HCJ members. Half of the members will be international experts with a casting vote. The competition commission must nominate at least two candidates for each vacant HCJ position, and the High Council of Justice will choose which one to appoint.

Doing business

✓ The law on facilitating connection for small and medium businesses to power lines (Reforms Index No.167, +2 points) introduces the “one-stop-shop,” simplifying the process of connecting to power lines for consumers of up to 1 MW. The law establishes the principle of tacit approval of the project documentation. The approval of project documents will now be received via the users’ electronic account in the Unified State Electronic System in the Construction Sector. Getting connected to the grid used to be one of the most problematic moments for businesses. According to the Doing Business 2020 study, the connection process on average took 267 days in Ukraine (in the high-income OECD countries, it takes 75 days) and cost 3.5 times more than GDP per capita (in the OECD countries, it is 0.6 of GDP per person). It reduced the country’s attractiveness to investors.

Urban planning

✓ The procedure for the development and approval of urban planning documentation (Reforms Index No.168, +2 points) provides the communities with mechanisms for comprehensive development planning, both within and outside of settlements. Among the decision’s risks are the significantly simplified process for changing the intended use of land and the procedure that, upon rejecting urban planning documents, makes it possible to make changes to them and approve them without securing the public’s approval.

✓ The Cabinet of Ministers changed the examination procedure for urban planning documentation (iMoRe 169, +2 points). Under the new procedure, the communities’ comprehensive spatial development plans and changes to them are included with the urban planning documentation requiring examination. The expert organization must be selected via public procurement system. The examinations cannot be conducted by specialists involved with the development of urban planning documentation.

Zeros

Regulations that have both positive and negative impacts on their sphere, as well as those, which cannot affect the situation in the country according to the Reforms Index experts, were given zero points. In this round, we have two such documents.

Support for internally displaced people

✓ Law that exempts internally displaced people from the consequences of non-fulfilment of their credit and loan commitments (Reforms Index No.166, 0 points) taken before the occupation of parts of Ukraine by the Russian Federation in 2014. Under the law, fines and penalties are not accrued for failure to repay loans, and interest on the loan accrues only for the term for which the loan was granted, at the minimum rate specified in the agreement. The experts provided different assessments for this law because, on the one hand, it protects IDPs’ rights, and on the other hand, it interferes with bank activities, inflicting losses on the banking sector.

Another law that received 0 points is ancillary to the primary tax amnesty law; therefore, we will describe it in the next section.

Fly in the ointment:

In the third quarter, the authorities passed two regulations that pushed the country backwards.

Tax amnesty

✓ The law on the specifics of one-off (special) voluntary declaration of assets of individuals (Reforms Index No.165, -2 points) provides people with the opportunity to voluntarily declare their assets on which they have not paid taxes during the year. To do so, one has to submit a one-off voluntary declaration and pay a one-off fee (2.5-9%, depending on the asset type). This law is aimed at helping de-shadow their income and assets. On October 13, Danylo Hetmantsev announced that since September 1, Ukrainians had de-shadowed UAH 90.5 million and paid UAH 4.5 million to the budget. That is not a very significant amount of money. Moreover, Ilona Sologoub warns, the world’s experience suggests that tax amnesties have been, for the most part, unsuccessful. Firstly, because the amnesty is perceived as an injustice by those who never evaded taxes, and, secondly, because society might be looking forward to future amnesties, which will worsen tax compliance.

✓ The law removing liability for willful tax evasion if citizens declare their assets in the one-off special voluntary declaration (Reforms Index No.165, 0 points) is a tool for implementing the tax amnesty. It proposes that taxable transactions conducted before 2021 not be deemed as willful tax evasion if specified in the one-off voluntary declaration and the agreed fee under the tax amnesty has been paid on them. This law only complements the tax amnesty law as described above, so it received 0 points.

The gas market

✓ The law on ensuring financial stability in the natural gas market (Reforms Index No.167, -1.0 points) introduces the process of writing off the debt accumulated by gas companies and teplokomunenergos (i.e. companies providing heat energy and utilities) to Naftogaz and amounting to UAH 93.3 billion as of August 31. The debt arose for several reasons, including differences in the cost of gas and tariffs, consumers’ late payments, and a cash gap because the teplokomunenergos must pay for the gas in the month they receive it while consumers pay for the services the following month. The law provides for debt repayment installments and a write-off of the debt accumulated due to the difference in tariffs, fines, penalties, etc. Some experts assessed the law negatively since it reduces the inflow of funds that Naftogaz could use in its activities, including developing new gas fields, creating incentives not to repay gas debts, or not to pay for the transportation of natural gas and heat supply in the future.

What changed in key areas?

In the third quarter of 2021, we recorded changes in all observation areas. Most of them took place in public finance (12). We recorded only one significant regulation in the field of energy, but it turned out to be the anti-reform (see above).

Graph 1. Total points by area, the 3rd quarter of 2021

Source: iMoRe No.164-169

Let us look at the areas that made the most progress on reform.

Business environment

We recorded nine important changes here. This time, four reforms were initiated by the Verkhovna Rada, three by the Cabinet of Ministers, and two by the President. Among the key changes in this area are the laws on the procedure for electing members of the High Council of Justice, on resuming the work of the High Qualifications Commission of Judges, on facilitating connection to power lines for businesses, and the resolution on the development and approval of urban planning documentation. All of them received 2 points and were described in the first section.

Here, we should also mention the following two laws:

✓ The law on organic products (Reforms Index No.166, +1.3 points), legalizes international organic labeling for Ukrainian producers of organic products and prohibits the sale of products labeled with words like “bio-,” “eco-,” “organic” without an international certificate.

✓ The law on facilitating connection to gas networks (Reforms Index No.165, +1 point) introduces interaction via electronic services. Previously, to connect to gas distribution networks, the customer had to physically visit the network operators’ offices.

Governance

During the three months, the authorities approved 11 public administration reforms. Five reforms were initiated by the Verkhovna Rada, five more by the Cabinet of Ministers, and one by the President. Among the key changes, the following law was passed in addition to the above-mentioned law on criminal liability for false declarations:

✓ Law on the transfer of property between state and communal education establishments (iMoRe No.164, +1.3 points) facilitates the process of free transfer of educational institutions’ excess property to those educational institutions that can use it. The law prohibits the privatization of such property, limiting its use for the services ensuring or associated with the educational process. It could now be a problem for the communities that would like to sell the premises of closed schools but will not be able to do so.

Public finance

In the third quarter, we recorded 12 important changes in public finance. Eight were initiated by the Cabinet of Ministers, and two by the Verkhovna Rada and the President, respectively.

In addition to the laws on state support for agricultural insurance and the examination procedure for urban planning documentation, among the most important regulations were the following:

✓ The law on the digital economy (Reforms Index No.166, +1.5 points) introduces the legal regime of Diia City for the IT industry and provides special taxation, employment, and regulation incentives. For instance, a Diia City resident can hire employees based on gig contracts. Unlike the agreements for the provision of services that companies usually conclude with their private entrepreneur employees, a gig contract can specify set working hours and the time off work. Also, non-disclosure agreements, agreements on refraining from competing, and loan agreements with an alternative obligation can be concluded under the Diia City. Instead of paying the debt, the creditor can be included among the participants in the debtor company.

✓ The resolution on the remote identification of residents of the occupied territories (Reforms Index No.169, +1.0 points) enables them to receive pensions and social assistance without having to travel to the government-controlled areas to confirm their identity. They can now do it online in their personal accounts on the portal of the Pension Fund of Ukraine using the “Diia ID”. This is a plus because currently, there is a lack of stable transport connections between the areas under government control and the occupied territories, and travel through the checkpoints is often blocked by the occupation authorities. However, according to the experts, this mechanism may not be available to people with low means or poor computer literacy.

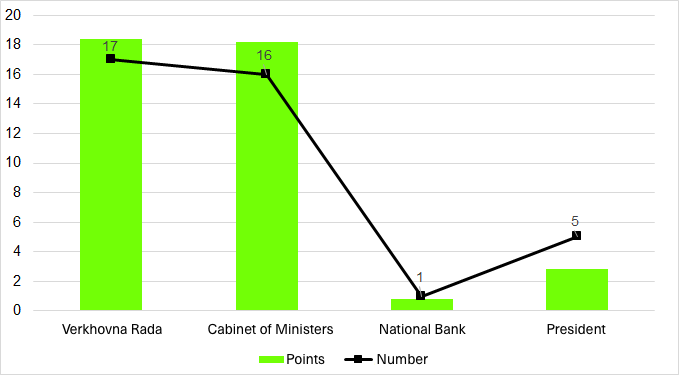

Who is the biggest reformer?

In this quarter, the Verkhovna Rada was the leader in adopting reforms with its 17 regulations. The Cabinet of Ministers is second, with 16 important regulations under its belt. The President is third, with five regulations. In the third quarter, two reforms were signed by the President after his proposals were taken into consideration (the law on the starosta institution development and the law on the resumption of work of the High Qualifications Commission of the Judges of Ukraine). He can, therefore, be considered a co-author of two more reforms.

Graph 2. Initiators of the reforms in the 3rd quarter of 2021

Source: iMoRe No.164-169

Compared to the previous quarter, in the third quarter of 2021:

- there was a slight increase in the number of important regulations (from 35 to 39 per quarter),

- the average score of the round fell from +0.8 points to +0.7 points,

- the average event score remained at +1, in the range from -5 to +5.

In the third quarter, the authorities took on a long-awaited judicial reform and tried to restore confidence in the High Council of Justice and the High Qualifications Commission of Judges. We hope that the focus of attention will stay put on this area. According to the European Business Association, distrust of the judiciary is the main obstacle to investment in Ukraine. The tax amnesty was the disappointment of this quarter because, as predicted by the experts, it did not bring much money to the budget. Yet, it could significantly decrease the desire of Ukrainians to pay taxes honestly and on time.

Graph 3. iMoRe quarterly average

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations